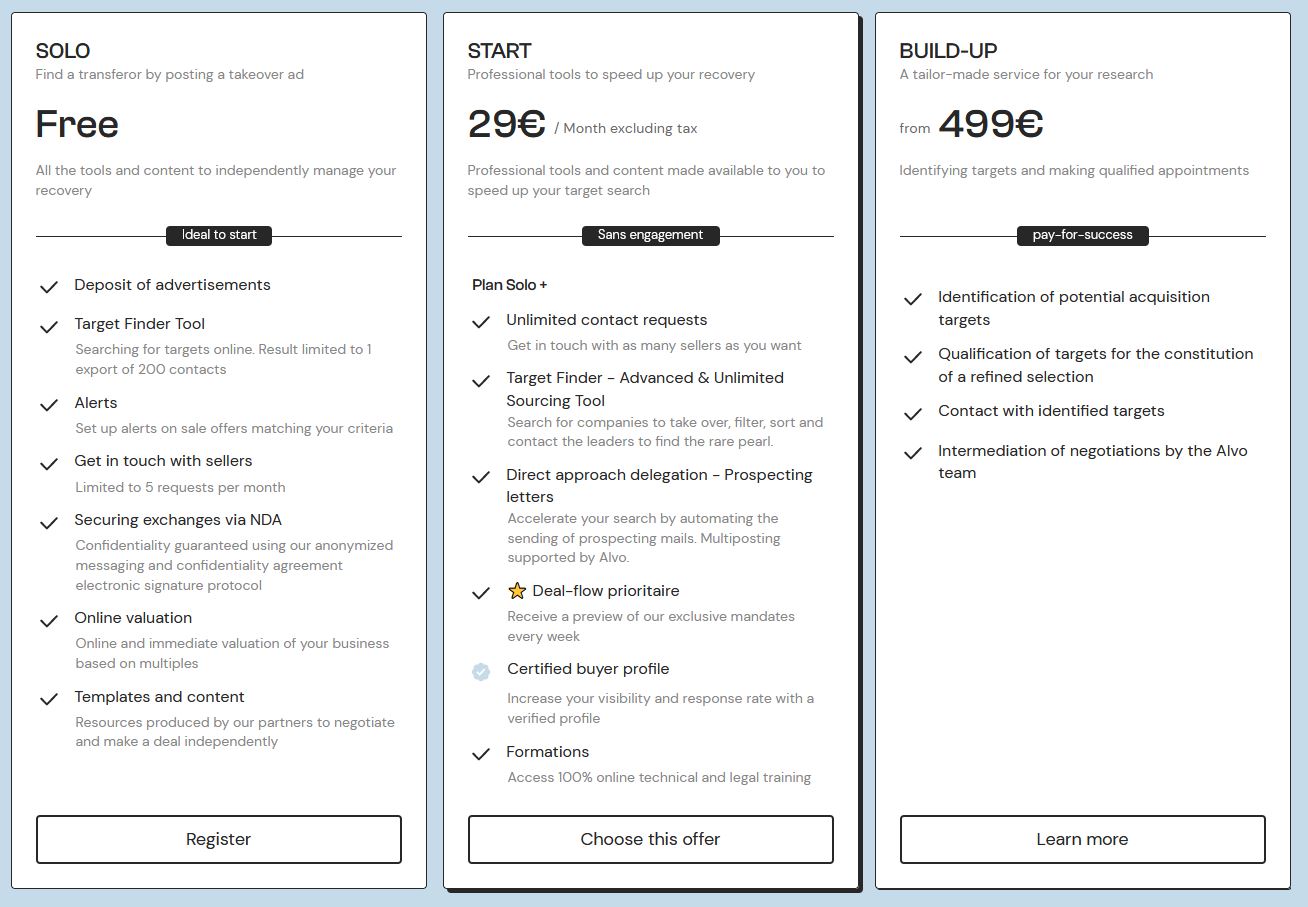

The market for the transfer of companies needs to be considered. Its enormous potential has been identified by Alvo, a start-up that proposes a platform that brings together sellers and buyers. The concept is simple, but Alvo has brought an innovative and very simple approach to this complex problem. Their business model is also very interesting because it is based on subscription formulas that generate recurring revenues. It’s very clever, and in this podcast, I’m joined by Germain Michou-Tonning to talk about this entrepreneurial adventure that earned Alvo a place in the Challenges 2023 ranking of the 100 start-ups to follow in France.

Statistics on the market for the transfer of companies

- 180,000 companies are sold each year in France. Only 1/3 are put on the market (60,000), and barely half (30,000) find buyers

- Within the next ten years, one out of two family businesses will be in a transfer situation. This compares to 15% over the last decade.

- 42% of French family-owned companies have worked on the transfer of capital, and 37% have designated a buyer

- Intra-family transfer concerns 12% of companies in France. It is 65% in Germany and 76% in Italy.

- 43%: the drop in M&A transactions in the first quarter of 2023 (compared to 2022), including at least one French company

The market for the sale/acquisition of companies

The M&A market is split in two. On the one hand, the large and mid-cap market (companies with a valuation of over €50m) is very profitable. This market has been declining sharply in recent years. It had already declined in 2022 and will decline even more in 2023. In the first quarter of 2023, deals involving at least one French company were down 43% compared to 2022. This market continues to generate very high margins for traditional M&A firms. It is set to rebound because, within the next ten years, one out of every two family-owned companies will be in a transfer situation. This compares to 15% over the last decade.

Only 42% of companies have worked on the transfer of capital, and a buyer has been designated in only 37% of cases.

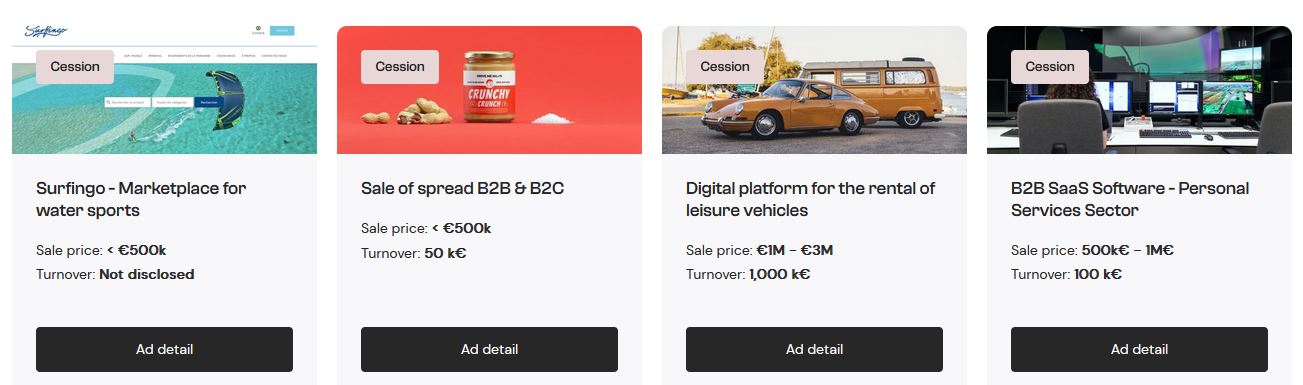

On the other side of the spectrum is the market for “small cap” companies (less than €50m) and “very small cap” companies (less than €10m in value). This market is growing rapidly but is not very profitable because it applies the same codes and methods as the “large cap” market. The remuneration of this type of operation being a percentage of the operation and being linked to the success, we immediately understand the problem of the “very small cap.” However, this market has been growing for several years because the managers are getting older.

The baby-boomer generation (born after the Second World War) has found itself in the situation of having to pass on the company they have created for several years. However, only 42% of companies have worked on transferring capital, and a buyer has been designated in only 37% of cases.

Some ideas inspired by Alvo for the launch of your start-up

Try directly confirming the idea “for real” with your future targets. In the case of Alvo, the 3 partners had assignment mandates signed before the creation of the platform to get a feel for the reality of the market. There is no better way to confirm the existence of a market.

When you identify your targets, you should also think upstream about how to contact them. The key may lie with other people. In Alvo’s case, Matthieu Colin’s newsletter proved to be the right way to reach the first customers.

Genesis of Alvo

Alvo was created by 3 entrepreneurs who were convinced that the market for small and very small-cap transfers could be changed.

Matthieu Stefani himself has sold and bought companies. He interviewed many sellers who expressed the same difficulties through his podcast. Thomas Colin has accompanied several companies and start-ups in their M&A process. Germain Michou-Tonning was convinced that it was possible to digitalize and innovate in investment banking as he had done in retail banking.

Validation of the idea: nothing better than testing it on real customers

Alvo’s idea was tested before the company was even launched. It’s quite atypical, but it’s worth it if you can do so.

Concretely, the 3 co-founders used their network for prospecting for owners who wanted to sell their companies and signed transfer mandates. This allowed them to execute the deals from A to Z and thus identify all the automation leads and capture precious feedback. This “service” stage is longer and less sexy from an investor’s point of view (because it is less scalable), but it is key to calibrate the product to be developed properly.

Alvo start-up or how to use all your resources wisely

The network is key. This was the role of Matthieu, who, through his activities and podcast, found the first entrepreneurs who would like to sell their companies.

Then it was the, word of mouth that took over for the first deals. In the age of “growth marketing,” word-of-mouth may seem outdated, but it remains one of the most practiced inbound marketing techniques. In our survey on companies’ online marketing practices, 50% of companies use word-of-mouth to find customers frequently or very frequently.

Alvo proves that it works. As Germain says, recommendation and word-of-mouth are the best acquisition channels when you have no awareness and a website with perfect SEO.

To finish on an analytical note, the use of Matthieu’s network developed through his podcasts is typical of what is called effectuation. This is the entrepreneur’s ability to use all available resources (even those outside the immediate scope of the company) to achieve his goals.

A newsletter to get the first customers

What I find surprising about the podcasts I carry out is that each start-up has a different way of generating its first leads. I invite you to read the research I published on companies’ lead generation practices.

To get its first customers, Alvo has once again relied on effectuation. The launch of Alvo was announced through Matthieu’s newsletter, sent to 4000 entrepreneurs. This resulted in 30 leads and 5 sales mandates signed.

When you need to find your first customers, all methods are good. Using the newsletter was a great idea because there was a clear convergence between its readers and the profile of Alvo’s potential customers. And even if the return is not immediate (30 leads and 5 contracts signed out of 4000 subscribers), the idea is planted, and Alvo will remain “top of mind.”

To get your start-up off the ground, look for media exposure

Alvo’s take-off happened with 2 simultaneous events:

- The announcement of the fundraising in the press and an article in Les Echos

- The rise of SEO.

This ensured a large number of leads quickly (this is the strength of inbound marketing). Alvo has understood the benefits of inbound marketing and is currently focusing on it. The objective is to create a niche in the Small Cap market and to be recognized as a key player.

Alvo’s future lies abroad within a network of partners

The statistics on the company transfer market are promising. This is a generational issue with huge opportunities. To seize these opportunities, Alvo relies on

- the development of a complete business suite for professionals. This will involve moving the business development team towards outbound marketing to propose the tool to chartered accountants and M&A advice, …

- the opening of new national markets

Posted in Entrepreneurship.