Our most recent market research has identified 5 trends that will shape the future of retailing.

- Technology and tools to enhance decision making

- Innovations in visual display to make customers’ purchase decisions easier

- Differentiating customer experiences

- Collection of data at massive scale (Big Data) and their usages

- Use of analytics to improve profitability

- Case studies

In today’s article we will discuss and illustrate each of those 5 market trends.

This article was last updated in March 2020 following:

- a podcast we made with Olivier Delangre, CEO of Amoobi, who after a trip to the US and UK, shared with us his retail discoveries. You will find the audio excerpts of his interview at the beginning of each chapter.

- the Coronavirus crisis leading to critical behavioural changes

UPDATE: Impact of the Coronavirus crisis on supermarket purchases (31/03/20)

The Coronavirus crisis is completely reshuffling the cards in terms of supermarket purchasing behaviour. The changes we are observing could be long-lasting and become habits. I’m not even talking about the business failures that will follow the confinement measures and the collapse in demand.

So, what are the 2 changes that we’re going to see?

- the disaffection of physical points of sale: social distancing measures will leave their mark, and it is illusory to think that customers will quickly go back to the supermarkets.

- shift in demand towards online purchases: new customers have tested online purchases (collect-and-go, collection points) and are not ready to change them. Order preparation capacities will have to be reinforced, and the means to make them available will have to be strengthened.

The 5 trends we had anticipated (see below) are impacted:

- Trend 1: Stores will become more and more “automated” to spend as little time as possible. Personalisation will be done more and more online at the time of reservations made by customers.

- Trend 2: The influence of the product on the shelves will diminish. New ways of highlighting products outside the physical sales area will have to be thought about.

- Trend 3: the customer experience is going to have to be created online rather than offline. This is a significant challenge that will lead retailers to question the factors of satisfaction and loyalty online.

- Trend 4: Big Data will see its influence increase as more and more people are buying online. On the one hand, this is positive because collecting data online is more straightforward. But on the other hand, online data is likely to be less productive than the information that can be captured offline.

- Trend 5: In line with trend 4, cost-effectiveness analyses will be more critical than ever. Eventually, the profitability of physical points of sale will be called into question and disinvestment will be observed in the latter. The last remaining strongholds of physical retailing will fall in the next 5 to 10 years.

Technology and tools to enhance decision making

Technology and tools to enhance decision making

Several technological developments have changed dramatically the way we shop and will continue to be important in the future.

-

More and more personalization

Thanks to cloud and distributed computing purchases logged on loyalty cards can be better leveraged to propose personalized offers. Further technological improvements will help retailers propose personalized offers in real-time, for instance through mobile applications.

-

The shopping trip will become more convenient

The Tap-To-Go system by Ahold is the Dutch response to Amazon Go. In the future shopping trips will become frictionless, hassle-free and always faster. This will imply having less human interactions at the checkout. Experiments like AmazonGo in the US or Tap-To-Go in The Netherlands support this trend and will most probably replace other checkout systems like quick scan or self-scan on the long-term.

-

E-commerce market share to grow

In some countries the market share of e-commerce is still low for Fast Moving Consumer Goods (FMCG). But it will keep growing. Consumers have less and less time to go to the supermarket and online ordering will increase. Whether the delivery is at home or picked-up in the supermarket will depend on the supplement asked for that kind of service but shoppers willing to undergo the hassle of a crowded saturday afternoon supermarket will become rarer and rarer.

Innovations in visual display

Innovations in visual display

How to stand out from the crowd when consumers are overwhelmed by product offerings ?

Shoppers are unable to process the amount of information at hand in a supermarket. The cognitive load is just too high. As a consequence they buy always the same and don’t discover what the range of products available.

Supermarkets need to change the way they display product to make it easier for shoppers to discover products and process the related information. Smart shelves like the one presented by AWM are obviously going to be a groing market trend in the future. Beware however of potential ethical issues.

Differentiating customer experience

Differentiating customer experience

The importance of creating differentiated customer experiences should not be stated again.

One excellent definition of customer experience is offered by Prof. Verhoef :

“[it] involves the customer’s cognitive, affective, emotionnal, social and physical response to the retailer. This experience is created not only by those elements which the retailer can control […] but also by elements that are outside of the retailer’s control […]”

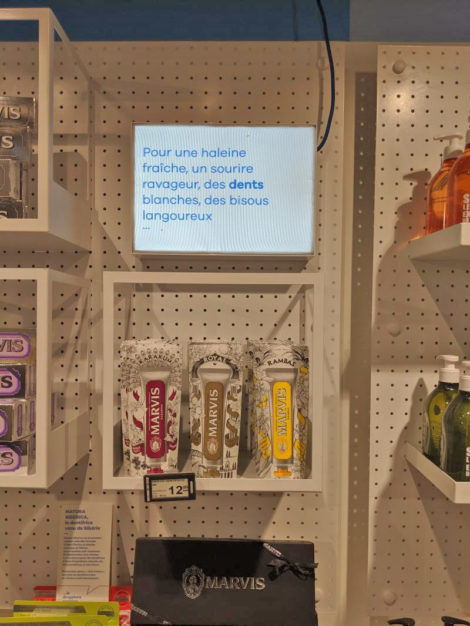

We believe that the future of retailing will leverage emotional connections with customers. Several strategies can be used by retailers to reach this goal :

-

higher purposes or values

Retailers may try to connect with customers through the development of strategies emphasizing higher values and purposes.

-

out-of-store experience

The retailer’s category will play a role in determining which experience is proposed. Premium food retailers will certainly engage in campaign for healthier eating and will try to make purchases less of a commodity. Higher technological maturity may also lead retailers to renew out-of-store experiments that had failed in the past (see for instance the Delhaize “The Cube” experiment).

-

in-store experience

Visual aids, smart shelves, faster payment methods will all contribute to making the in-store experience different. In-store experience will also be revolutionized by mobile apps. They have been very underestimated until now and their use remain rare and is mostly limited to experiments (see for instance the augmented reality app launched by Ahold).

Big Data

Big Data

Collecting data has been at the heart retailers’ strategies for years. Personalized coupons for instance were created using complex algorithms to predict what you’d like to purchase next.

The availability of cheap computing power in the cloud will enable to leverage even more the data collected and support the development of new systems aiming at collecting even more. See for instance the Amazon Go concept store launched by Amazon which collects and analyses a wide range of data previously not captured.

Linking analytics and profitability

Linking analytics and profitability

Supported by the previous trend (Big Data collection) it seems obvious that retailers will invent new ways to improve their profitability (especially in a context of tug-of-war between e-commerce and brick-and-mortar stores.

New experiments of in-store dynamic pricing will certainly be reported in 2018. New types of data collected (for instance through instant payment methods) will enable retailers to visualize in-store shopping sequences and improve store layout to lead to more impulsive purchases. An important performance indicator in that respect is the percentage of products purchased that are new to the customer. Ensuring that the customer explores the widest range possible of products is key to the retailer’s profitability.

Case studies

Case studies

Offbeat communication for Drugstore Parisien

Robots checking inventory and prices

Colruyt makes it more convenient to checkout

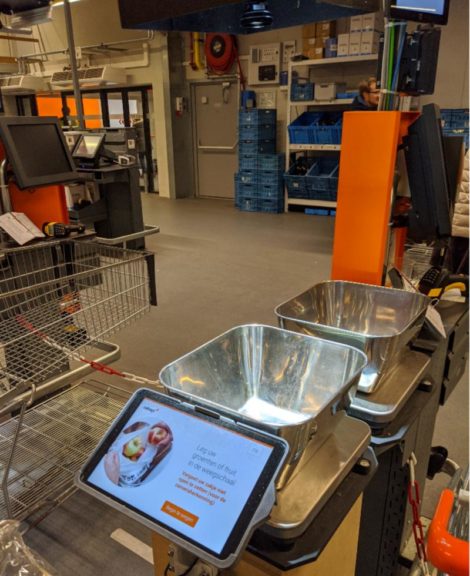

Here’s a very nice use case of how retailers use artificial intelligence (object recognition in that case) to make it easier for customers to shop. Olivier Delangre, the CEO of Amoobi, posted the following picture after a visit at a Colruyt store in Kortijk (western part of Belgium). He wrote :

“Colruyt recently installed smart cameras at the check-out of the store in Kortrijk. Those smart cameras recognize automatically fruits and vegetables to speed up the check-out process.

It turns out it was a great way to understand the interaction between technology and user/colleague experience.

I selected apples and decided to test it myself. A 60+ lady was in front of me at the check-out and was for sure a regular customer. She put her grapes in the scale, bag opened and started the scanning process (all by herself). Unfortunately, it didn’t work and the help of the cashier didn’t help and the cashier had to put it on the regular scale (yes they have both) to do the traditional process. When I came next, I wanted to scan my apples but the cashier asked me to put it in the regular scale, “to make it easy”. I truly believe in technology and this one is super interesting but it’s also a good reminder that technology has to be perceived as a positive contribution and it’s a good reminder for all of us, technology providers. Finally, congratulations to Colruyt for trying new stuff. Innovation can’t wait and I’m sure they are learning a lot thanks to this trial.”

Two checkout zones at Waitrose in London

Images: Shutterstock, Olivier Delange

Posted in Marketing.

Technology and tools to enhance decision making

Technology and tools to enhance decision making

Innovations in visual display

Innovations in visual display Differentiating customer experience

Differentiating customer experience Big Data

Big Data

Linking analytics and profitability

Linking analytics and profitability Case studies

Case studies