Market research isn’t an option if you want to launch a small business. It’s an obligation. The problem is market research usually costs more than you can afford. A tool has just been launched in France that simplifies the task for those creating or taking over a business. We explain the advantages and limitations of this tool and hope it will be emulated abroad.

Contact IntoTheMinds to conduct local market research

If you only have 30 seconds

- U2P has launched an interactive tool that lets you conduct local market researchthroughout France.

- The market research will eventually cover 96 professions (22 available at the time of writing).

- The tool is particularly useful for obtaining, in just a few clicks, a visual representation of the competition and the economic potentialof the activity in the geographical area envisaged.

- Nevertheless, overly simplistic assumptions are made when calculating competitive pressure and economic potential.

- The tool can, therefore, only be used to pre-validate a choice of location. Market research must confirm customers’ needs to be complete. The quickest method is an online survey.

The “créer et reprendre” website was set up by U2P, the Union of Local Companies, to simplify conducting market research. The problem of transferring companies is a major one. We talked about it in depth in this podcast.

This website proposes to conduct a mini-interactive market research based on some basic data:

- The activity

- The location

The tool’s highly visual data lets you ask the right questions and avoid the most obvious mistakes. The tool allows you to automate certain stages of desk research and assess both competitive pressure and economic potential. In this article, I

- Detail how the tool works

- Point out its limitations

List the next steps in your local market research

Step 1: Select profession and location

The first step is remarkably simple: you choose a profession from among the 96 represented by U2P and a location. In the example below, I’ve chosen the profession of “baker” in Orleans (a city in central France). It is also possible to vary the analysis by modifying the distance or travel time of the catchment area. This is especially useful but would have required some explanation in the tool. The catchment area is different in the city than in the country. It would have been nice to pre-select a distance according to profession and location.

The first limitation concerns the choice of activity. As U2P represents local trades, the selection is only possible for “artisan” type trades or those with a strong local base. In this type of business, the catchment area and location of the retailer are important success criteria. This is why this tool is so relevant.

The second limitation concerns the number of professions. Only 22 professions (out of 96) can be analyzed at the time of writing.

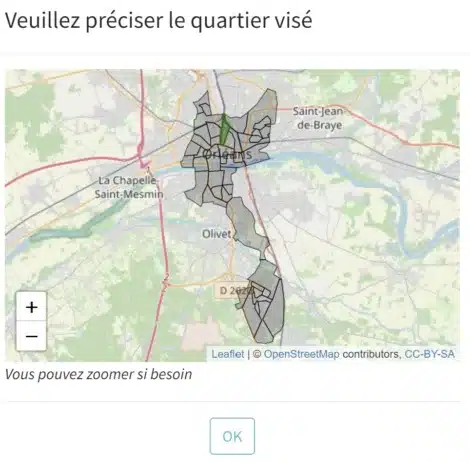

Step 2: Refine the location

In cities, commercial dynamics can change from one neighborhood to another. That’s why defining the neighborhood where you would like to set up shop is important. The tool also proposes this by asking you to choose a neighborhood to locate your future business. This is a particularly important feature that U2P has implemented very well.

You can go straight to the results after completing this second step.

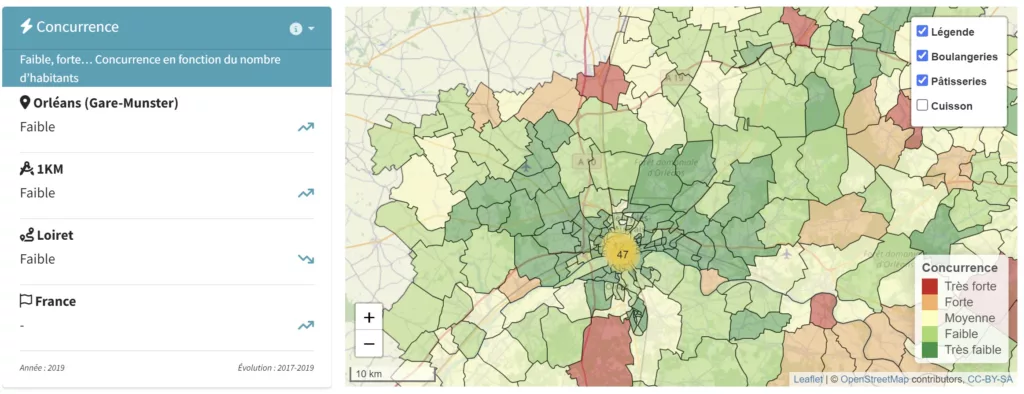

Step 3: Competitive analysis results

The first results tab lets you estimate the competitive pressure in the area you want to enter. The map also gives you an idea of the situation in the surrounding neighborhoods. In this way, you can immediately identify more favorable neighborhoods if the one you’re targeting is already too surrounded by competition. However, before choosing another neighborhood, you must check its economic potential in the next step.

The colors shown result from calculations based on the area’s population divided by the number of bakeries. There is, therefore, no notion of positioning or needs. The assumption is that all an area’s inhabitants have an equal need for the same shops. This may be true for a bakery but not for a pet grooming business.

On the left, a text section shows neighborhood, catchment area, and regional and national trends. Pay close attention to the data used. As you can see in the screenshot below, the data dates from 2019, and the evolution concerns the 2017-2019 period. This is, therefore, relatively old data that banks will criticize if you apply for a loan.

The third limitation concerns the method used to calculate competitive pressure. The calculation needs to be more complex and reflect the real needs of consumers in the area. The data is also relatively old and may not reflect the current situation. The U2P tool can, therefore, be used to pre-validate a geographic zone for your business location. Still, you must confirm it with more comprehensive and recent market research. The most appropriate method is an online survey.

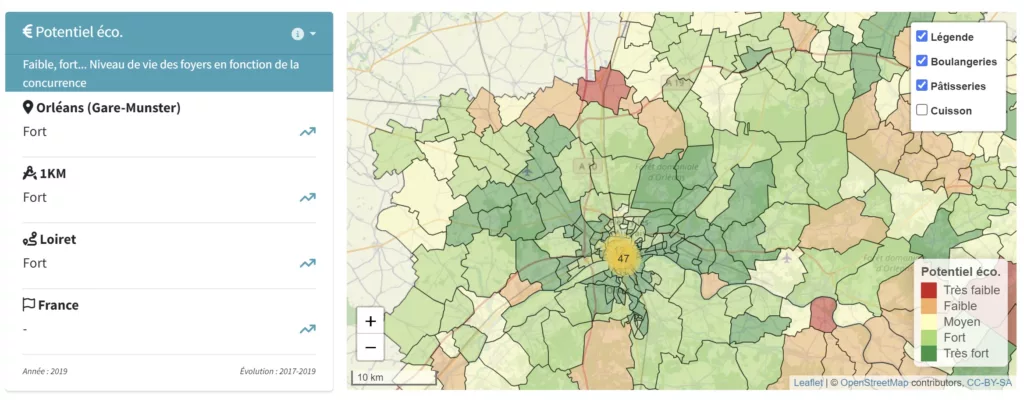

Step 4: visualize economic potential

The second tab proposes visualizing the economic potential. This is calculated based on the area’s standard of living and the number of companies operating in the same activity. If you compare this map with the previous one, you will see they are remarkably similar. The calculation is based on a simplistic assumption: potential is highest without competition. But this is not (always) true.

If there’s little competition in some areas, there may be another reason: there are too few inhabitants, people have diverse needs, and regulations differ. For example, there are fewer gas stations in big cities. In that case, their inhabitants are less motorized partly because regulations are becoming stricter (pedestrian zones, low-emission zones, etc.). This has nothing to do with people’s standard of living, which tends to be higher in towns than in the countryside.

This approach to economic potential is, therefore, highly restrictive. As in the previous step, the tool should be much more educational, explaining the limits of the calculation and the additional checks to be conducted. Fortunately, the online survey allows us to explore this aspect more deeply and provide clear answers.

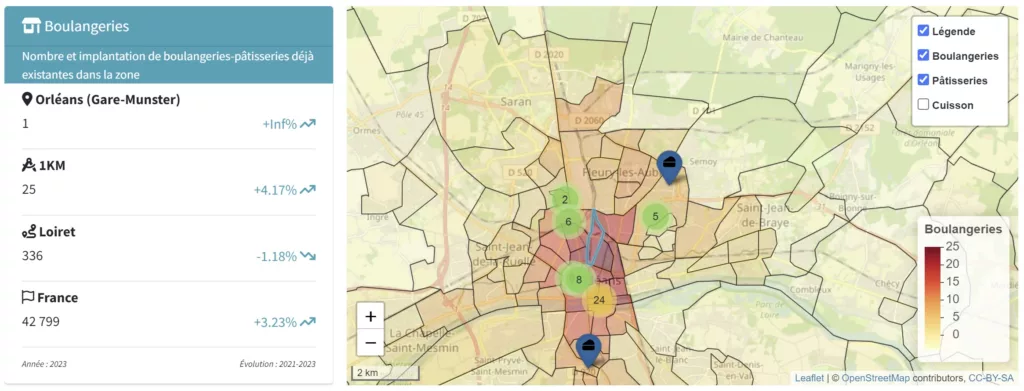

Step 5: visualize direct competition

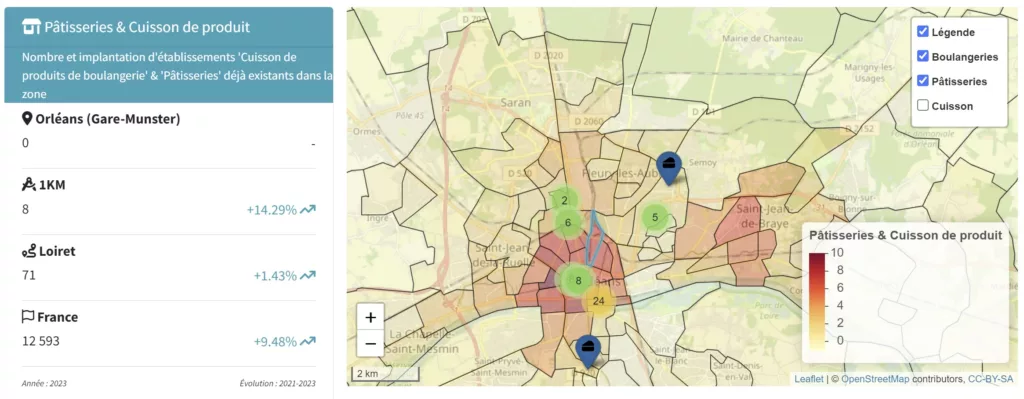

Direct competitors are the companies that do the same business as you. In the third tab, you can put concrete figures on the competition. This is extremely useful, and the map is very well designed. The figures displayed are recent (2023), and the evolution is measured at a neighborhood, catchment area, regional and national level.

You can also zoom in on the map to see the exact location of your competitors.

Step 6: visualize indirect competition (1/2)

The fourth and final tab gives you statistics on activities close to yours. In the example below, we’re talking about pastry shops (bakeries in most cases) and shops where the bread is baked (but not manufactured).

This, too, is a very well-done tab. Not only are the figures recent and accurate, but U2P does the work for you by identifying activities that could cover the same needs. Indirect competition should be more often noticed in market research. This is an especially useful feature that is proposed here. But it’s not the only one, as in step 7.

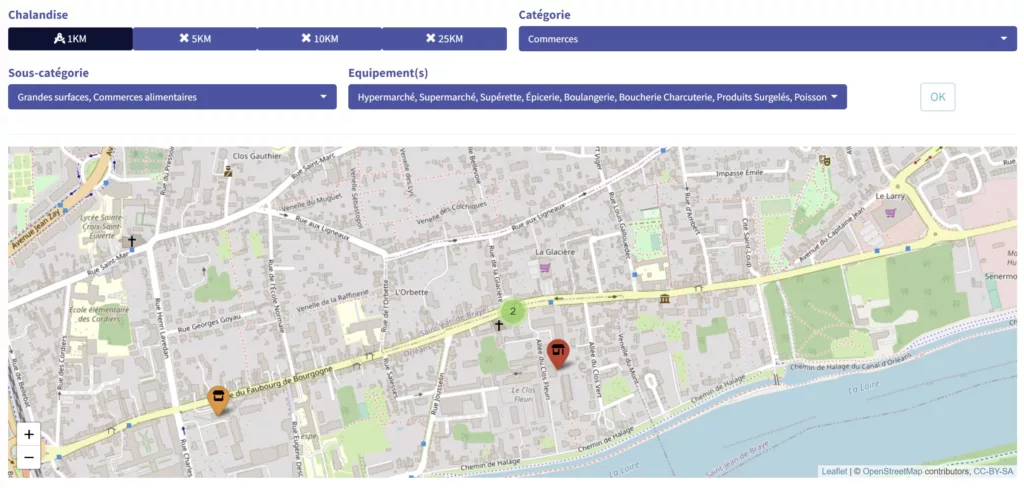

Step 7: visualize indirect competition (2/2)

Another map is also proposed. It visualizes even more indirect competition. The selection is made automatically and is highly relevant. We must often remember that completely different retailers can also cover the customer’s needs. This is true of supermarkets and food retailers, most of which propose a “bakery” section. By zooming in on the map, you can see exactly where they are located (see example below).

Posted in Entrepreneurship.