What are the significant trends in the food market? What is consumed, and how? In this article, we return to the evolutions of this market. Discover also the prospective study that we carried out on the future of the retail sector at the time of Covid-19 and our study on the market of organic products.

As we detail in our white paper on market research, you will have to rely on many complementary aspects for a complete study adapted to your activity. In which case, if you have a market research project, do not hesitate to contact us for a tailor-made analysis.

Summary

- Introduction

- Statistics on the Food market

- Interesting general conclusions

- Findings on purchasing behaviors

- Significant innovations

- Legal aspects

- What our food will look like ten years from now

- Conclusions

- Sources

Every 7 years, the French government agency Anses publishes its conclusions on the evolution of French eating habits. An extensive, scientific market study, which this time “contains” more than 500 pages. We have gone through the conclusions and made a list (below) of highlights that should be useful to anyone interested in this market and in particular to project leaders. This study can be linked to the one we carried out for the SIAL 2018 World Food Fair. We detected 5 significant trends that we have dealt with in specific articles (trends 1, 2, 3, 4, 5). We will also rely on the data disseminated by other research centres such as the sites of national health ministries and the EFSA (European Food Safety Authority), to draw the most accurate picture possible of the food market and its evolution.

Statistics on the Food market

- 2 hours 22 min: the average time spent each day on food by the French in 2010, that is to say 13 minutes more than in 1986.

On average, European Union citizens spend 18.5% of their monthly budget on food (Eurostat, 2010):

- 31% in Romania

- 23% in Poland

- 20% in Hungary

- 18% in Czech Republic

- 17% in Greece

- 15% in Italy, France and Spain

- 12% in Germany

- 11% in the United Kingdom

Consumption of foodstuffs:

- On average, 10% of Europeans declare themselves vegetarian (Meat Atlas)

- Between 2008 and 2018, the consumption of poultry has drastically increased in European Union countries (OECD Data)

- “44% of Belgians reduced their meat consumption” between 2016 and 2017 (Gondola)

The food industry in Belgium (Fevia):

- €51.8 billion turnover in 2018 (-0.8%)

- €1.64 billion investment in 2018 (-6.7%)

- €27.6 billion exports in 2018 (+3.5%)

- 93,000 direct jobs and 173,000 indirect jobs in 2018 (+2.9%)

Interesting general conclusions

Interesting general conclusions

- More and more of our diet is made up of processed foods.

- The number of dietary supplement consumers increased by 50% between 2006 and 2007 (CNIB study2) and 2014-2015 (IINCA study3)

- The supply of locally produced food is a common practice that can affect up to 75% of the population. Two-thirds of these regular consumers adopt this behaviour weekly (basket of vegetables delivered by local producers).

- People between 65 and 79 years of age, compared to younger people, have eating patterns that are considered more regular. Also, they consume more homemade foods, foods that they produce themselves, and fewer food supplements and processed foods.

- Consumers with higher levels of education adopt eating behaviours closer to the recommendations (they eat more fruit, drink less sweetened drinks), suffer less from obesity, have more active behaviours

- Several trends are emerging in France, Belgium and Europe. Among the best known is the organic market, the evolution of which we detail in this article and which will be at the heart of the debate at the Bio 2020 world congress.

- “In 2018, the organic market represents a turnover of 10.9 billion € in Germany, 9.7 billion € in France and 760 million € in Belgium” (Agence Bio, Gondola).

- The vegetarian and vegan market has also grown (+24% turnover in France in 2018)

- Consumers are increasingly concerned about the origin of food and are becoming more informed. Yuka, an application that scans products before purchase to determine their health impact, passed the 15 million user mark in January 2020.

- Responsible and sustainable consumption is also being democratised. The emergence of applications such as Too Good To Go, which allows consumers to access products with a CSD (Best Before Date) that are not yet available on the market. Many players in the food market offer baskets for this type of application, whether they are distributors or restaurateurs (more than 40,000 partners).

- “Snacking“: eating fast and well, whether in fast-food chains such as Le Pain Quotidien or Exki or by visiting Delhaize’s new Fresh Atelier concepts.

- Home delivery services are also seeing their business flourish: UberEATS records €1.3 billion in turnover in 2018 (Liberation), compared to €95 million for Deliveroo (+63% compared to 2017 for Deliveroo according to Les Echos).

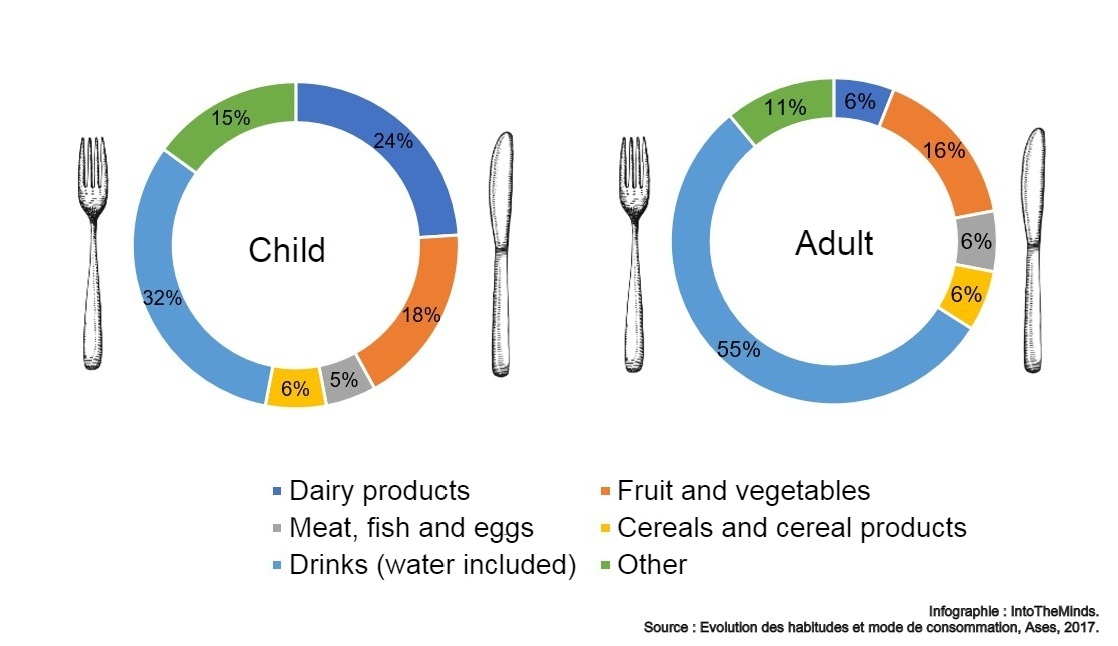

The consumer’s plate

The Anses reveals the typical plate of the French consumer, who consumes a majority of beverages (55% for adults, 32% for children), fruit and vegetables (16% for adults, 18% for children). The percentage of consumption of products based on cereals and meat, fish, and so on is similar for children and adults (around 6%). The big difference between the two targets is in the consumption of dairy products, with an average of 24% for children compared to 6% for adults.

Findings on purchasing behaviors

Findings on purchasing behaviors

In terms of purchasing behavior, the study published by the ANSES is also rich in information on the current state of the market. The comparison that can be made with previous conclusions (INCA2 study) is also a significant source of information for any self-respecting marketer.

- The study classifies the main criteria for choosing food products. In descending order, we find the price (48%), consumption habits (43%), taste (38%) and the origin of the product (36%). A vital correlation is found with the level of education of the consumer. The higher this level, the source of the product, its production method, the list of ingredients and the signs of quality are highlighted to justify the purchase.

- The novelty of the product is the least put forward feature to justify the choice of a product, whatever the level of education.

- A minority of children read the labels on food products before buying them. The ingredient list is the information most read by teens aged 15 to 17. The least read parts are nutrition messages or messages describing beneficial effects, for those who rarely read labels (56%), and nutritional content for those who read them more regularly (75%).

- About half of the adults surveyed say they usually read the labels and packaging of the food they buy: 12% say they do so systematically and 37% regularly. Interest in labels and packaging is related to age, with adults aged 65 to 79 more likely to read them than younger adults.

- Remarkable differences are also highlighted between the north and south of France. People in the north of France are more sensitive to one-off promotions and read labels less than their counterparts in the south.

- The study establishes with certainty that nutritional or health claims on the packaging of certain food products have a real influence on purchasing behaviour. Furthermore, the older the household reference person is, the more households report paying attention to nutrition or health messages on the product label.

- As mentioned earlier, the awareness of the damage caused by mass consumption on health and the environment is pushing consumers to be increasingly more careful and selective in their purchases. Retailers and brands are also committed (C’est Moi le patron! Carrefour’s Act for food, among others) to the development of ethical and sustainable products.

- “Home-made” is gaining momentum. After the many debates we have seen about the “home-made” label for restaurants, it is time to talk about it with consumers. The consumer wants to eat more healthily, but also needs support in the creation of recipes, for example. This is what Delhaize and Kazidomi, distributors, offer, as well as tutorials and cooking shows. For instance, we published a report on a Belgian store that sold ingredients and recipes to make yourself.

Significant innovations

Every two years we go to SIAL, the International Food Exhibition. This event aims to accompany the sector “in the globalisation of food and the development of local anchors”. It is the global platform in this area and selects the most outstanding innovations for us.

In 2018, we were there and showed you many innovations. One of the innovations that caught our attention on this occasion was the “Cocasse” vegetable bars. Cocasse, named after the start-up that created them. An ingenious 100% organic food aid, composed of 65% vegetables and 35% cocoa butter.

Legal aspects

Legal aspects

Regulatory changes also influence consumer behaviour. In market research, the influence of these external factors is usually studied through a PESTEL study. We detail below the case of France.

In France, the Agriculture and Food Law, known as the EGALIM Law of October 2, 2018, follows the major trends in the food market and makes several measures mandatory:

- Paying the correct price to producers to enable them to live with dignity.

- Strengthening health standards

- Promote healthy eating

The opinion of a project manager at the Ministry of Agriculture’s regional directorate

We interviewed a project manager at the local branch of the Ministry of Agriculture to obtain his opinion on the application of the Equalim Act. According to him, a flagship application of the law is the introduction of one vegetarian menu per week in the canteens. This measure has been in place since November 1, 2019, and it aims to reduce the bad eating habits highlighted by the ASP (Public Health Agency):

- The law (Article 28) provides for a ban on plastic utensils by 2020 and 2025.

- Reducing food waste

- The introduction of 50% organic farming products

we still overeat meat and cold cuts. We need to introduce white meat, more vegetable proteins. With a definite advantage: everything that is leguminous in terms of supply is cheaper and will, therefore, free up resources to buy quality products.

Another essential measure is the fight against waste: “In Strasbourg, some establishments have already opted for stainless steel bins to replace plastic trays. Also, salad bars have been made available to schoolchildren. They serve themselves as much as they need and eat vegetables that they would not normally choose, such as leeks.”

Unfortunately, he concludes, “At the same time, we continue to go to supermarkets without necessarily paying much attention to the quality of the products. We must, therefore, continue to educate the consumer.”

What our food will look like ten years from now

What our food will look like ten years from now

According to the United Nations, by 2050, the world population will reach 9.7 billion people, a 34% increase over today. “To meet demand, agriculture in 2050 will have to produce almost 50% more food and livestock feed than it did in 2012,” the FAO predicts.

A solution: eat insects

They are more and more present in our minds and specialist shops. Insects, rich in vitamins and omega 3, would be an excellent alternative to animal proteins to feed the 10 billion people who will populate the planet by 2025. In other words, tomorrow! A development that has already attracted the attention of the European Union and the stalls of specialist and organic shops. Come on, will you have a little worm?

According to the Food and Agriculture Organisation of the United Nations (FAO), the beetle is the most popular insect among consumers at 31%.

See: first edible insect farm in France

- Another solution: increase agricultural production by 70% by 2050 to feed 9.1 billion people.

Tomorrow’s challenge has many dimensions. We need to produce more to feed more mouths, ensuring a balanced diet for all and being more environmentally friendly.

This requires agriculture that consumes less energy (and energy other than oil), less water, and preserves water and soil quality. But changes will also come from our consumption choices and behaviour.

- Adopting food choices that have less impact on the planet

Each food-type has more or less environmental impact. Everyone can take action to ensure a quality diet that also contributes to the conservation of resources.

Above all, it is a matter of having as varied a diet as possible by applying two main principles:

- consume a variety of fresh, seasonal, locally produced and more environmentally friendly fruits and vegetables

- favour pulses at a level recommended by nutritionists

Conclusions

Conclusions

The Anses report is a goldmine for entrepreneurs, market researchers and project developers wishing to understand the food market better. Not only does this research offer a complete and scientifically validated picture of the practices of an entire country (France), but it also highlights the evolution of society thanks to the possible comparisons between the 3 studies that have already been carried out for nearly 2 decades.

As far as market research is concerned, it should be remembered that government agencies are an excellent source of information that can be relied upon with our eyes closed. Therefore, do not forget to visit the sites of the various existing organisations to verify the information available to you when doing your documentary research. If you would like more advice on conducting market research, don’t forget to read our 3-part article on the subject: “The Secrets of Market Research” part 1, part 2 and part 3.

Sources

- ANSES: Etude individuelle nationale des consommations alimentaires

- Agriculture.gouv.fr: La consommation alimentaire

- OECD Data: Meat consumption

- EFSA: European Food Consumption Database

- Meat Atlas: Facts and figures about the animals we eat

- FranceAgriMer: Combien de végétariens en Europe ?

- Gondola: 44% des Belges ont réduit leur consommation de viande

- Yuka: Dossier de presse

- ISP WIV: Enquête de consommation alimentaire

- Fevia: Industrie alimentaire

- Belgique en bonne santé: Alimentation

- BMU: Konsum und Ernährung

- FAO: Comment nourrir le monde en 2050

- ONU: Feeding the World Sustainably

Posted in Marketing, Research.

Interesting general conclusions

Interesting general conclusions

Findings on purchasing behaviors

Findings on purchasing behaviors Legal aspects

Legal aspects What our food will look like ten years from now

What our food will look like ten years from now Conclusions

Conclusions