4 steps of competitive analysis to conduct a successful market research

Published on 18 May 2018download the complete guide in .pdf format

Episode #4/9 – In this section we will discuss another vital step in market research: analysis of the competition, also known as competition research or competitive analysis.

“I have no competition”. We’ve heard that phrase a thousand times. A thousand times, entrepreneurs have told us that their idea has no competition and a thousand times we have contradicted them. Competition is not necessarily around the corner. It is now global, worldwide, and sometimes hiding in complex value chains that are difficult to penetrate.

Summary

- Identification of competitors

- Which criteria to analyse for your competition research (with a practical and detailed example)

- Where to find information about your competitors

- Benchmarking and analysis of Porter’s 5 strengths

Step A: Identifying direct and indirect competitors

Step A: Identifying direct and indirect competitors

It is useful at this stage to reason in terms of needs. Your product may indeed be innovative and not have a counterpart. But it undoubtedly has indirect competitors. A competition that, with a significantly different product or service, satisfies the same need. They are also called substitute products and services. For example, thirst can be quenched by a multitude of drinks. An entrepreneur launching a new drink will, therefore, have to compete with all the other manufacturers, even if his drink is unique (we had precisely this case to deal with, in 2015).

How to quickly and easily identify your competitors?

Our miracle recipe is not applicable in all sectors, but it works relatively well. To identify a maximum number of competitors in a minimum of time, trade shows are the ideal place. They usually concentrate the maximum number of exhibitors over a short period and classify them according to their activity. So, you can effectively identify them and even do a little mystery shopping.

For our market and trend research, we visit several trade fairs every year. In the field of food (which represents a significant part of our business), SIAL is a must. The Paris Franchise Exhibition (see a report here) is also an excellent opportunity to study the competition, especially as franchisors often announce in which new cities, they wish to establish themselves.

If the exhibition is too far away, the exhibitors’ catalogues will be a golden alternative for your competition research.

Google maps allow you to identify your competitors in a given area quickly. The representation is also very convenient to apprehend the different geographical regions where the competition is concentrated. We have prepared a short tutorial for you below.

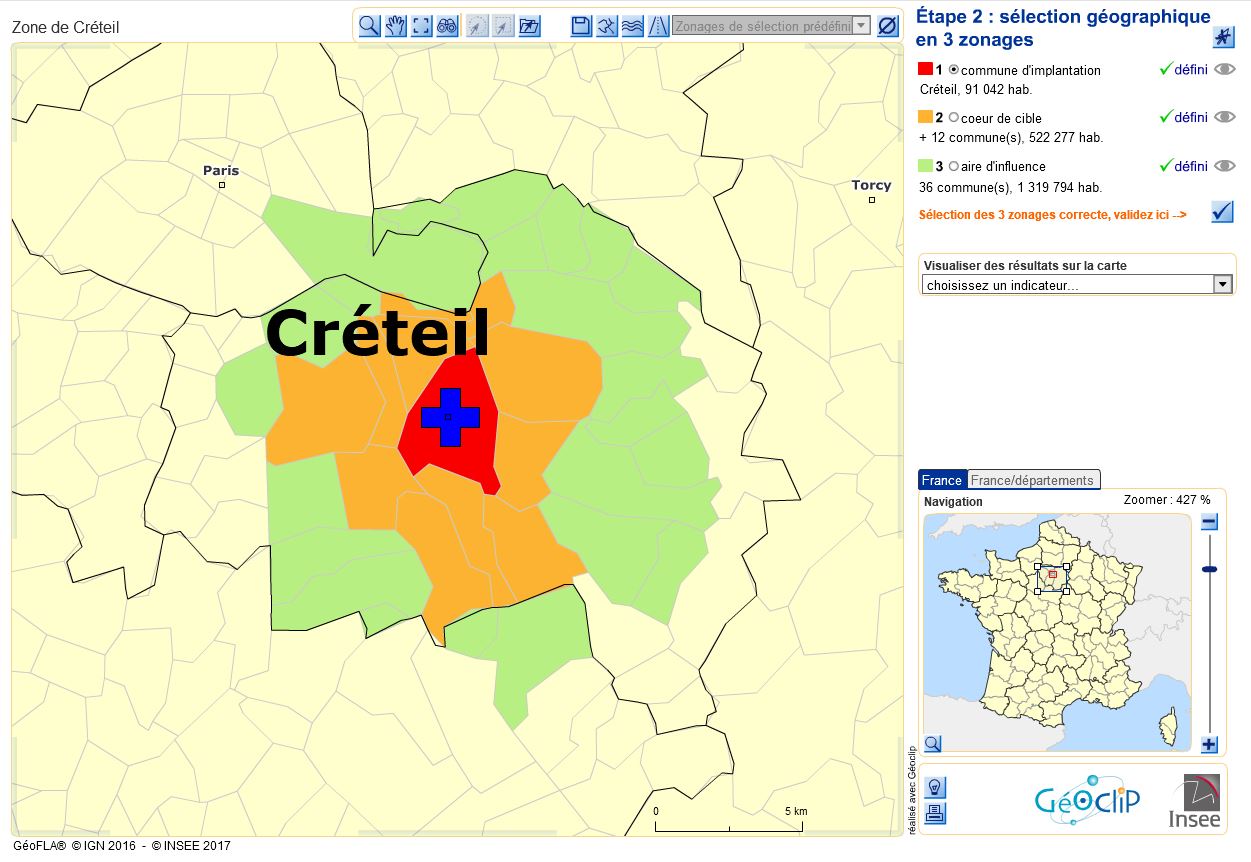

INSEE proposes another powerful tool. This is ODIL, the acronym for Outil d’aide au diagnostic d’implantation locale. We have already written a specific article on this subject to which we refer you for more details. ODIL is a powerful interactive tool that allows you, based on a selection of your activity on the one hand, and a geographical area on the other, to list all your competitors. However, you will need to be comfortable with NAF codes and the concept of the catchment area. Indeed, using ODIL requires you to define the zone in which your company will go to collect its customers.

Definition of the different market research areas in the interactive tool ODIL.

We would strongly recommend that you take care to differentiate between direct and indirect competition. The same customer need can be satisfied in different ways, and it is not always necessary to offer the same product to compete. The course below (presentation available in our SlideShare area) will help you understand the different “market levels”. This concept is essential because it defines how far you will analyse the competition. Are you going to stop at the primary market and direct competitors, or will you, on the contrary, consider that the surrounding market or the generic market offer valid alternatives to your offer?

Many sites, like Kompass, also allow you to select your competitors according to several criteria. Please note that the lists are subject to a charge, so make sure you define your catchment area and the categories of direct and indirect competitors precisely.

Step B: Define the competition analysis criteria for your market research

Based on the data collected, it is useful to make an initial assessment: who are your most serious competitors, those who are likely to give you a hard time in your immediate market? Start by listing these competitors in an excel table on the x-axis and the criteria to be evaluated on the y-axis. To identify your competitors, remember to take into account the concept of the “catchment area”. This is the area within which most customers come. If you want to start a fast-food restaurant, it is not necessary to consider establishments beyond a certain perimeter.

Next, an analysis of Porter’s 5 Forces is required, which will allow you to make an inventory of the competitive forces at work in the market. To fully understand the strengths and weaknesses of your competitors, it can also be useful to conduct a mystery shopping phase. The mystery shopping technique can be both a source of factual information about your competitors and a method that will allow you to highlight the criteria to be evaluated.

Below is an example of an analysis grid (benchmark competition HORECA to download the Excel file) for a fast-food establishment. The criteria to be evaluated are based on HoReCa / CHR market research we have carried out in the past. The catchment area will determine the number of competitors to be taken into account.

What criteria should you evaluate for your competition research?

The criteria to be assessed will, of course, depend on the type of activity involved. If we take the competition analysis for a local business as an example, the above grid is relatively generalisable. To complete it, you will have to go on-site and make observations (this is a market research technique that is part of ethnography).

First of all, you’re going to rely on factual information:

- Prices charged: this information will give you a first idea of your competitors’ positioning.

- Average shopping cart: essential information for your financial plan. The average basket will indeed have a significant impact on your bottom line.

- The number of customers: this information may be limited to a specific time slot when the majority of sales are concentrated there. For restaurants, for example, an observation on the 12h – 14h period will be sufficient.

- Average time spent by customers on site: significant in the case where the sales outlet has limited capacity, as may be the case with a restaurant. Remember that customers do not like to wait, and if the waiting time is too long, they will go elsewhere!

- Pavement traffic: Measuring

- Measuring flow is essential to understanding the dynamics of the neighbourhood. One street is not the other, and the number of customers you will receive will also depend on this dynamic that you do not control. For food shops, it can be useful to limit your flow measurements to a specific time slot (12h – 14h, for example).

- Catchment rate: is the number of customers who entered the outlet during a given time divided by the number of passers-by on the sidewalk during the same period. The catchment rate will allow you to project turnover for your point of sale.

- Opening hours

- Opening days

- Distance from the envisaged point of sale: how far away from your future point of sale is your competitor?

- Who are the founders?

- Experience of the founders in the field: there is always more to fear from competitors with extensive industry experience and a well-established network.

Then focus on the marketing aspects:

- The number of online customer reviews (google, TripAdvisor): although some merchants are revolting against online platforms, the latter remain a significant source of information and decision-making aid for customers. Take an interest in these comments to understand what is going well, what is not so well, and try to identify any changes that may have taken place recently (have the ratings and comments changed gradually?). Do clients complain about anything in particular?).

- Average rating of customer reviews

- Positioning: here, we come back to purely marketing concepts that lead you to evaluate how your competitors position themselves. A competitor who focuses on high-end or luxury products will not be a direct competitor if you aim for low cost.

- Differentiation axis

- Strengths/weaknesses: solicit external opinions (customers leaving the point of sale, analysis of online views) and supplement with your own recorded impressions as soon as possible after your observation.

- Type of clientele (tourists, executives, students, workers…): this information will be derived from your observations made on the spot

During your observations pay particular attention to operational aspects (which are often a source of differentiation and profitability). To continue on the example of the catering industry (criteria to be adapted according to the sector), we would evaluate:

- number of employees

- number of checkouts: a substantial investment, but one that reduces waiting time and increases customer satisfaction at the time of payment

- waiting time: customers no longer wait to be served. They prefer to leave. Measuring waiting time is therefore crucial.

- number of dishes à la carte

- number of place settings

- number of outside covers

Finally, you will look at the financial situation of your competitors:

- The number of partners: several partners can be a sign of financial strength. Think about taking an interest in the personality of the partners, their background and possibly their financial means.

- Economic situation: here, you will use financial indicators such as turnover and its evolution over the last few years, gross margin and its evolution, debts.

- Date of creation

- Number of establishments

Step C: Looking for and finding information about your competitors

To carry out market research, you will, of course, need information about your future competitors. In this age of the Internet, this information is fortunately much more easily accessible than it was 20 years ago. Your competitor’s website is first and foremost, a great playground where a lot of information can be collected. It is then essential to check their financial health based on official information (commercial courts, national databases…). A lot of data is public. However, they are not always easy to find. Several companies offer to collect this information for you, or even have already recorded it. In essence, all you have to do is ask for it, usually using a commission for research and data formatting. In Belgium, you can contact Graydon, Data.be. In France, the CCI (Chamber of Commerce and Industry) in your region can be a good source of information. A third method is to pretend to be a client to collect information. This is called mystery shopping.

Where can you find information about your competitors?

Here is a non-exhaustive list of sources of information about your competitors:

- your competitors’ website

- online customer reviews (especially for HoReCa where reviews are legion on TripAdvisor platforms)

- offline customer reviews (why not ask your competitors’ customers what they think of your competitors’ offers).

- trade shows (a particularly useful technique for market research in B2B)

- financial information sites (for more information, see this page dedicated to free-market research in which we list a series of websites where this information can be found)

- mystery shopping and mystery calling: By pretending to be a customer, you will collect valuable information on the quality of service, prices (which can vary from official prices as we recently saw during a mission on retirement homes), … So much information that will allow you to better position your offer and better meet consumer expectations.

Step D: Benchmarking (comparison with the competition)

The best way to analyse the competition is to build a massive Excel spreadsheet in which you can record your analyses. In the columns, you will indicate the different factors to be analysed (turnover, price, number of employees, type of clientele, employees, geographical markets served, as well as any other more specific criteria relevant to your study). You will then assign a row to each identified competitor and only have to fill in the cells of the table. An essential criterion for retail businesses, and generally for all market research involving physical outlets, is called the catchment area. This is the geographical area from which the majority of customers come. The catchment area is more or less critical depending on the type of outlet: from a few hundred metres in radius for fast food restaurants to hundreds of kilometres for destination shops. Our market research on the N5 wine bar in Toulouse showed that customers sometimes travelled more than 500 km to come to what was voted the best wine bar in the world in 2017.

How to conduct a competitive analysis using

Porter’s 5 Forces Model

Michael Porter, in his seminal book “Competitive Advantage”, lists a series of 78 questions that allow you to assess the following 5 competitive forces in a factual manner:

- Threat of new entrants

- Supplier bargaining power

- Clients’ bargaining power

- Threat of substitutes

- Rivalry

To help you in your understanding of this essential tool of competition analysis, we propose you to go through the online course we have dedicated to it (see below).

Read our next article about qualitative market analysis

The cover of our white paper on market research. This guide can be downloaded free of charge here.

The next episode will deal with a very crucial stage of market research. Read our tips on qualitative market research. We’ll start by laying the groundwork and answering recurring questions (in Episode 5) before going into the details of conducting a qualitative interview (in Episode 6).

Don’t forget that our complete guide to market research is also available as a pdf book, which can be downloaded free of charge (see opposite).