The return to work and school in September 2020 is atypical and is subject to uncertainty. Companies are wondering whether the long-awaited recovery will finally take place. Nothing is more uncertain. Nevertheless, companies that wait too long could be the ultimate casualties. And here’s why.

If you only have 30 seconds

The end of the year 2020 will see only a slow economic growth from September 2020. Companies will remain on the lookout, and the fear of the COVID-19 epidemic’s resurgence during the winter will be challenging to handle for the constitution of the 2021 budgets. A sharper recovery will only be felt from January 2021. This period, which sees a critical number of disinvestments in sometimes crucial projects, is the ideal time to gain market share and to get ahead of your competitors. We identify 4 types of promising projects:

- Investments allowing online visibility benefits (SEO)

- The transition to e-commerce

- Supply chain efficiency improvements

- Value-added using data

What can we expect from the return to work in 2020 in terms of business?

In trying to “predict” the future, I like to think that we need to measure consumer confidence. They’re the ones who are at the root of everything: no consumer spending = no income for businesses = no investment opportunities.

No consumer spending = no income for businesses = no investment opportunities

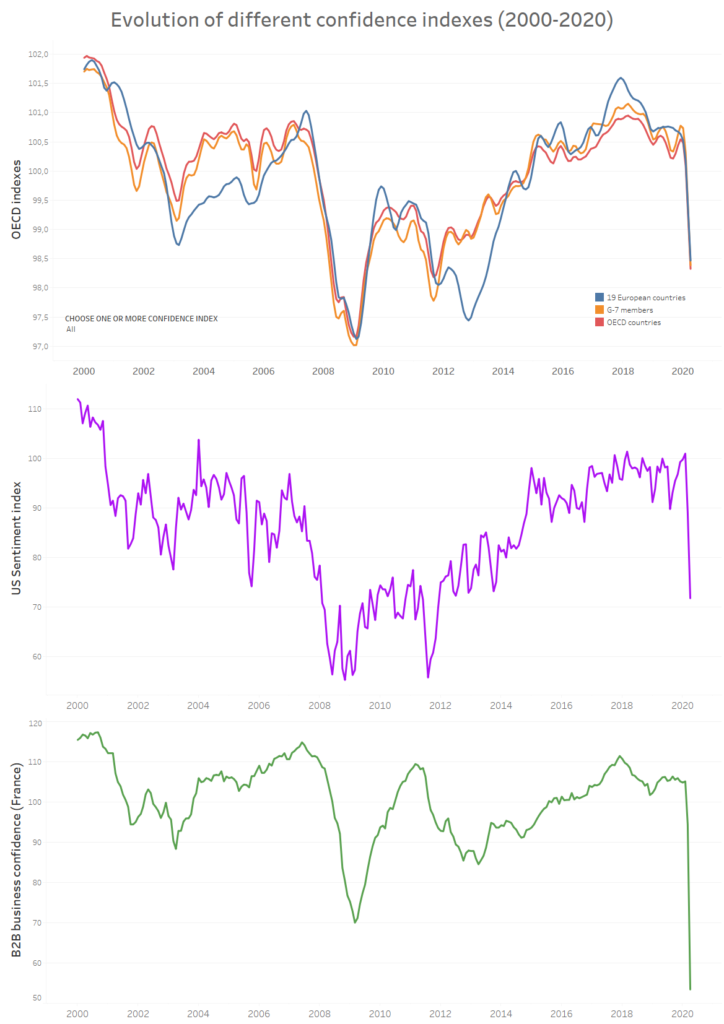

So, let’s look at the indexes that measure consumer confidence. The OECD produces a series of indexes for different jurisdictions; the University of Michigan produces the Customer Sentiment index.

Firstly, let’s remember that consumer confidence is far from having reached the same abyss as in 1980, 2008, or 2011. The US sentiment index, for example, is 15 points above its 2011 level. On the other hand, as measured by INSEE in France, business morale reached an all-time low in April 2020. Since then, it has soared but has not regained the level of February 2020.

Therefore, we can have hope, especially since the pandemic no longer has the same effects as during the 2nd trimester. Despite the catastrophism of the media, the lethal consequences of COVID-19 have been drastically reduced.

The post-COVID recovery scenario that I had outlined in May 2020 is, therefore, more and more probable. We will see a gradual but slow recovery from September 2020 to December 2020. During this period, companies will prepare their budgets for 2021. Companies’ outlook is now better: a vaccine is a possible short-term option, pandemic management is now under control, and consumer morale is rising. Therefore, the signals are green (pale green, let’s be precise) to resume almost routine business management.

What strategy for the end of 2020 and 2021? Cost reduction or investments?

However, it would be an illusion to think that companies will open their wallets wide in 2021. Burned by the crisis, with cash flow often under pressure, companies will make cost reduction a priority in 2021. Investments will, therefore, be lower. This represents a massive opportunity for companies who will dare to go against the market and invest. The end of the investment programs means that many companies will be on the side-lines. I am not even talking about those that will not survive. Market shares are, therefore, to be taken by the bravest.

In terms of “smart” investments, we pinpoint 4 categories in particular:

- all investments that allow greater online visibility and improved SEO. In 2021, online positioning will become more crucial than ever because digitalisation will be one of the most promising growth areas in the coming years. Our content strategy has allowed us to double the traffic to our site during the lock-down.

- for the retail sector, investments in the transition to e-commerce. The period of lock-down has shown that e-commerce has become indispensable for food and non-food retailers. The next few years will see a mass extinction of retailers who have not been able to adapt. This is what I have called “the mass extinction of commerce 1.0“.

- for food retailers, investments allowing a quick return on investment through supply chain efficiencies. With the decline in consumer purchasing power, a price war between retailers is more than likely. Protecting margins will, therefore imply looking for “smart” savings, especially in a supply chain that suffered a lot during the COVID crisis. One can even imagine that these efficiency gains will not only result in savings but also in an increase in customer satisfaction (fewer breakdowns, shorter delivery times, environmental promises respected).

- for all companies, projects that enable them to monetise their data or that of others (customers, suppliers).

Conclusion

I am one of those who see a crisis as an opportunity. The situation of 2020 is an opportunity for the digital transition, and I don’t understand the paralysis. Everybody understands that the world of work and leisure will never be the same again. Yet, companies are stopping their investments, destroying many of their projects, no longer communicating, severing ties with their employees.

On the contrary, this crisis should be a catalyst by accelerating the digital transition and strengthening data skills. Counter-cyclical investments are undoubtedly the most profitable. When your competitors are anaesthetised by fear, your freedom of movement is more significant, and your profits accelerate.

Illustration images: Shutterstock

Posted in Entrepreneurship.