In the days of confinement, interest in entertainment increases. The Belgians are looking to keep busy with free movies, and are interested in Netflix. The figures from Google Trends are conclusive.

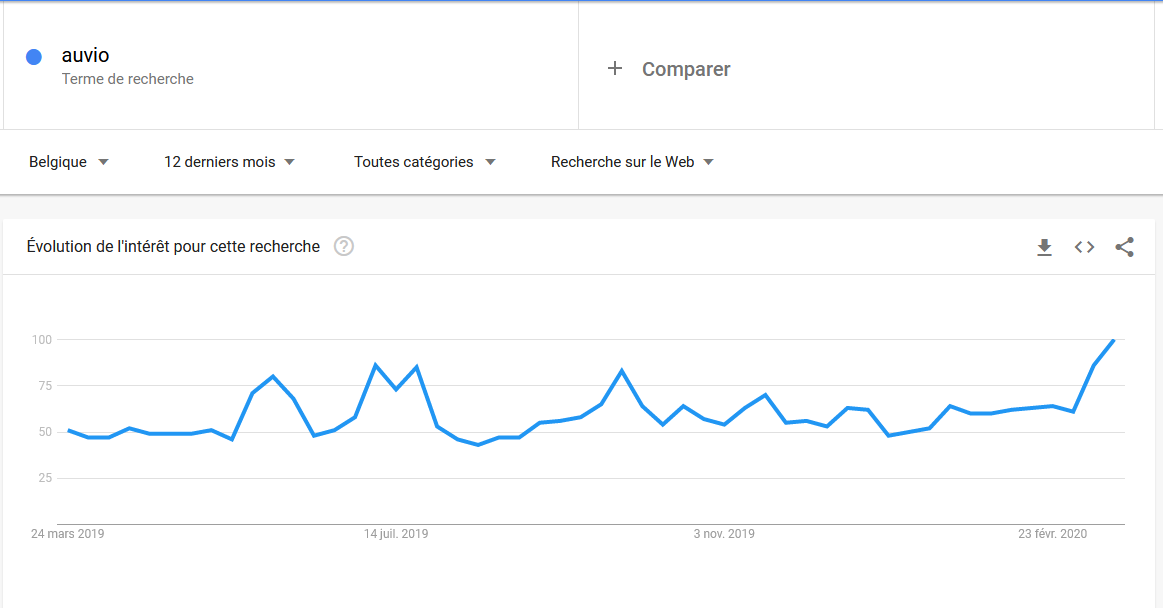

The research of Belgians since the beginning of the Coronavirus crisis also shows us that interest in the RTBF Auvio platform has never been so high. It even exceeds the level reached during the last football world cup. Does this mean that a Belgian content distribution platform would be the solution against Netflix? This is the question that the editorial staff of Pub.be asked me and to which I have given a summary answer in the next issue to be published. In today’s post, I develop and clarify my arguments.

Evolution over 12 months of searches in Belgium on the Google search engine for the keyword “Auvio”.

Many obstacles seem to jeopardise this happy prospect, which, moreover, is only a necessary but not sufficient element of success.

Summary

- Strategic and cultural aspects

- Selection criteria for a streaming platform

- Solutions to counter Netflix

- Conclusions

Facts and figures

- Americans subscribe to 3.4 streaming services on average (source: Vindicia)

- 70% of Americans and 40% of British people had a subscription to at least one streaming service in 2019 (source: Vindicia)

- 1 million: the number of Belgian Netflix subscribers

- Telenet (owner of the TV channels Vier and Vijf in Flanders) and DPG Media are about to launch a joint platform in Belgium. The VRT has declared itself ready to join this alliance.

- France Télévisions, TF1 and M6 will launch the Salto platform in France on 3 June 2020.

- BBC and ITV launched the Brit Box at the end of 2019.

- In Germany ProSiebenSat1 and Discovery launched the Joyn platform (formerly 7TV) in 2019.

- In Spain RTVE, Atresmedia and Mediaset España have launched the LovesTV platform.

- In Belgium Proximus launched its Pickx platform and was joined by VRT and then RTBF.

Strategic and cultural aspects

It is already too late for a Belgian streaming platform on a national scale.

Proximus launched Pickx and VRT joined in December 2019, followed by RTBF in January 2020. But it was a bad start. In September 2019, Philippe Delusinne, the head of RTL “does not hide his interest in Proximus Pickx” (source: Pub.be). And in February 2020, the integration of RTL Play was effectively completed.

Telenet and DPG Media are preparing their platform, which will benefit from a rich Flemish content as well as international content. Telenet has a broadcasting agreement with the American channel HBO (the originator of the successful series Game of Thrones). Public service content will reinforce this, as VRT has also joined the project.

On the French-language side, Auvio (RTBF) is stronger than ever and is ready to open up to external French-language content: TV5’s content, but also Uncut’s (auteur cinema) material, for which negotiations are reportedly underway.

Each new entrant diminishes the content of the others and becomes necessary in this ecosystem.

Emmanuel Tourpe, ARTE

Emmanuel Tourpe, Director of Antenna Programming at ARTE.

So, everyone is taking their initiative in the hope of forming a block strong enough to conquer market share. The strategy sought is that of first-mover advantage. As Emmanuel Tourpe, ARTE’s Director of Antenna Programming, says, the problem is that “each new entrant diminishes the content of the others and becomes necessary in this ecosystem”. Economies of scale, of “scope”, become less and less feasible with the multiplication of particular initiatives.

And of course, a consolidation of these platforms into one is highly unlikely. For technical aspects first and then for strategic aspects which will not be without reminding us of the failure of the Belgian Media ID unique identifier project.

Selection criteria for a streaming platform

Selection criteria for a streaming platform

Streaming offers are therefore multiplying, and not only at the local level. At the international level, we could mention Amazon Prime Video, Disney+, AppleTV+. WarnerMedia is preparing the launch of HBO Max and Comcast NBCUniversal that of Peacock. In the United States, Disney+ convinced 24 million households in 1 month. Europe being a growth relay for all these platforms, they will inevitably arrive here (Disney+ is announced for this summer in Belgium).

One problem remains, however. Even with several subscriptions, an individual can only consume one programme at a time. However, the American example shows us that several subscriptions can coexist (3.4 according to the Vindicia study). But in the coming period of economic scarcity, is it reasonable to bet on an increase in consumer spending for a fee-based streaming platform? If consumers have to make a choice (because they need entertainment), it is a safe bet that they will opt for a reliable option in terms of variety, quantity and perceived quality of content. Amazon could, of course, be mentioned, but it is Netflix that immediately comes to mind. Because beyond its distribution platform, Netflix has also become a real trademark with its independent content.

On closer inspection, Netflix is the streaming platform that best meets the criteria of customer satisfaction and loyalty. The Vindicia study identifies 5 of them (in decreasing order of importance):

- amount of content available

- ratio value received / price paid (“value for money”)

- easy to find content to watch: Netflix wins the prize thanks to its recommendation algorithms, which we’ve talked about at length on this blog.

- interesting original content

- new shows

What solutions to combat Netflix?

What solutions to combat Netflix?

There is no miracle solution to combat Netflix: there is a set of actions to be taken to give oneself a chance to cohabitate. I insist on this term: “cohabitate”. For me, it is essential and explains part of the success of a channel like ARTE. From my exchanges in the preparation of this article (in particular with Emmanuel Tourpe, Director of Programming of ARTE’s antennas), 3 axes emerge.

Building on a language identity

In Belgium, Flanders seems to me to be better armed than the French-speaking community to fight Netflix. The production of highly differentiated content with a Flemish cultural flavour is an undeniable asset for the channels in the north of the country. Flemish viewers want this content, but Netflix is not the best placed to produce it, and the size of the market would not make this kind of operation profitable. A Flemish streaming platform can, therefore, do well and coexist with Netflix without any problems. And the platform that is taking shape is the one initiated by Telenet, DPG Media, which VRT is ready to join. The Flemish streaming platform is, therefore, looking very promising.

The situation is not the same in the south of the country. The French-speaking culture is not anchored in media consumption in the same way as the Flemish culture is in the north. It is imperative to create a French-speaking common front beyond the Belgian borders to coexist with the generalist streaming platforms. The Coronavirus crisis and the appetite for information offer an exciting springboard, just like other niche content. The aggregation of these different niche needs can ultimately create a reliable and diverse platform, playing on the satisfaction of complementary entertainment needs. The RTBF has understood this and is “opening up” its Auvio platform to others (TV5, auteur cinema via Uncut) and does not rule out making it a legally independent entity.

Renouncing an individual strategy

A successfully shared platform strategy requires that an individual platform strategy be dispensed. Indeed, as Emmanuel Tourpe points out, “Each participant in a shared platform must choose to put in content of lesser importance or to lose preview or replay rights on his proprietary platform”. Giving up a proprietary platform may be a smart choice for small content producers (see AB3 now available on Auvio) but is contradictory for a channel like RTL Belgium. On the one hand, the latter benefits from technical developments made abroad, notably by M6; on the other hand, Philippe Delusinne seemed to highlight RTLplay as a strategic asset in defending its market share in an interview in January 2020. If the alliance within the Pickx makes sense, a similar merger in OTT (Over-The-Top) is highly unlikely.

Opening up to other audiences through translations

You need to think outside the needs covered by Netflix (pure entertainment) to activate other requirements, attract subscribers and build loyalty. ARTE (whose audience has reached historical records) has very well invested in the niche of culture and quality documentaries. But the intelligence of the management has also been to invest very early on in making this content available in other languages. The example of “Casa de Papel” shows that local material can very well be exported, all the more so when it touches on culture. This is an intelligent way of “recycling” content to seek out growth relays in new territories. In the same vein, producing content in collaboration with international counterparts is also a way of multiplying outlets. The Alliance, the grouping created between ZDF, France Télévisions and RAI to provide content, seems to me to be moving in this direction.

Conclusions

Conclusions

This analysis shows that the possibility of a Belgian streaming platform is purely ideological and no longer relevant. Indeed, a Flemish platform is already on the rails, and convergence with the south of the country is excluded.

For the south, salvation can only come from a platform that includes international French-speaking media in the first instance. Secondly, it is essential to think about a broader alliance, led by the example of the EBU (European Broadcasting Union), to federate “culturally homogeneous” broadcasters. Then a voluntary translation policy, focusing on the most easily transposable content, could be launched to bring new, differentiating, quality content within reach of new audiences. This is the only way to counter Netflix’s expansionist policy and create a credible alternative.

Illustration images: Shutterstock

Posted in Strategy.

Selection criteria for a streaming platform

Selection criteria for a streaming platform What solutions to combat Netflix?

What solutions to combat Netflix? Conclusions

Conclusions