For this last podcast of the year 2019, we welcome Jean-Louis Van Houwe, founder and CEO of Monizze and Chairman of the Board of Directors of FinTech Belgium.

Jean-Louis Van Houwe reviews the need to structure the FinTech scene, the balance sheet of FinTech Belgium and the main trends of FinTech.

Jean-Louis Van Houwe will detail in particular the three axes of value creation that structure the FinTech universe:

- a radical change in user experience

- integration of new technologies such as artificial intelligence

- innovation in the business model (consumption by use, …)

as well as the extension of the original scope to assurtech and regtech (respectively technology start-ups active in insurance and regulation).

Finally, in light of our study on the GDPR, we will discuss the impact of this regulation on innovation in Fintech. What has been the contribution of Fintech start-ups in a regulatory environment that has paralysed the more significant players in the banking sector? Have they been a driving force for innovation?

We hope this podcast will be of interest to you. Don’t forget to subscribe, and see you in 2020 for new episodes.

Facts and statistics about FinTech

- 47 billion dollars: the amount invested in 2015 in FinTech start-ups (source: La Tribune)

- In 2018, the market for Fintech was estimated at $111.8 billion (source: KPMG).

- 2/3 of Fintech are active in digital payments (source: Statista)

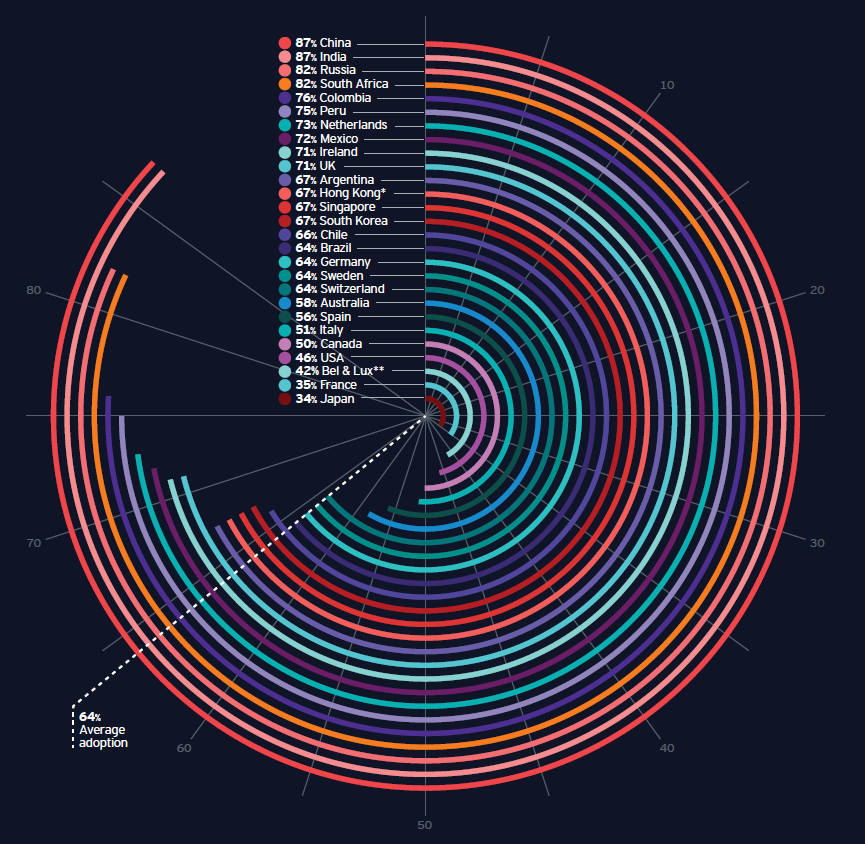

- 64%: the average percentage of consumer adoption of Fintech services (source: Ernst &Young Global FinTech Adoption Index 2019)

- 87% of Chinese and 34% of Japanese use one or more Fintech services.

Posted in Entrepreneurship.