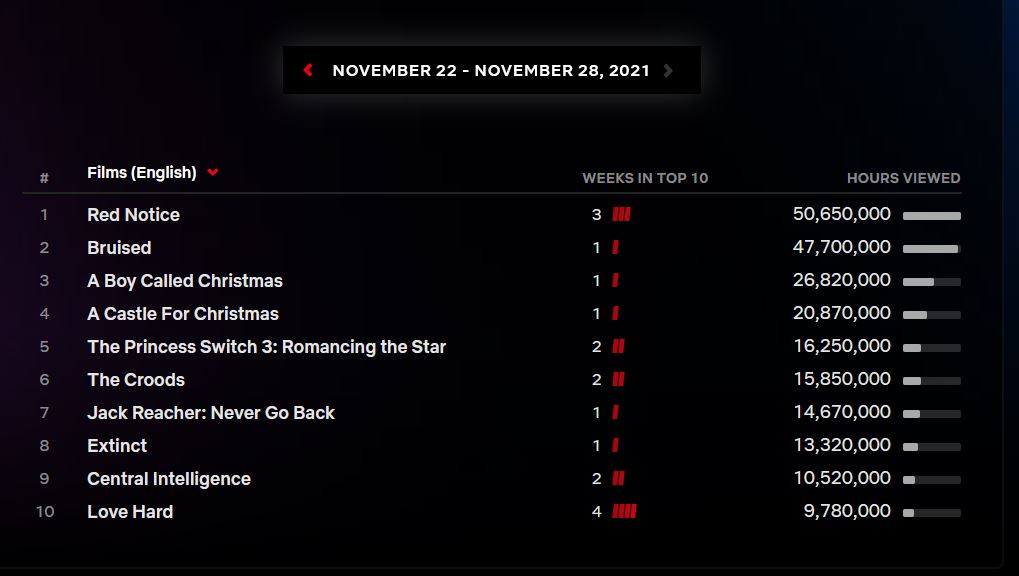

Netflix has decided to publish its ratings every Tuesday on a dedicated website. This is an essential change for the Los Gatos-based company, which had somewhat accustomed us to the opacity of its audiences. Netflix is now making public a TOP 10 of its audiences in the form of the number of hours watched per week. They are counted in tens of millions of hours for the most-watched programs. This article analyses the 4 strategic reasons behind Netflix’s initiative.

Objective 1: Prove the profitability of its investments in content creation

Netflix invests 17 billion Euros per year in its productions. More precisely, these 17 billion investments translate into millions of viewing hours. The company intends to show that the colossal investments in creation generate returns by proposing its audience measurement metric.

This TOP 10 also has the advantage of showing only the successes. The “flops” will therefore go unnoticed. There are probably many of them. Because next to the success of Lupin, Casa De Papel, or Squid Game, the Netflix productions also contain more confidential titles. These last ones probably only interest “niche” audiences and make less interesting scores.

The possible disadvantage of this strategy is that producers and writers might also want their share of the cake. Currently, Netflix is not interested in the success of productions. By publishing the viewing hours generated, some might want to claim a share of the success.

Objective 2: Define the metric for comparison with Disney+ and Amazon Prime Video

After an upturn due to Covid and successive confinements, linear television loses ground again. Audiences are moving more and more to non-linear TV, and we can see that Netflix is taking a big slice of the pie with YouTube, Disney+, Amazon Prime Video, Hulu, HBO Max, and others. Traditional audience measurement is becoming obsolete.

With 213 million subscribers at the end of 2021, Netflix now “weighs” enough to propose a favorable metric. This metric is the TOP 10 most viewed contents each week. And we can reasonably think that if Netflix has chosen this metric, it is because it will be favorable to it. By doing so, it will be able to put pressure on competitors who have proven to be more challenging than expected.

Objective 3: acquire sports content and build customer loyalty

Netflix has not yet ventured into acquiring sports rights, unlike Amazon. By publishing its ratings, the company gains credibility. Above all, it shows its “strike force” to the authorities who grant the rights and who were perhaps tempted, until now, to favor linear television.

It would therefore not be surprising, in the future, to see Netflix bidding for the rights to major sports competitions. This type of content could be an exciting entry point for a new customer. Netflix would then have the opportunity to build loyalty thanks to its content catalog and see its number of subscribers grow.

Objective 4: monetize its audience?

It’s a sea serpent as old as Netflix itself, but one that could be justified by the plateau the company has reached. Its subscriber base isn’t growing as fast anymore. In the 2nd quarter of 2021, Netflix only gained 1 million additional subscribers compared to 10 million a year earlier. The stock was sanctioned and lost 10% on the New York Stock Exchange.

In this context, how to sustain the growth that the markets expect? Competition is tougher, purchasing power is decreasing (due to galloping inflation), and households will make choices. The monetization of audiences (advertising) could provide an answer and allow Netflix to retain this new clientele once the economic tensions have eased.

Posted in Marketing.