The new car market is in crisis. Sales fell further in 2021, and the decline is as much as 25% compared to 2019. The automotive sector is one of the only sectors that has not benefited from the post-COVID economic recovery. Four factors explain this unprecedented situation. Their analysis will show how they are linked and the vicious circle they feed. We will also look to the future to decode the prospects for this market by 2023.

If you only have 30 seconds

The crisis in the new car market is the result of a combination of 4 factors:

- Production line disruptions

- The semiconductor crisis and arbitrages leading to a supply deficit

- Loss of purchasing power with inflation and the rise in the price of second-hand cars

- Accelerated transition to electric vehicles due to restrictions and state aid

These 4 factors are self-perpetuating and create a dangerous spiral for the market. The market is evolving in sudden jolts that disrupt all stakeholders.

We see 3 other factors that could contribute to the gradual unblocking of the situation:

- The savings accumulated by households in 2020-2021 will be mobilized under the pressure of inflation, which is eating away at them, and confidence in the future

- Production lines will gradually return to their cruising speed with the disappearance of the risk of a pandemic

- The natural limits of semiconductor extraction should favor thermal models, which require fewer chips

Factor 1: shutdown of production lines

The situation of the automotive market in 2022 is, first and foremost, the consequence of the shutdown of the production lines in 2020 following the confinements. This event, unprecedented in recent history, shows the fragility of the “Just in Time” (JIT) principle adopted by the automobile industry. The JIT system is like a stretched rubber band that has been snapped and is much harder to repair than expected.

With inventories at rock bottom and delivery times sometimes exceeding one year, consumers turn away from the new market and shift to used cars. The consequence is a rise in second-hand prices. All countries are affected: +56% in Ireland, an average price for used vehicles in the United States close to $30,000.

The crazy figures of a car market in crisis

- 1.66 million new cars registered in France in 2021, compared with 1.65 million in 2020 and 2.21 million in 2019

- 25.5% of new car registrations between 2019 and 2021 in France, -22.8% in Italy

- In Germany, new car registrations were down 19.1% in 2020 and a further 8% decline between 2021 and 2020.

- Slight recovery in 2021 compared to 2020 for Italy (+8.6%), Spain (+3.8%) and France (+2.5%) (Source: ACEA)

- Fossil fuel disaffection. The share of electric vehicles reaches 20.3% in Germany (November 2021)

Factor 2: Semiconductor crisis

The semiconductor crisis is partly linked to the shutdown of production lines. The sudden halt and then the sudden restart of production created a substantial imbalance in demand for semiconductors. The pandemic then accelerated the digital transition, which emerged as a competing trend for semiconductor consumption. The demand shock was, therefore, twofold.

Trade-offs had to be made. Firstly, by the semiconductor manufacturers who had to choose who to supply. Secondly, car manufacturers had to reserve components for higher value-added models.

[call-to-action-read id=”44705″]

In the coming months, electric cars will be particularly concerned by the availability of semiconductors because they are very chip-intensive.

Factor 3: a loss in purchasing power

Inflation is at its highest, and the loss of purchasing power has reduced the desire of households to buy a new vehicle. A certain wait-and-see attitude has been observed on the part of private individuals. In 2021, in France, the share of sales to private individuals fell by 4 points (43% of registrations compared with 47% a year earlier).

Rampant inflation is not likely to go away in 2022. In the United States, the price of used cars contributes 1 point to this inflation, whereas previously, the effect was zero.

Factor 4: transition to electric

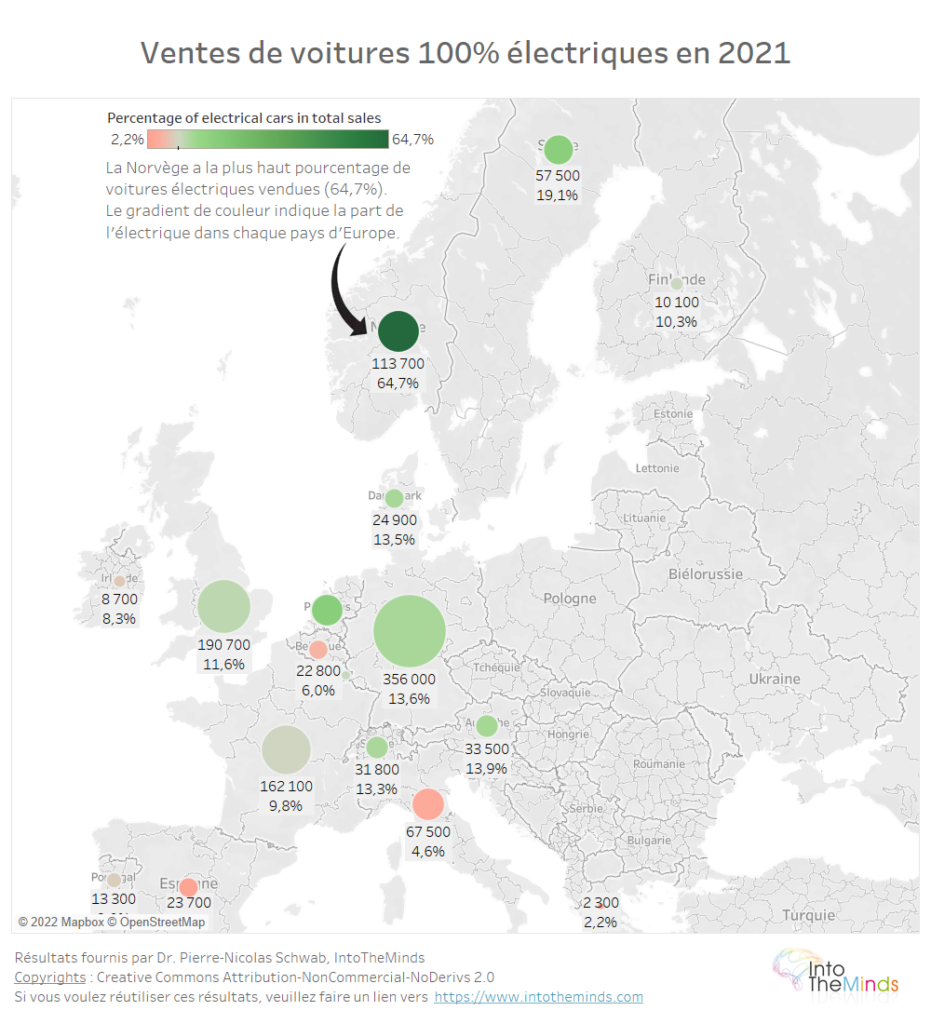

The transition to electric cars is now well underway. The acceleration of this transition has probably been stronger than expected. Between 2020 and 2021, sales of electric vehicles increased by 64%, supported by government subsidies and increasingly stringent restrictions (e.g., Low Emission Zones). Including plug-in hybrids, the electric market accounts for 20.9% of sales in Europe.

This craze for electric cars makes combustion engines look old-fashioned and contributes to a drop in sales. The overconsumption of semiconductors in electric models makes their delivery times even longer (up to 18 months for a BMW i3). The wait-and-see attitude of individual consumers is thus further reinforced. It is a vicious circle.

| Country | Number of 100% electric cars sold in 2021 | Percentage of electric cars in the total sales of new vehicles in 2021 |

| Norway | 113700 | 64,7% |

| Netherlands | 64000 | 19,8% |

| Sweden | 57500 | 19,1% |

| Austria | 33500 | 13,9% |

| Germany | 356000 | 13,6% |

| Denmark | 24900 | 13,5% |

| Switzerland | 31800 | 13,3% |

| United Kingdom | 190700 | 11,6% |

| Luxemburg | 4600 | 10,5% |

| Finland | 10100 | 10,3% |

| France | 162100 | 9,8% |

| Portugal | 13300 | 9% |

| Ireland | 8700 | 8,3% |

| Belgium | 22800 | 6% |

| Italy | 67500 | 4,6% |

| Spain | 23700 | 2,8% |

| Greece | 2300 | 2,2% |

Signs of hope for car manufacturers

In Europe, the Covid crisis has led to a surplus of savings fueled by fear of tomorrow. This tendency to save more than usual has slowed down since the third quarter of 2021. For example, the French saved 22 billion Euros between April and June 2021 and 6 billion between July and September 2021.

Household morale has remained at a reasonable level since June 2021. In France, it was up in December 2021. Despite inflation, consumer sentiment is sustained by a good economic outlook and the general decline in unemployment (3.9% in the US). Full employment is insight.

The convergence of these excess savings, an excellent economic outlook, and the scarcity of raw materials for electric cars could therefore lead to an easing of the market in 2023.

Posted in Marketing.