![[Podcast] Emna Everard revolutionises the organic market with Kazidomi](https://www.intotheminds.com/blog/app/uploads/legumes-fruits-bio.jpg)

The organic food market is growing steadily. Between 2008 and 2018, household expenditure on organic products more than tripled. In Belgium, it has gone from +/- 220€ per year in 2008 to more than 750€ in 2018. It is in this buoyant context that Emna Everard launched her start-up Kazidomi. A recent graduate of Solvay Business School, she started her company without any previous professional experience and has just raised €1m to support the growth of her company. In this podcast, she explains the difficulties she has encountered, her strategy to make a place for herself in this coveted market, and her development plans.

Find here the lessons to be learned from this podcast and the “recipe” of Kazidomi’s success.

Summary

- Genesis of the entrepreneurial idea

- the role of customer loyalty in Kazidomi’s strategy

- Conclusions and lessons learned

Once clients are with us, they don’t want to go anywhere else

Emna Everard, Kazidomi

The genesis of Kazidomi

As is often the case, personal experience plays a significant role in the emergence of an entrepreneurial idea. Kazidomi is no exception. As Emna Everard explains:

I was born into a family where my parents specialise in all things nutritional, and so I was immersed in the world of healthy food and sport from a very young age. During my studies at a business school in Brussels, I decided to go into entrepreneurship with these passions in mind, and that’s how I came up with the idea of creating an E-commerce site offering healthy products, all selected by health experts. The first version of the site was put online when I was still a student. It was rather a battle between the courses and entrepreneurship, and I realised, quite quickly, that the price was a problem for a lot of customers, especially the younger public who can’t necessarily afford to go to organic stores, but who often want to eat more healthily. That’s how we came up with the idea with my partner Alain, to propose a subscription formula to reduce prices. That’s when the company started to get off the ground when we began to get very loyal users with more in their shopping baskets.

Some organic market statistics

- Organic products turnover in Belgium: 760 m€ (2018)

- Organic products turnover in Flanders: 289 m€ (2018)

- Organic products turnover in Sweden: €2.66 billion (2016)

- Organic products turnover in Germany: € 9.48 billion (2016)

- Organic products turnover in France: 7.15 billion € (2016)

- 40 % of the expenditure on organic products are “potatoes, fruit and vegetables”.

- 36 % of the share of the market is to be attributed to conventional supermarkets.

Customer loyalty, an important part of the marketing strategy

To distinguish herself from the competition, Emna Everard explains that the community built around Kazidomi is an asset. This community is moreover rather “generalist”. It is not necessarily a clientele already addicted to organic products.

We have a lot of customers who are not used to shopping in organic stores. These are people who want to live better, to feel better about themselves and therefore want to go in that direction, but who didn’t know-how. Thanks to Kazidomi, we try to simplify the purchasing process for them, to suggest baskets, and so on, to make it easier and to break down the barriers for people who shop in traditional retail.

The axis that I found very interesting in Kazidomi’s strategy is this desire to lower the barriers to buying. Firstly, the price barrier through a subscription-based business model; secondly, the choice barrier by guaranteeing the customer that everything is healthy. As we say in English, this becomes a “no-brainer”. The consumer no longer needs to procrastinate, to ask complicated questions that would prevent him from making a purchase decision. We are breaking down barriers to free up purchasing. And when the first purchase is made, and satisfaction is there, the road to loyalty is clear.

What we try to do at Kazidomi is to make the purchasing process super transparent by explaining not only why these products are healthy, why we chose to put them on Kazidomi, describing the origin, and so forth, but also by favouring environmentally friendly products. So, that’s where we stand out.

Lessons learned

I think the podcast provides several lessons that will be useful to other entrepreneurs.

Eliminate barriers to purchase

A clear value proposition is essential. Here, it is clear, Kazidomi offers you healthy products at an attractive price. This value proposition is made possible by a rigorous selection by nutrition specialists on the one hand, and by a subscription.

Focus on customer loyalty

I’m not going to dwell on the benefits of customer loyalty (for more information, see this page). What should be retained here is the fact that Kazidomi plays both on its business model (by subscription) and on the community to leverage and achieve this loyalty.

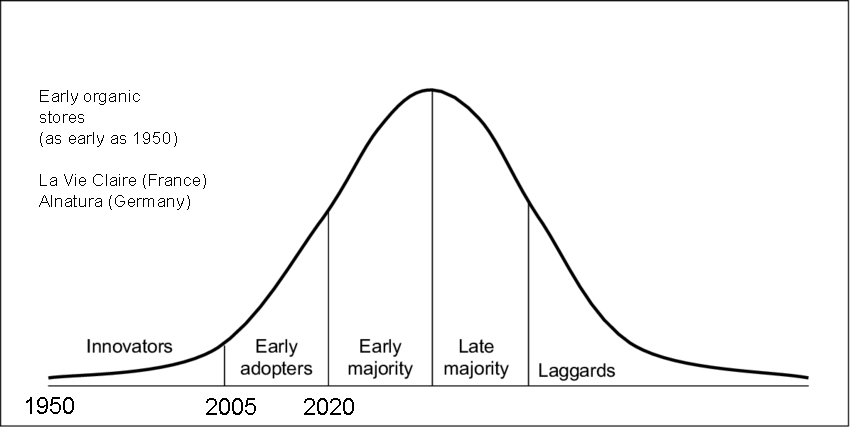

Do not target a niche market

Organic is only a small part of the food market in the general sense. It would be a mistake to target, within this market, only an even more limited portion, that of people who already consume organic food. These people are already convinced and no longer have any barriers to purchase. They are already buying elsewhere and converting them can only be done based on solid arguments. Kazidomi is rather addressing a target that I identify at the border between early adopters and an early majority on the Rogers curve. The evolution of the organic market will be the subject of new analyses in the year 2020 since in September 2020, the SIAL trade fair is to be held. This food trends laboratory is organised every 2 years, and we have been covering it for 12 years. (find here our advice to prepare your visit).