This article presents the results of quantitative research among distributors and consumers. The results highlight significant differences of opinion between these 2 groups.

Are consumers ready to change their packaging habits? A recent survey echoes market research we conducted in 2024 for the Consom’Action network among 1,000 consumers on purchasing bulk products. We detail the results here.

Contact IntoTheMinds for your market research needs

The survey was conducted with distributors and consumers, enabling us to cross-reference points of view. As you will see from the results, there are several areas where consumers and distributors disagree.

Consumers remain unconvinced by brands’ commitment to the environment

The first thing to learn from this survey is that there is a marked difference between what retailers say and what consumers perceive. We had already noted this paradox in another survey, this time dedicated to the benefits of digital in-store.

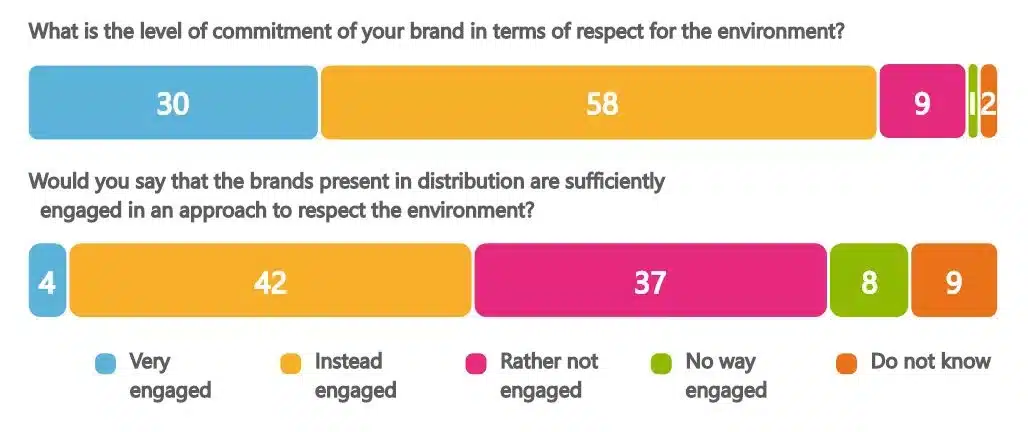

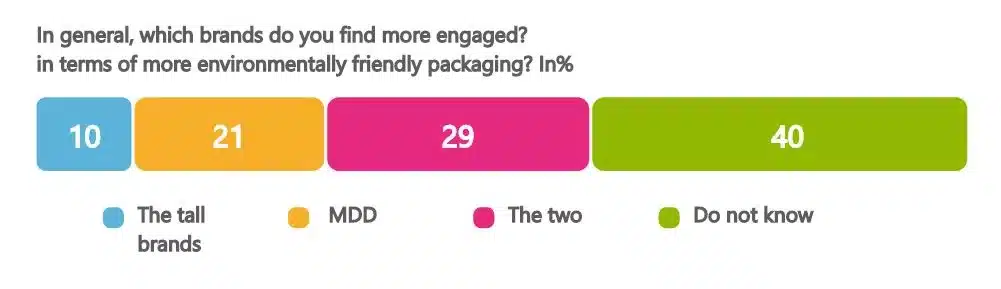

While 88% of distributors say they are committed or very committed to respecting the environment, only 46% of consumers feel that brands need to do more. Although striking, this difference is not in itself very surprising. Indeed, the efforts of retailers and brands are only sometimes visible to consumers. And even when they are (reducing over-packaging, for example), consumers can only sometimes assess the industrial effort conducted. 40% of consumers need help determining which brands are making the most effort regarding packaging.

Priority to reducing excess packaging

The survey reveals that 59% of retailers have prioritized packaging reduction, and 29% are considering it. Only 5% of retailers claim to refrain from conducting such a survey. If the result of this question is so marked, it may also be due to confirmation bias. Currently, is it still possible to say that the environmental impact of packaging is not a priority for a retailer?

The priorities are clear: 68% of distributors are tackling the issue of over-packaging, and 55% are the outright elimination of plastic. However, this last point needs to be put into perspective. While eliminating over-packaging is a common-sense measure, its industrial impact should be noticed. Whether it’s reducing over-packaging or eliminating plastic, industrial logic must be reviewed. Production lines will have to be modified.

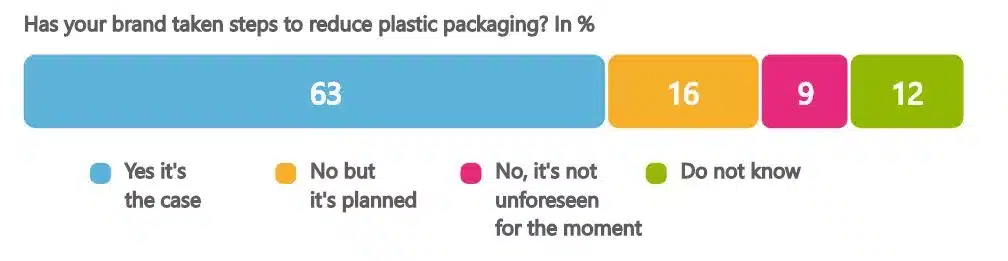

63% of retailers surveyed have already taken steps to reduce plastic packaging specifically.

Consumers in favor of an eco-score

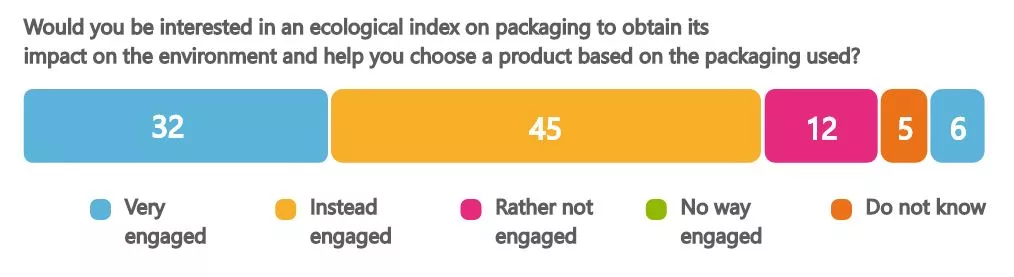

77% of consumers are in favor of an eco-score. Based on the nutri-score model, this eco-score would make it possible to measure the impact of packaging on the environment. Logically, 58% of consumers favor a single label binding on all brands. This would be a standard independent of product category, in the same way as the Nutri-score is applied to all types of food.

Consumers conduct themselves with care when it comes to plastic packaging

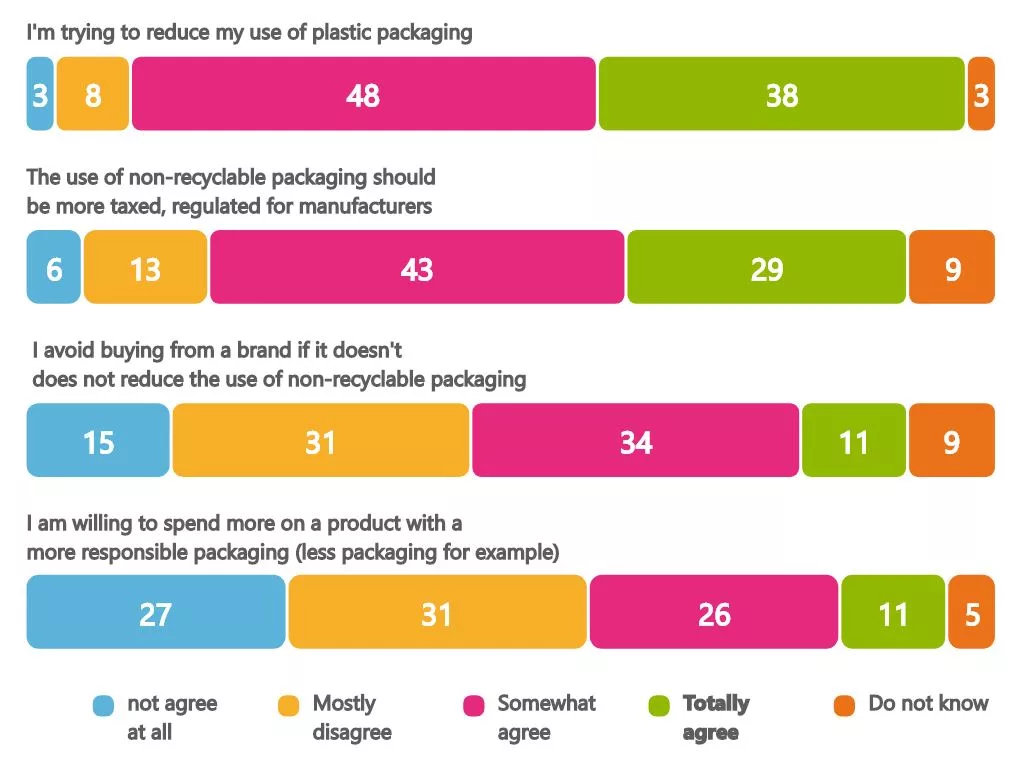

86% of consumers surveyed say they are reducing their use of plastic packaging, and 72% favor a tax on non-recyclable packaging. But at the same time, only 37% are prepared to pay more for products with more environmentally friendly packaging. There’s no contradiction among consumers.

Consumers are prepared to conduct themselves in an environmentally friendly manner, provided it doesn’t cost them anything financially, but more generally in terms of effort. A minority of consumers (45%) say they are prepared not to buy from a chain that does not make the effort itself.

Bulk buying food makes its mark on distributors.

With this kind of popular pressure, bulk sales are a natural solution for distributors. In this survey, 73% of respondents see bulk sales as a solution for reducing packaging in the food sector and 41% for household products.

Support declines rapidly with other product categories. Even if some case studies already exist in cosmetics (see our report on the Clarins boutique in the Marais district of Paris), they still need to be implemented. They are also undoubtedly technically and operationally more costly for a lower frequency of use. As a result, distributors are logically concentrating on the most profitable case studies in the shortest possible time.

Conclusion

The results of this survey show that consumers are aware of the environmental impact of packaging. Retailers and brands can, therefore, only follow suit. But their efforts need to be more visible to customers, who do not perceive the efforts that need to be deployed to reduce plastic packaging, for example. The challenge is to educate customers.

Against this backdrop, bulk sales will become a major trend over the next few years, reinforced by the legislative arsenal. However, not all products will be treated equally. Retailers will prioritize investing in the most cost-effective bulk sales solutions for the products they sell most frequently. Foodstuffs in the first instance and household products in the second will be sold this way.

Posted in Marketing.