Automobile manufacturers are moving towards the production of electric vehicles, which are increasingly gaining market share. Against the Chinese and American giants (to name only Tesla), how is the European car industry reacting? In this article, we detail the European market, the restraints on the growth of electric vehicle sales and, above all, the impacts of the COVID-19 crisis.

Summary

- Key figures and statistics

- The impact of COVID-19 on the market

- Why electric cars: CO2 emission constraints

- The European electricity markets

- Batteries: the nerve of electricity

- The restraints to the expansion of the electric

- Conclusion and sources

Contact us for our B2C studies

Key figures for the electric car market

Key figures for the electric car market

- > 1 million electrified cars (electric or hybrid) sold worldwide in 2018

- 30% the value of the battery as compared to the whole of an electric vehicle

- 100,000 charging stations in France by 2022

- 1.8 billion euros is the national budget dedicated to the creation of a Franco-German battery construction industry.

- 40 billion euros of investments in electricity over the next 3 years are planned for the Volkswagen Group

- +25% CO2 emissions measured by the new WLTP vehicle type approval standard

- 1.18% of the Belgian car fleet consists of electric and hybrid cars

- > 400,000 registrations of electric vehicles in Europe

Impact of COVID-19 on the market

Impact of COVID-19 on the market

Between the new WLTP (Worldwide Harmonised Light Vehicle Test) standard, meetings and auto shows paused during the time of the confinement, the automobile industry is in bad shape. Indeed, the consequences of the new WLTP standard are having an impact on CO2 emission measurements and therefore on penalties and taxes, especially for company cars. Professionals are consequently particularly affected by these new measures and their impact on taxes, which does not make it any easier for them to withstand the COVID-19 crisis.

As is the case with internal combustion engine vehicles, electric vehicles see their registration rate drop considerably. In March 2020, corporate automobile purchases are reduced by almost 64% compared to March 2019. The closure of car dealerships, postponements of trade fairs, and so on, is, of course, having a substantial impact on sales to both individuals and businesses. In France, more than ¼ new cars are sold to professionals, companies or organisations.

Why electric cars: CO2 constraints

Why electric cars: CO2 constraints

Considered a crucial issue for the climate, the new CO2 standards at European level are shaking up the car market.

Adopted by the Council of the European Union, these standards stipulate that from 2030 onward, new cars and vans will emit on average 37.5% and 31% less CO2 than in 2021. Over the period 2025/2029, emissions will have to be reduced by 15%. An effort shared between manufacturers based on the average mass of their vehicle fleet.

CO2 emission measurements are being reviewed to reflect the current situation, but above all, to reflect the reality of the day. Indeed, the NEDC (New European Driving Cycle) tests of the 1980s have been revised by the European Union to better adapt to the new driving and traffic conditions as well as to technological advances. Further experiments are in force: the WLTP (Worldwide Harmonised Light Vehicle Test) and restrictions on new vehicles sold with emissions below 95 g/km (CAFE standards: Corporate Average Fuel Economy) in 2020. Failure to comply with this rule would result in substantial fines for car manufacturers. This would be enough to bring the manufacturers in question to heel, and most of them have moreover widely anticipated this.

The WLTP (Worldwide Harmonised Light Vehicle Test)

The automobile industry must comply with this new series of vehicle type-approval tests, the aim of which is to assess the following points more effectively and realistically:

- fuel consumption

- carbon emissions

- pollutant emissions

- energy consumption values for alternative power units

This series of tests replace the NEDC tests, which were based on hypothetical and above all theoretical road conditions that do not correspond – or at least no longer correspond – to reality. The WLTP, therefore, aims to analyse these data according to real road experience and according to numerous criteria:

- speed: low, medium, high, very high

- driving in phases: stopping, accelerating, braking

- the model: from the most economical to the least economical

The aim is to offer a set of tests that can be used worldwide to standardise the tests and help everyone understand them.

This new standard, defined to be more in line with real road conditions, is causing CO2 data to skyrocket (+25% on average). Le Figaro explains that the fiscal consequences are considerable, particularly for professionals, since the malus and the company car tax (TVS) are impacted, which “represents 20% of the cost of using a company vehicle”, compared with 13% for fuel. The bonuses are being reviewed and will be awarded to vehicles emitting less than 20g of CO2 (electric vehicles) and will be halved, from €6,000 to €3,000.

Many players in the automotive industry have understood this: to stay below the thresholds for CO2 emissions, and electricity is king. Moreover, the various cities in Europe have also imposed their regulations on CO2 emissions. In France, a sticker allows drivers to access or not to access certain zones depending on the pollution. In Belgium, as in Germany, many cities are adopting “low-emission zones” with restrictions ranging from some of the most polluting models to a ban on non-residents driving.

The European electricity markets

The European electricity markets

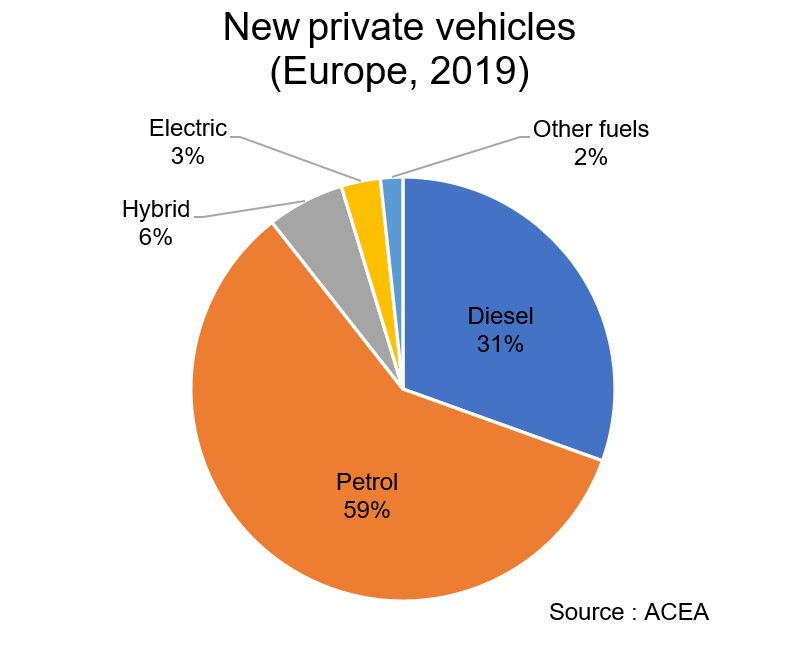

At European level, the European Automobile Manufacturers Association (ACEA) has compiled the distribution of fuels for private vehicles for 2019:

In comparison, new private cars registered in 2018 were 57% of petrol engines compared to 36% diesel engines. Europeans are buying fewer and fewer diesel cars and are switching to petrol engines. Hybrids also increased from 4% in 2018 to 6% in 2019. Slight growth even for electric vehicles (2% in 2018 against 3% of the market in 2019).

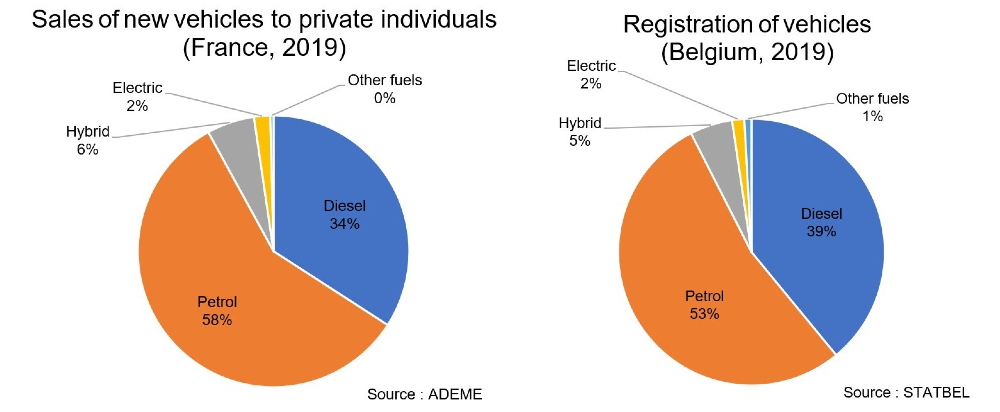

When comparing sales to private individuals in France in 2019 and new car registrations in Belgium in 2019, a similar trend emerges. In essence, consumers favour petrol-fuelled engines and are increasingly turning to electric cars.

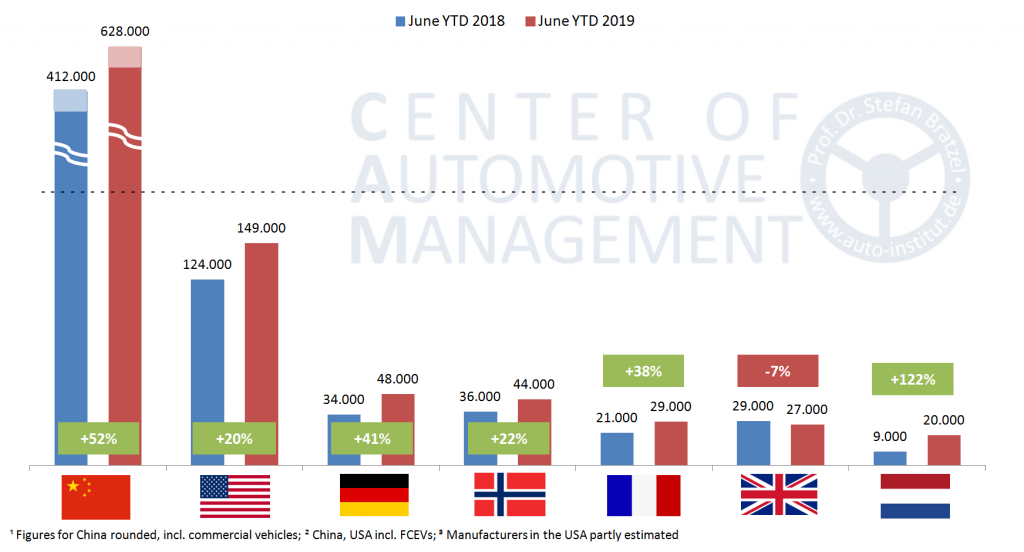

Globally, China and the United States are the two countries with the most extensive stocks of electric cars in the world.

In the Netherlands, electric cars account for nearly 8% of the market share, with growth of +122% between the first half of 2018 and the first half of 2019.

Germany, which has always lagged behind global and European players in terms of vehicle electrification, is moving up in the rankings with +41% sales in the first half of 2019 compared to the first half of 2018. Indeed, the Volkswagen Group is getting into the electric business. In particular, the Audi brand is having batteries manufactured in its Brussels plant to start the transition and counter market players who have primarily anticipated their switch to electric vehicles such as Tesla, Renault, Nissan…

In France, the share of electrified vehicles sold in the first quarter of 2019 was 7% compared to 17% at the beginning of 2020.

Batteries: the core of electricity

Batteries: the core of electricity

While the Asian market remains number one in terms of batteries, Europe is also looking for its place. In particular, the various groups in the automotive industry are making significant investments in R&D to expand their electrified offerings (electric and hybrid vehicles). Governments (notably French and German) are also putting their hands in their pockets to support and maintain the switch to electric power in Europe.

4-step project in France

In early 2019, the French government announced a four-phase plan that should benefit the electric car market in Europe.

- France and Germany are joining forces to create a European battery industry with the financial support of 700 million euros on the French side and 1.12 billion euros on the German side.

- Transparency on the amount of ecological bonuses until 2022.

- Adaptation of infrastructures with a target of 100,000 charging stations on French territory by 2022 (25,000 stations in 2019).

- Financial and regulatory incentives as to the location of charge stations (individual, condominium, business, and so on).

The restraints on the expansion of electric

- The infrastructure remains poorly adapted to electric vehicles. Indeed, electric cars need to be able to be recharged, which is not possible in all potential consumer outlets.

- Questions about the range of electric and hybrid vehicles are also on the minds of many consumers. Also, of course, there is the previous point on recharging.

- Price also remains a definite hindrance for some users. The Peugeot brand is banking on the use of low-price vehicles to offset the high purchase price of electric or hybrid cars. In 2019, the PSA Group stated that it would begin its drive towards the systematic electrification of all new models produced by 2025.

“To realise the total cost of a vehicle, you don’t just look at the purchase price, but also take into account the cost of energy (electricity or fuel), insurance and vehicle maintenance. With a Peugeot electric car, you can enjoy an average 40% reduction in consumption and up to 30% less expensive maintenance than for a combustion vehicle”. (Presentation of the Peugeot electric vehicle range on their website)

Conclusion

The automobile industry is facing many difficulties at the beginning of 2020. Between the new standards to be met, the regulations put in place. And, as is the case for many sectors and many companies, the COVID-19. These new regulations, the initiatives being taken by governments, are heading, in any case, towards the electrification of vehicles.

Sources

- ACEA : Statistics Press Release

- WLTP FACTS EU : What is WLTP and how will it work?

- Conseil de l’Union Européenne : Le Conseil adopte des normes d’émissions de CO2 plus strictes pour les voitures et les camionnettes

- Center of Automotive Management : Electromobility

- ADEME : Car Labelling

- STATBEL : Immatriculations des véhicules

- SIRIUS Insight : Livre blanc : Le secteur automobile décélère

.

Illustrations: shutterstock

Posted in Research.

Key figures for the electric car market

Key figures for the electric car market Impact of COVID-19 on the market

Impact of COVID-19 on the market Why electric cars: CO2 constraints

Why electric cars: CO2 constraints The European electricity markets

The European electricity markets

Batteries: the core of electricity

Batteries: the core of electricity