This article on market research is brought to you by the market research agency IntoTheMinds. It is the first of a series of 3 devoted to conducting market research (you will find the 2nd article here, and the 3rd here).

We also remind you that in 2018 we wrote a comprehensive guide to conducting market research. You will learn, step by step, how to progress in understanding your market. This guide will give you the essential keys that will allow you to put all the chances on your side for the success of your project.

In this series of articles, we will focus on the preliminary stages of market research and the synthesis of the information collected. We will use the following plan to present to you in 3 posts all the information we have gathered for you.

In this first article we will discuss point 1 as well as methods n°1 and n°2 for carrying out market research (part 2 and part 3 of this article are accessible by following the hypertext links)

1. What market research is not

Recently, an entrepreneur contacted us following a proposal we had made to him. He did not understand our offer because the work we were offering him “included more than an online questionnaire”. Let us be clear. Market research is NOT an online questionnaire. The questionnaire (online or offline) is only one step in conducting market research. There are many others. PESTEL research, trend research and of course, qualitative research are complementary techniques that allow market research to be carried out.

2. The main methods of market research

Strictly speaking, there is no method for conducting market research. The marketing approach detailed below should be understood as a guideline for a comprehensive marketing strategy.

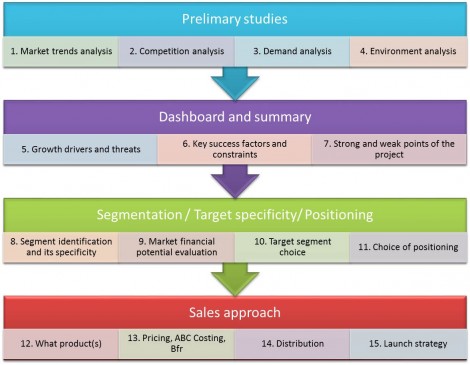

IntoTheMinds conducts market research but sometimes goes well beyond that, making recommendations about the marketing strategy to adopt or the communication channels to use first. This corresponds to the three main steps you see represented below:

- “dashboard and synthesis”: very useful to have a synthetic view and make the right decisions

- “segmentation / specific target / positioning”: it’s a little like the ABC of marketing strategy. Based on your market research, you will be able to segment your market and focus on the targets that will bring you the most return with the least effort.

- “trade policy”: in this step you finalise your product offer, pricing and set up your distribution channels as well as your launch strategy

But before you get to that point, you will need to have done some market research. Depending on the nature of your business, some steps will have to be more thorough than others. Some analyses will be useless, while others will be particularly relevant. For each stage, you will need to use a palette of “tools” (what we call “tools” in this case, they are managerial models, precise analysis tools) to reach the desired conclusion.

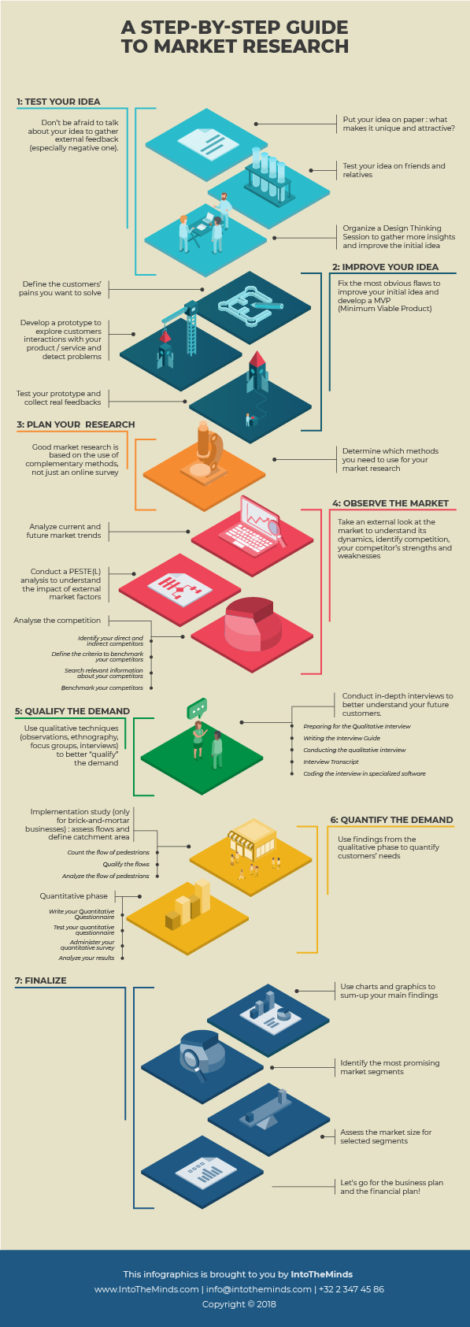

We have summarised all our knowledge in our online market research guide, which you can consult free of charge. We have divided this guide into seven main independent phases. We have even created a computer graphics that will be very useful for you to have a complete overview of the steps involved in conducting market research.

In the rest of this article, we review several specific techniques that will be useful to you in your market research.

Method 1: Analysis of the general market trends

To study the general market trends, firstly it may be useful to ask yourself about the market in which your project is situated. Understanding in which primary, surrounding, generic and support market your project is part of will also enable you to question yourself on the dynamics of each market and its trends.

Support market trends often determine trends in the underlying markets.

However, there is no magic formula for detecting these significant trends. Reading specialised magazines will give you a first impression. If your product is intended for individuals (B2C), it is not a waste of time to look at publications specialising in consumer behaviour. Professional marketing magazines are full of analysis, but you will also find innovative elements in high-flying scientific publications such as the Journal of Marketing. The articles in the current issue are available free of charge for you to read.

As market trends are often linked to consumer behaviour, it is also appropriate to look at trends in countries that are more advanced than the one in which you want to operate. Take, for example, the IT sector and in particular mobile phones. South Korea is mainly at the forefront in this sector because consumer behaviour has reached an exceptional level of maturity that allows specific trends to emerge early. A recent example is the use of mobile phones as a means of shopping. Tesco supermarkets were the first to innovate in 2010-2011 before Delhaize supermarkets launched a similar innovation in Belgium in 2012. By the end of 2012, Carrefour had followed the trend in France. A complete article awaits you on our blog as well as a review, published well after, of the results achieved.

Method 2: Analysis of the competition (supply analysis)

“I have no competitors.” I can’t count the number of times I’ve heard that sentence. And yet every product and service has its competitors. It all depends on the “market level” you are considering. At its launch, the iPad may not have had any competitors in the graphics tablet market. However, in terms of consumer needs, other products were able to compete with the iPad on specific dimensions: weight (mini laptops), features (Kindle, iPhone), alternatives were not lacking. Keep in mind that a consumer will gladly settle for a product that satisfies 90% of his needs. No one needs all the features of your product, and that’s why you’ll have multiple competitors. An iPad is just a big iPhone that you can’t phone with, isn’t it?

While the competitive analysis can best be done through a five forces analysis (see presentation below), do not forget to ask yourself about aspects as essential as the profitability of your direct competitors. It would be a shame to invest your money in a sector where all companies make losses. If you wish to set up in Belgium, use the Central Balance Sheet Office, which provides you with all the balance sheets of Belgian companies free of charge. If your market is in France, the website www.societe.com, an entity of the commercial courts, will be able to provide you, against payment, with the desired information.

Posted in Marketing.