After my forecasts on the future of the aviation sector, I propose today to focus on the future of the retail food industry, in other words, the trade and mass distribution sector. 25% of jobs in the US are in the retail industry. The stakes of the effect of the coronavirus on this sector are therefore significant.

To write this article, I interviewed several leaders of the retail sector, including CEOs of well-known brands. I also used the latest available statistics and various reports.

Finally, as food retail is part of a larger universe (retail), we will discuss the future of non-food retail in an article that will be published separately. If you don’t want to miss it, you can subscribe to the newsletter below.

Summary

- Introduction

- The current impact of COVID-19 on the food retail sector

- Impact 1: security at the point-of-sale becomes a strategic issue

- Impact 2 : declining profitability and forced automation

- Impact 3 : adaptation of payment areas

- Impact 4 : reorganisation of sales areas

- Impact 5 : bulk products avoided

- Impact 6 : cannibalisation effects

- Impact 7 : acceleration of the transition to e-commerce

- Impact 8 : a new customer experience is more than ever necessary

- Impact 9 : a significant impact on the tourist food trade

The essence

- Consumers spend more time in the store, spend more but come less often (49% more spending per minute spent in the store). Source: Amoobi

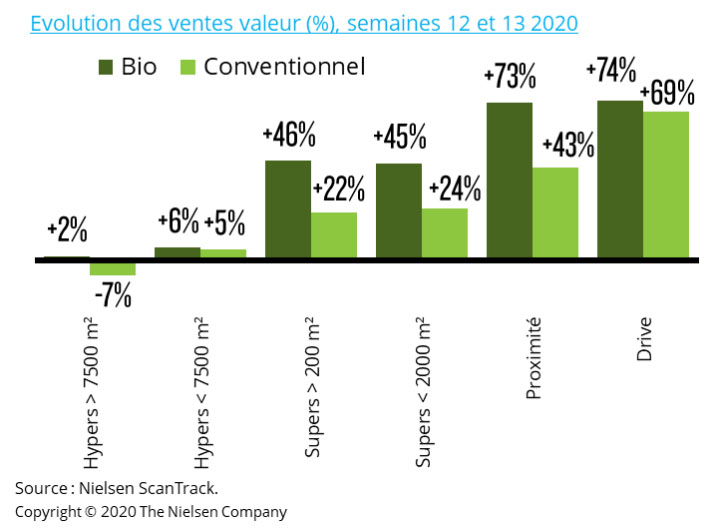

- Organic products benefit more than others from the increase in food purchases (20 to 30 percentage points difference). Source: Nielsen

- Customer health safety at the point of sale will become a strategic issue until 2022. New facilities will be developed to ensure a minimum of risks during the visit to the sales outlet.

- The online channel is becoming an integral part of food purchasing habits, and the proportion of online purchases will exceed 10% among major retailers by 2022. There is no turning back, and all retailers will have to have an e-commerce website within 3 years.

- Physical points of sale will see their profitability fall, forcing them to find ways of reducing their sales areas.

- The last reluctant customers start to pay by card, and the cash will, therefore, be erased from the transactions more and more.

- The in-store customer experience will become a key success factor from 2022 onwards.

Introduction

How will purchases and attendance in food stores and especially supermarkets evolve? This is the question that many analysts are asking at the moment. The period of confinement has seen the emergence of irrational behaviour. When the deconfinement takes place, a catch-up effect will inevitably take place, which will lead to a rebalancing of purchases.

However, the psychological effects of the crisis will continue long after the deconfinement and consumer behaviour will be lastingly affected. The fear of infection will persist for a long time to come, particularly since a Harvard study published in the journal Science predicts regular periods of confinement until 2022. Under these conditions, consumer confidence will be impaired for a long time to come.

In this article, we begin by detailing, with numerous statistics, the currently measurable consequences of the coronavirus crisis on the retail food sector. We then go on to look at the foreseeable medium- and long-term consequences on this sector of activity.

The current impact of COVID-19 on the food retail sector

Bulk buying behaviours

The implementation of confinement procedures, leading to the shutdown of many activities, naturally affects local shops first and foremost. All non-essential shops have been closed. Only food stores remained open, with supermarkets in the lead, which have to manage rising demand and hysterical behaviour. We will remember in particular the massive purchases of toilet paper, but also those of pasta in Germany. Aldi supermarkets had to charter special trains to bring spaghetti from Italy. In some cases, the authorities had to ban promotions to curb the shopping frenzy. At a time when Vietnam is blocking rice exports, and Kazakhstan is reducing wheat exports, we can expect disruptions in the supply chain in Europe from the summer onwards, as harvests on European soil, will by no means be sufficient to meet demand. In November 2007, the FAO analysed a similar situation (but on a much smaller scale) which led to a scarcity of raw materials. Whatever the channel (offline or online), the statistics of food purchases during the confinement are frightening:

- frozen food sales: +57% (Lidl), +51% (Cora)

- French fries: +50% (Delhaize)

- soups: +360% (Cora)

Less frequent, more substantial, but less impulsive purchases

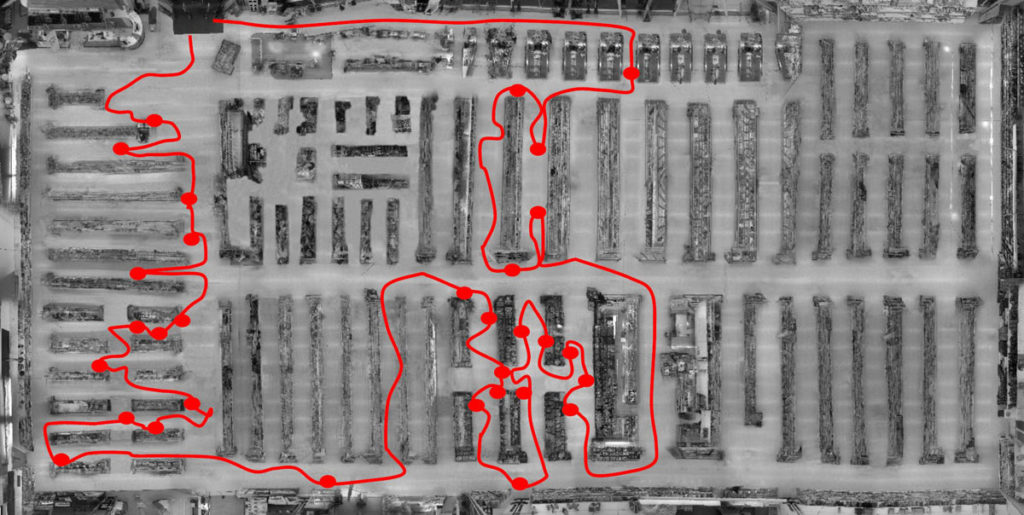

What the Amoobi study shows is that consumers are buying more in less time. As a result, the ratio of spending on time spent in the store has increased by 49%. However, this is to the detriment of point of sale exploration. The illustrations below clearly show how COVID-19 has changed the in-store routes. Consumers are exploring less, following more linear trajectories. Efficiency has become the watchword because time in the store is counted, the health risk is present. Impulse purchases are on the decline, which affects the profitability of mass distribution. Purchases are indeed concentrated on essential products (remember the cases of flour, pasta, …). Those massive purchases are well reflected in the sales figure of retailers : +20% in the UK in March 2020, +30% for Casino in France on the second half of March Mars, +30% in The Netherlands.

Unprecedented pressure on online sales

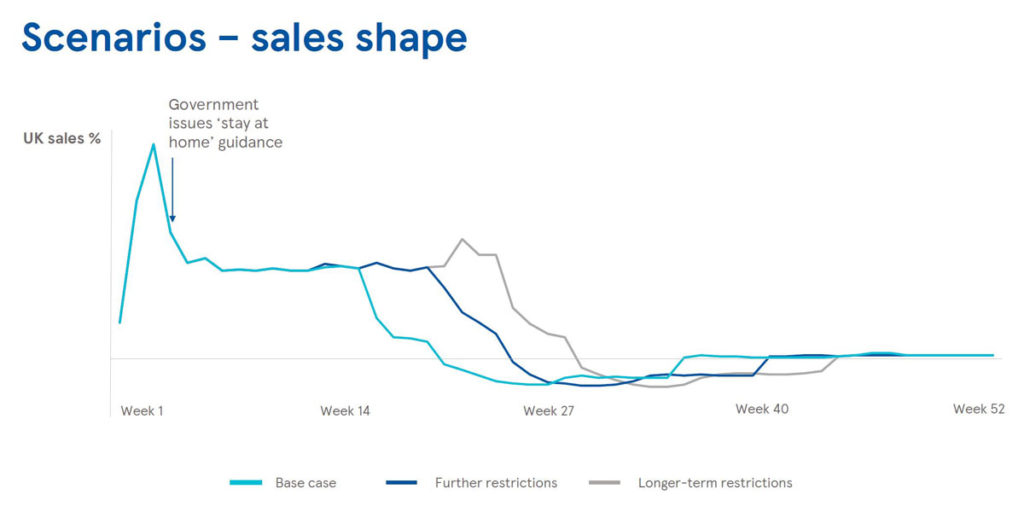

The immediate impact of containment measures should be analysed according to the type of trade. For businesses that have had to close (non-essential stores) or have chosen to close voluntarily, incompressible costs must still be incurred (including lease and loan interest). At the same time, there is no longer any revenue. These businesses are facing bankruptcy. For food shops, the situation is in total opposition since supermarkets are under unprecedented pressure. This is paradoxical since the absolute number of customers in points of sale is falling. In particular, online orders have soared, whereas until now they have been the poor relation of supermarkets (between 1% and 10% market share in Europe). This craze will propel the percentage of online retailing to over 10% in all the countries of continental Europe. Expect a 2-3 percentage points increase already in 2020.

- x 6: the increase in home deliveries at Carrefour

- x 5: increase in online orders, all delivery channels combined, at Carrefour

- 300-400%: increased demand at Colruyt (Belgium) for the “Collect & Go” service

Never before has there been such a passion for organic products

It is also surprising that the market of organic products is following an upward trajectory never seen before. The gap with standard products is widening. In stores of less than 2000 m² and convenience stores, the growth in sales of organic products is respectively 20 and 30 points higher than that of conventional products (source: Nielsen ScanTrack). There are two explanations for this phenomenon: on the one hand, consumers need reassurance in such an uncertain period; on the other, organic products are less easily out of stock.

The current consequences of COVID19 on the food retail sector having been analysed, let’s now move on to the 8 impacts of this health crisis in the medium and long term.

IMPACT 1 : health safety becomes a strategic issue

Regardless of the sector of activity, physical outlets will not miss out on the implementation of reinforced hygiene measures. These actions are well developed in convenience stores and in particular in food retailing. Most of these tests are pragmatic and are carried out with the means at hand (provision of hydroalcoholic gel, compulsory hand spraying, ground markings to respect minimum distances, protection in Plexiglas or various materials, visors, and so on).

Stores that do not offer disinfection measures are out of the game.

Arnaud Lesne, Carrefour

Other tests are more structured with a real desire for control at the entrance to the sales outlet. Carrefour is currently testing a prototype in Belgium (the StaySafe Cube) which looks like an entrance airlock. It was designed by Arnaud Lesne, Innovation Director, in one weekend. Customers are required to disinfect their hands in the airlock, and complete spraying is also taking place. A marking on the ground outside the store allows safety distances to be marked and queues to be formed in an orderly manner. The apparent advantage of the #StaySafe cube is that it is installed on public property and therefore does not reduce the surface area of the store. This system does not apply to all stores, and a more compact model is under development. “Safety measures are set to become the new norm. Customers demand them,” says Arnaud Lesne, who also points out that customers are satisfied with the system. He tells us that a more extensive scale deployment is under consideration.

Carrefour quickly launched an improved version of its #StaySafe; more compact than the above model, it has been operational since April 22nd, 2020. In our opinion, it prefigures the solutions that will become widespread in the near future.

Another structured initiative is the one visible in a Delhaize Group outlet. A UV-C disinfection machine has been installed there for the trolleys.

Renaud Caeymaex, the boss of AD Delhaize supermarket who decided to buy this machine, explains that it is better to do too much than not enough. He has taken measures since March 2020 to protect his staff: visors and goggles, masks, Plexiglas protection, compulsory hand disinfection at the entrance for all customers, markings on the floor. He explains that these measures, having been judged excessive by some customers before confinement, are now well accepted. They aim to reassure those in the store, and it works. Renaud Caeymaex sees the tension in his store decreasing and has not had any incidents between customers since the beginning of April. All these measures have of course a cost (see next paragraph), but he considers them essential: “It is essential to be the best in disinfection” he explains. He is also convinced that these measures will continue beyond 2020.

Investing in health measures is essential to gain a return on “customer confidence”.

Renaud Caeymaex, Delhaize

In any event, as long as the situation remains anxiety-provoking (that is to say, in the absence of a hypothetical vaccination), the outlets that implement such solutions will have a competitive advantage. Arnaud Lesne goes further, stating that outlets that do not have such a system in place will be “out of the game”. This view is shared by Renaud Caeymaex, who sees health measures like a real “marketing strategy” which is already bearing fruit.

IMPACT 2 : Profitability impacted for large-scale retailers

If spending is on the rise, we could expect that mass retailing will be the big winner of the crisis. This is without counting on the increase in personnel and logistics costs. Let us not forget that disinfection equipment also has a price. As Arnaud Lesne (Carrefour) reminds us, the price of hydroalcoholic gel reaches a peak with 5L cans that exceed 100€. Even sprayed in small quantities, when several hundred customers a day pass through a point of sale, the bill can quickly become very high.

While the cash flow will remain functional thanks to increased sales, the bottom line will not follow in the same proportions because fixed costs are also rising rapidly. Massive customer purchases are putting pressure on the supply chain. This means that more staff have to be employed. A race to automate will, therefore, take place. This will lead to the appearance of robots in the aisles, as is already the case at Walmart. In terms of order preparation, major projects will also be launched (not before 2022-2023) to increase production rates. This minimum 2-year lead time takes into account pre-engineering, execution of the work and commissioning.

Sales/m² will remain stable in the short term despite the drop in customer numbers, but will deteriorate slightly from the second half of 2020. Before the crisis, the average monthly occupancy rate was 2.2 times per month. It is projected that in 2020, the number of visitors will be divided by 2 or 3.

The profitability of mass retailing will be down. The forecasts published by Tesco on 08/04/2020 are not reassuring (see below). They show rising costs: from £650 million to £925 million depending on the scenarios. Profitability will be significantly affected (1 billion Euros less on the bottom line will not go unnoticed). Ahold Delhaize estimates the impact on the bottom line at €170m. Let’s not forget that the related activities of retailers can also be affected and contribute (very) negatively. We will think here of petrol stations, or specialised retailers (toys, baby articles and so on).

In terms of staff costs, some retailers who already make extensive use of automation may be less affected. The reopening date of restaurants and cafés, if further postponed, could also benefit food retailers. In the columns of a Belgian daily newspaper, the director of the two most abundant restaurants in the capital explains that he expects them to reopen in mid-July and return to normal in 2021-2022. This gives the retailers time to stabilise their revenue.

The mass retail sector (and all retailers for that matter) could also count on an unexpected ally to make their 2020 year a success nonetheless: the summer holidays. Cancellations are on the rise (20% of summer bookings have already been cancelled) and holidaymakers, for fear of the epidemic or forced to stay home if the containment continues, could spend the summer at home. At the very least, they may well decide to spend their holidays in their own country and bookings to do so are already on the rise. Northern European countries, whose inhabitants go south for their holidays (Italy, Spain, France) could provide an unexpected windfall in turnover in the Netherlands, Belgium, United Kingdom, Denmark, Germany.

IMPACT 3 : the payment zones will have to be adapted

The Coronavirus crisis has allowed contactless payment to make new friends, to create new habits, especially since in some countries the payment limit has been raised. For example, in Belgium, the limit has increased from €25 to €50, in the UK to £45 instead of £30, in Australia to $AUD 200 instead of 100, in Ireland to €50 instead of €30. France will double the limit from 11 May 2020. Cash payments will, therefore decrease and are already being observed. In Belgium, withdrawals have fallen by 50%. Even the most cash-favoured countries will see new habits emerge. This is good news for the finances of the countries concerned since electronic transactions are reducing the rate of tax fraud. Worldline estimates the share of contactless payments at 30-35% in 2021, compared to only 10% until now.

The trauma of the virus, the learning and practice of “barrier gestures”, the surge in electronic payments, do not mean the disappearance of traditional cash registers (in favour of quick scans, self-scans, …). Moreover, it can be seen that conventional cash registers are currently more popular. This is due on the one hand to the volume of purchases, and on the other to the restrictions imposed by the shops (some of them impose the use of shopping trolleys to keep customers at a distance) which makes the use of automatic cash registers impossible. Alternatives to traditional cash registers can only become credible again if shops offer facilities that guarantee the safety of customers. For example, special rules will have to be introduced to deal with waiting times and the concentration of people in automatic checkout areas. Situations such as the one mocked by a twitter user on the opposite page cannot be tolerated.

The trauma of the virus, the learning and practice of “barrier gestures”, the surge in electronic payments, do not mean the disappearance of traditional cash registers (in favour of quick scans, self-scans, …). Moreover, it can be seen that conventional cash registers are currently more popular. This is due on the one hand to the volume of purchases, and on the other to the restrictions imposed by the shops (some of them impose the use of shopping trolleys to keep customers at a distance) which makes the use of automatic cash registers impossible. Alternatives to traditional cash registers can only become credible again if shops offer facilities that guarantee the safety of customers. For example, special rules will have to be introduced to deal with waiting times and the concentration of people in automatic checkout areas. Situations such as the one mocked by a twitter user on the opposite page cannot be tolerated.

IMPACT 4 : Organisation of sales areas

Pending a return to a safe situation, and given Finnish research showing the spread of the virus from one wing to the other, improvements could be made. For example, we can think, even if it is unlikely, that mechanical protections could be set up between the shelves to isolate them from each other.

Other, more likely, improvements include the temporary removal of refrigerator doors and the generalisation of floor signs to help customers maintain safe distances. The latter are already widely used (see for example the inventory of measures compiled by Olivier Dauwers). Tension is high in supermarkets (confinement has unsuspected psychological effects), and arrangements of this type can help reduce anxiety. Some retailers have also introduced one-way traffic flows in stores. For local supermarkets, which are often cramped, one-way traffic seems to be the only solution in the short term (unless the flow of customers is further reduced and meeting within an aisle is unlikely).

In the end, the whole issue, at least temporarily, will be to bring back the time of in-store exploration to encourage impulse purchases, which have currently disappeared. This will last from 6 to 12 months. An imposed route (in the manner of Ikea) is a disastrous solution. It would be equivalent to pushing consumers to be even more efficient and less impulsive. On the other hand, supermarkets would be well advised to adopt the codes of concept stores by taking certain products off their empty shelves and placing them on the new customer routes. New routes must be invented to simplify impulse buying while minimising the time spent in the store. Previous attempts to take products off the shelves and put them together have so far not been successful. But the current situation is unprecedented and also calls for new solutions.

IMPACT 5 : the bulk products will be avoided in the medium term

Vegetables and fruit in bulk are being shunned during the confinement in favour of those that were packaged. The fear of touching fresh produce could continue for some months, forcing retailers to plan solutions to avoid physical contact. Stores relying on a “no packaging” concept will have to review their approach and adjustments will be inevitable. This could, for example, include the obligation to put on disposable gloves on arrival in the shops. Wearing masks when going outdoors will become widespread, as in Asia, and it will, of course, be compulsory at sales outlets.

Under these conditions, it is logical that single-use plastic is making a noticeable comeback at the points of sale. The lobby of the plastic producers, reveals the French newspaper Le Monde, has moreover written a letter to the European Commission asking for the postponement of the SUP directive.

IMPACT 6 : cannibalisation effects and short circuits

The food retailers that have voluntarily closed have made a strategic mistake. In doing so, they sent their loyal customers to buy from their competitors. Some will not recover because their former customers will not return. It only takes a better product or service to make a customer decide to change his or her habits. The period of confinement has mostly allowed new patterns to develop. Beware of collateral damage. The economic crisis has only just begun.

A cannibalisation effect is also underway between local shops and supermarkets. Nielsen notes that the former are seeing their sales increase by 26% compared to the previous year. Habits are made to stay, and a return to normality is ruled out, at least in the medium term. The emotional and psychological bonds that will be created during this crisis between a local shopkeeper and a customer are made to persist, provided that the reduced sales area does not become too anxiety-provoking for the customer.

The need for reassurance will persist long after the crisis, as was already seen to a lesser extent after 2008. This is perhaps an unprecedented opportunity to revitalise city centres with a new food offer. Proximity brings us closer together (sorry for the euphemism) and we may be entering a cycle of deconstruction of the glocalised model that has prevailed until now. The fear is that part of the population will be excluded from these qualitative choices and that an even more visible break will occur in the purchasing habits of the extremities of the community.

IMPACT 7 : acceleration of the transition to e-commerce

The technological changes that were timidly underway before the crisis are being accelerated at the speed of light. There is no turning back. Customers are adopting online channels, and retailers must adapt, at the cost of very significant human investment. In some large retailers, the size of preparation and delivery teams (for online sales) has quadrupled.

During the crisis, the online channels have, therefore helped to shift part of the sales. This will eventually be insufficient to compensate for lost sales in physical outlets. But since the Easter weekend is over, let’s talk a little bit about chocolate. A report on the subject tells us that the Galler brand has no sales channel and that “E-commerce has always been a small part of the business” at Leonidas. In France, a report from BFM shows that chocolate makers have converted to e-commerce as a matter of urgency. This state of affairs is symptomatic of traditional retail. A study by Comeos shows that 54% of their members did not have (23%) an online sales channel, or that it represented a tiny part of the turnover (31%).

Is this, therefore, the beginning of the end for physical trade, the “brick-and-mortar” as the Americans say? It certainly is not. I was talking about it in a podcast with Bob Phibbs, The Retail Doctor. Consumers need to get out, take their minds off things and find new products. Physical stores are first and foremost places of discovery. We can see this nowadays since purchases are made out of necessity and with a focus on efficiency. This leads to a 49% increase in spending per minute spent at the point of sale, according to a report by Amoobi, whose CEO, Olivier Delangre, I had the pleasure of interviewing.

IMPACT 8 : the customer experience will become essential as of 2021

As in the non-food sector, we can anticipate that the customer experience will grow in importance. Shopping must remain above all a moment of pleasure, and it is, therefore, reasonable to expect that after the imposed confinement, consumers will want to return to places of pleasure. However, with mass unemployment and an economy at its lowest level since the Second World War, the number one priority for retailers will have to be customer loyalty. Customer service will, therefore, have to be particularly meticulous. As Bob Phibbs explained to me, you have to go beyond “how are you today” to show real empathy with customers. Empathy and flexibility will become competitive advantages. They will have to become part of the customer experience.

“Chocolate awakens all five senses, in-store you can taste the product, smell it and enjoy the advice of the salesmen, which is impossible on the Internet,” Jos Linkens, the boss of the chocolate maker Neuhaus, told a Belgian newspaper. And he is right in that respect. Mobilising the senses is a crucial part of the customer experience. Re-attracting customers to the store will, therefore, require the creation of a customer experience that mobilises the senses and allows the consumer to escape from an anxiety-provoking daily life.

In supermarkets, the customer experience will also be more critical than ever. The current health crisis could, as in the days of the mad cow scandal, bring back the need for healthier, more authentic products. The organic market will only be better off, but so will the e-commerce of healthy products such as Kazidomi. The promotion of authenticity will also involve a revaluation of local production and local producers. This process is not new but it will be more necessary than ever to rebuild the link with the producer. Does this mean that short circuits will be favoured in mass distribution? Consumers may indeed show an ever-increasing interest in brands that promote local production, and supermarkets may well have to diversify their sources of supply. We also remember the Delhaize urban farm project launched by the visionary Denis Knoops.

IMPACT 9 : an essential effect on the “Tourist” brands

Some food retailers, some brands, operate in large cities with a tourist clientele. This is particularly the case for national specialities that tourists like to take home. In Belgium, a brand like Pierre Marcolini, which has developed an international reputation, is going to experience challenging years. Its future is linked to that of the airline sector, and it is not a bright one. On the other hand, a chocolate maker like Jérome Grimonpon (best chocolate maker in Belgium 2020) is going through the crisis without too many problems thanks to a mostly local clientele.

Illustrations : shutterstock

Posted in Strategy.