Marketing strategy: should banks charge customers more?

The boss of the National Bank of Belgium suggested that banks change their tariffs and charge customers for services like cash withdrawal, payments made by bank cards, yearly fees charged to have a bank account, … Is it a good marketing strategy ? Why were such proposals made when, at the same time, consumers keep losing purchase power each and every year ? If such proposals were to be implemented, what would be the consequences on...

The Delta Lloyd recipe to acquire new customers

Some customers segments are more difficult to reach than others. Independent workers are certainly one of them. They go by the “time is money” principle and usually try to make their days as productive as possible. As a consequence little –if any- time is left to handle formalities, go to the bank, take care of insurances, … Delta Lloyd had an interesting idea to capture that audience. 50% of independent workers have no insurance against revenue...

Unicredit explicitly warns investors about national currencies reintroduction scenario

Very few people have noticed it but readers of this blog will be aware of an event that recently took place in Italy, when Unicredit launched a capital increase on the market. The bank edited a 300-page leaflet which sums up all risks for the investor and on page 66 you can read the following: Furthermore, concerns that the Eurozone sovereign debt crisis could worsen may lead to the reintroduction of national currencies in one or...

Sabine Laruelle, Belgian ministry of SMEs, on the importance of entrepreneurship

I was listening on Dec. 13th to an interview of Sabine Laruelle, the Belgian Ministry in charge of SMEs, on a local Belgian radio (Twizz). In a crisis context like the one we are currently going through, it is perfectly understandable that the attention of the States focuses on entrepreneurs. For instance Bruno Wattenbergh, the Managing Director of the Brussels Enterprise Agency, was dealing the other day on RTL with the powerty problems 15% of the...

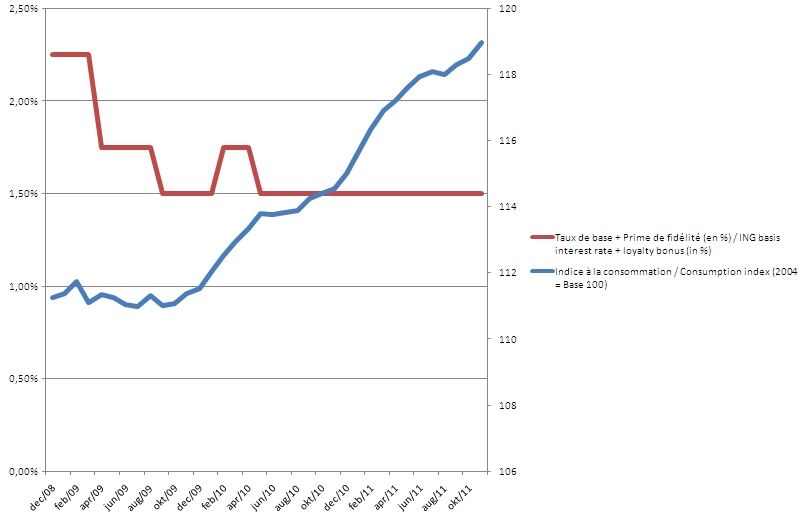

How to announce a bad news: the example of ING

Today’s post is far away from marketing but was triggered by a communication issue, which remains a central topic is modern marketing. ING announced within 30 days that it would reduce interest rates on both its current account and its savings account. Interest rates for current accounts will be 0,05% (let’s say nothing) and on savings accounts it will be decreased from 1% basis rate + 0,5% loyalty bonus to 1%+0,25%. In today’s context those two...

Dexia: you’re not alone

Everyone has heard about Dexia’s problems. The French Belgian bank was eventually nationalized last week and it seems that customers had withdrawn an amazing 1b Euros since early September when they starting loosing confidence in the bank. Coincidently the bank sent its customers about 3 weeks ago a leaflet in an attempt to differentiate from the competition in terms of customer service. I bet this leaflet is already forgotten and so are the promises of a...

Crédit Agricole: why I don’t understand their communication on Facebook

After I published my post on Crédit Agricole, I got several comments (one of them from the Crédit Agricole itself) which call for a more detailed argumentation. Here are the main points of concerns I was dealing with in my previous post: the communication campaign called “Frein’Art” doesn’t’ allow to stress the values of the banking industry and doens’t draw on the empirical results obtained in the field of service quality as far as appearances are...