Qualitative interviews are probably an essential method for B2B market research. Nevertheless, we notice that many companies do not know what to expect in terms of budget. This article explains how to budget for qualitative interviews in B2B and what the alternatives are for your market research.

Summary

- Why use qualitative interviews for B2B market research?

- What budget should you expect?

- B2B focus groups vs B2B interviews

- Alternatives to qualitative interviews in B2B

Qualitative interviews in B2B: nothing better for your market research

Most of the market research we realize using a B2B approach, one thing is clear: qualitative interviews are a must. The issues to be addressed in B2B are generally complex and require time for discussion that neither surveys nor focus groups allow.

In an exploratory context (discovery of a new geographic market, understanding the needs of a new segment), the B2B qualitative interview allows you to get “to the bottom of things”. Even in B2B, speaking time is often around 60 minutes. This leaves enough time to study complex subjects, such as strategy, needs, or decision-making mechanisms.

Success in a qualitative B2B interview requires serious preparation and a good knowledge of the sector.

The budget for B2B qualitative interviews

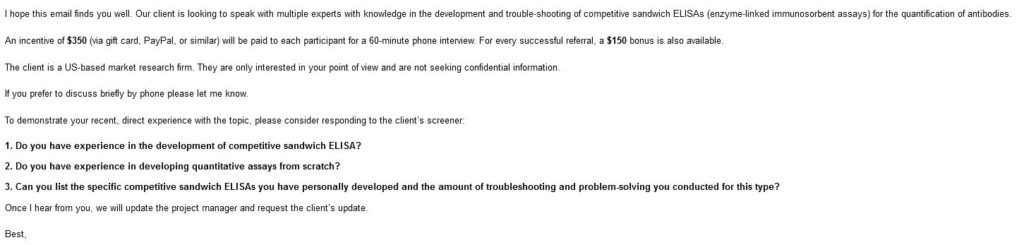

The budget for qualitative B2B interviews depends on 5 factors (see table below) plus:

- the project follow-up budget (kick-off, intermediate meetings, interview schedule management)

- logistical costs (interview recordings, GDPR documentation) reporting of the results

Based on the hundreds of B2B interviews conducted by our agency, the average budget for a qualitative B2B interview ranges from 650€ to 850€.

| Workload | Budget | |

| recruitment | between 1 and 4 hours | Up to 350€ |

| Interview preparation | 1 hour on average, sometimes more in case of technical training | from 120€ |

| Realizing the interview | 45 to 75 minutes | 100€ to 150€ |

| compensation for the respondent | n/a | 50€ to 100€ |

| analysis | 2 to 4 hours per interview, depending on the method chosen | 220€ – 440€ |

Here are the details of the different phases.

Recruiting respondents

Depending on the type of profile to be interviewed, it is necessary to plan from 150€ to 350€ for the recruitment phase. Some profiles are incredibly complicated to find and justify that the time spent to “flush them out” is higher. However, the low range (150€) is sufficient in most cases.

Preparation of the qualitative interview

This involves preparing the interview guide, learning about the sector and its dynamics. In some cases, training will be necessary to master the technical terms. For example, we realized qualitative research for a large group specialized in B2B cleaning. Our consultants took a half-day training course on office hygiene and cleaning techniques to prepare for the interviews.

Realizing the interview

Qualitative interviews in B2B last on average less time than those in B2C. Nevertheless, it is reasonable to allow 60 minutes per interview and an additional 15 minutes in case of delays, no-shows or overruns.

Compensation

Even in B2B, it is good practice to compensate the interviewee for the time spent. We generally advise an amount between 50€ and 100€. Some clients, active in sensitive sectors (banking, insurance), opt for indirect compensation in the form of donations to associations. This way, both the interviewee and the client have a clear conscience.

Analysis

The analysis of a qualitative interview can be realized in different ways. It is based on a written debriefing of each interview and a cross-analysis in its simplest form. When more nuanced insights are required, coding can be realized. The latter requires a word-for-word transcription of each interview, which adds a significant budgetary burden.

B2B focus groups: fewer insights for the same price

Focus groups are often wrongly presented as an alternative to qualitative interviews.

First of all, it is wrong to substitute one approach for the other. Their objectives are different (see our comparison). Secondly, focus groups are more complicated to organize in B2B, and the speaking time per participant is generally low: 10 to 15 minutes on average. In the end, for an equivalent budget, B2B focus groups will deliver far fewer insights than individual interviews.

Alternatives to qualitative interviews for B2B market research

To realize market research in B2B, alternatives to individual interviews exist

- telephone surveys

- B2B online panel

These two methods should be seen as complements to qualitative interviews. Nevertheless, in specific contexts, it may be appropriate to opt for a telephone survey or a B2B panel, which will give more statistical security to the results. If you wish to opt for this method, don’t hesitate to contact us.

Posted in Marketing.