The subscription business model has become a standard in many sectors. Subscriptions have been subtly changed to boost sales revenue. But what is less well known is the effect of automatic subscription renewals. A recent research study shows that consumers “forget” their subscriptions, helping to boost sellers’ revenues from 14% to over 200%. Amazon has understood the potential of the subscription model and uses nudging techniques to prevent you from terminating Amazon Prime.

How customer inattention boosts subscription revenue

- Inattention (or forgetfulness) increases subscription sellers’ revenue by 14% to over 200%.

- If consumers were perfectly attentive, the average duration of subscriptions would be divided by 3 (4 months instead of a little over 12 months).

- The average monthly loss of customer subscriptions is around 2 percentage points.

- When a credit card is forcibly renewed, the subscription rate drops by 20 points: from 75% the month before renewal to 55% the month after renewal.

- Consumers with the least financial education are almost twice as likely to be trapped by automatic subscription renewal.

- 26 subscription services have more than 500,000 monthly subscribers in the U.S.

- 32% of American consumers say they subscribe because they enjoy receiving something every month 🤔

Whatever the sector, the subscription model is gradually gaining ground. It’s moving beyond the service sector (gyms, transport, cinema, digital services) to take hold in the mass consumer market. We mentioned Nespresso, for example, for whom recurring coffee deliveries protect themselves from the cannibalization of their market following the expiry of their patents. But you only have to visit Amazon to realize that many products (food, batteries, consumables of all kinds) can be bought on a subscription basis.

Customers forget their subscriptions

When the subscription is for a service, the consumer is more likely to forget, as there is no tangible sign of the subscription arriving each month. Therefore, Einav, Klopack, and Mahoney’s research set out to assess the effects of this forgetfulness on the consumer’s wallet.

The method used is particularly ingenious. The 3 researchers use the renewal of bank cards (change on the scheduled expiry date or early change following loss or theft) to detect changes in subscription rates. The change forces subscribers to re-enter their bank card number/expiry date to avoid automatic unsubscription.

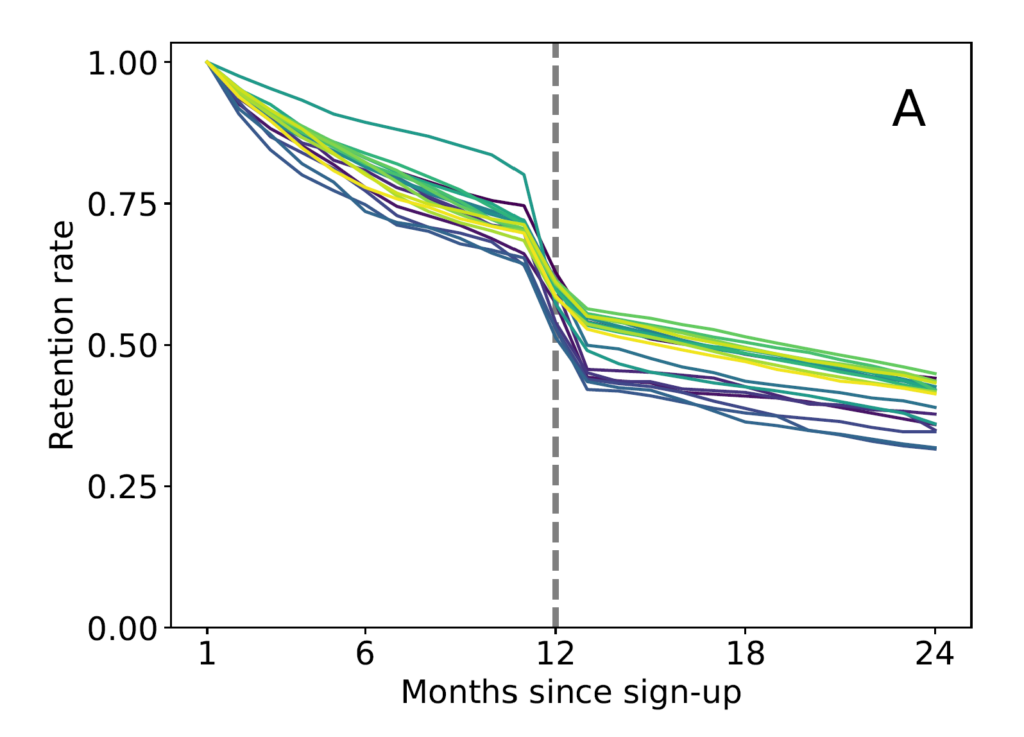

The analysis is conducted on 10 different services, each totaling at least 500,000 monthly active subscribers in the USA. The effects of card switching can be seen in the graph above, with the dotted line marking the change of bank card. We can see a sharp drop in the retention rate. For some services, the rate drops by almost 30 points; for others, the drop is more measured but still reaches 15 points.

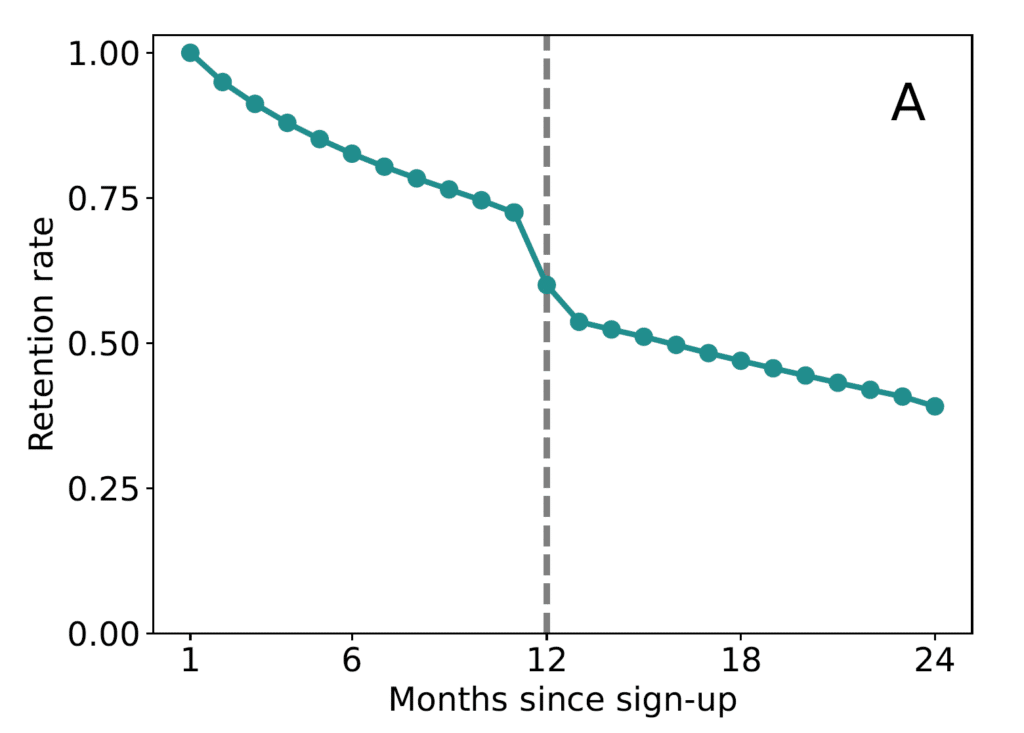

The average effect on retention is shown in the graph below. The first part of the curve is typical of subscription services, with an erosion of 1/4 of customers over 1 year, i.e., around 2 percentage points per month. At card renewal, the average effect is 20 percentage points (from 75% retention to 55%). Natural erosion then resumes at a rate similar to the first years.

Revenues explode thanks to forgotten subscriptions

The research also projects the additional revenue generated by these forgotten subscriptions. Using a simulation of 100,000 fictitious consumers, the authors simulated revenues over 10 years after removing the constraint of bank card renewal. The results are indisputable.

Of the 10 subscriptions researched, the one that benefited least from automatic renewal increased its revenue by 14%. At the other end of the spectrum, automatic renewal adds 200% revenue to another service.

As you can see, the tacit renewal of subscriptions is a financial windfall for all retailers. Who would refuse 14% more sales?

The tacit renewal of subscriptions is a financial windfall for all retailers.

Some consumers are more vulnerable than others

Another surprising finding concerns the profile of consumers who take out subscriptions. Some are much more “vulnerable” to forgetting than others. To prove this, the authors use another ingenious method.

You can use your bank card in the USA to obtain a cash advance. This amounts to borrowing money at an exceedingly high rate. This corresponds to 1.4% of customers in the dataset. The authors use these cash advances as a marker of the “financial sophistication” (in other words, the financial education) of the customers concerned. The results show that these customers are significantly less attentive than the rest of the customer base, making them even more vulnerable to the effects of automatic subscription renewals.

This is paradoxical. These people are the most financially fragile (they must borrow cash on a bank card), yet they don’t interrupt subscriptions they no longer need.

We could imagine a system where a customer who hasn’t used the service for 30 days is reminded that he’s paying for a subscription and can terminate it with a click.

Conclusion: What can be done to protect the consumer?

These results naturally lead us to ask what measures can be taken to protect the consumer. Subscriptions offer consumers a clear advantage: flexibility and peace of mind. The challenge is to strike a balance between these advantages and enhanced protection.

Asking consumers to renew their subscriptions every month voluntarily is not an option. The barrier would be too high. All subscriptions would expire at the end of each period. The churn rate would be too high and intolerable for companies and consumers.

A compromise might be to keep the tacit renewal mechanism while proactively warning consumers. We could imagine a system in which a customer who has not used the service for 30 days is reminded that they are paying for a subscription and can stop it at the click of a button.

Posted in Research.