Shared electric scooters can be found in many cities and have gradually taken their place in the market for shared means of transport.

While shared bicycles are a well-known mobility option and are present in many metropolises, shared electric scooters have established themselves as an essential part of urban mobility over the last 2 years or so.

Summary

- Market statistics for shared electric scooters

- Market overview

- Competition and profitability

- Regulations

- Shared scooters and covid-19

Market statistics

- Lime has raised $765 million

- Bird has raised $415 million

- Total financing of $1.5 billion

- Distances travelled < 10 km (between 0.5 km and 4 km)

- The life span of a scooter: 3 months

- Shared electric scooters are banned in New York and Chicago.

- Eligibility criteria in many cities (Paris, Brussels, San Francisco…)

- 11 providers of this service in the French capital

- 76% growth in the electric scooter market between 2018 and 2019

Overview of the market for shared electric scooters

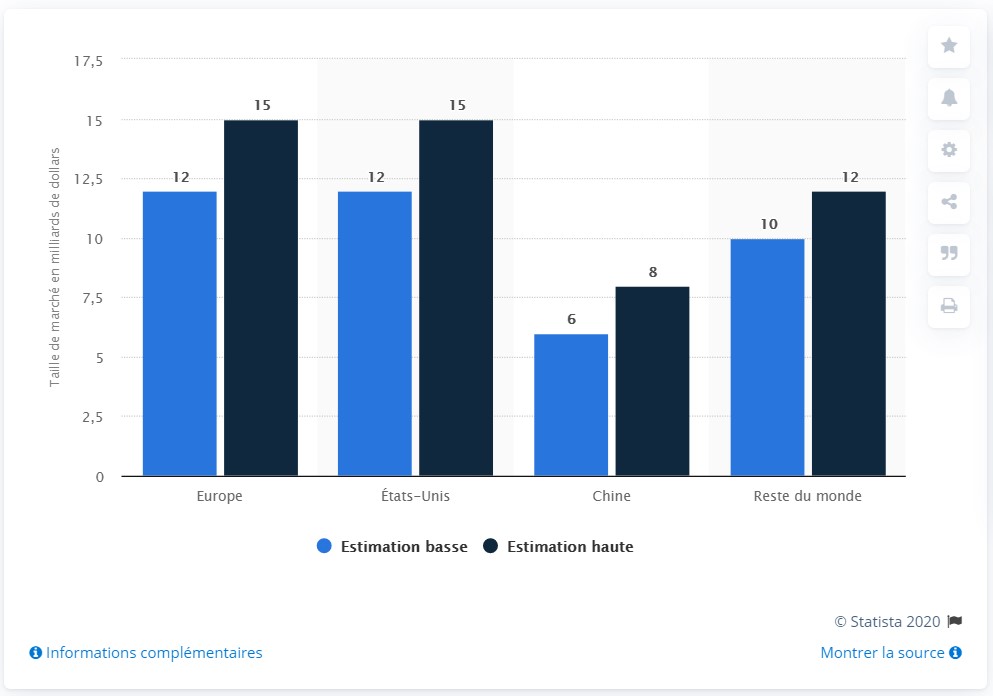

Before the covid-19 crisis, Boston Consulting Group estimated in a research that the global market could reach $40-50 billion by 2025. The European market would be around $12 to 15 billion.

At the beginning of 2020, in Brussels, the shared electric scooters of the Dott and Lime brands each had a fleet of around 2,000 scooters, while in Paris, more than 11 operators offer their services.

Prices for shared scooters are generally around 2 euros, with a flat rate on activation (usually 1 euro) and a flat rate per minute (a few centimes).

Competition and profitability of the service

According to research, the market is too competitive and not profitable enough.

Cost-effectiveness of shared electric scooters

he lifespan of a scooter is estimated at 3 months. The main reasons are related to the fragility of these means of transport and the recurrent vandalism that manufacturers have to face.

Costs related to the provision of shared electric scooters

These include maintenance, collection, battery recharging and fleet distribution. To date, the return on investment comes after 4 months, while the models have a lifespan of 3 months. Experts estimate that shared electric scooters should be on the market for at least 6 months.

Several ideas for improvements have been developed to increase this profitability, such as interchangeable batteries, increased capacities and more robust motors. We do not yet have the necessary hindsight to affirm the impact of these changes.

Advantages and disadvantages of this means of transport

| Advantages of shared electric scooters | Disadvantages of shared electric scooters |

|

|

A highly competitive market

Several start-ups have launched the introduction of shared electric scooters. Uber has also invested in the electrified and shared transport market with Jump as well as with Lime. The market players will have to find ways to differentiate themselves from their competitors: geographical coverage, price, service, and so on.

Market regulations

While cars and bicycles have defined and regulated lanes and locations (depending on the city and usage), this is not the case for shared scooters. Parking in inappropriate places, crazy traffic and even risky behaviour is regularly, if not daily, observed.

Since 2018, Paris has imposed several measures to regulate the market:

- Verbalisation of abuses: 135 euros fine for driving on the pavements, 35 euros fine for abusive and inconvenient parking.

- Delimitation of parking by creating specific zones.

- Making operators responsible by signing a charter of acceptable practices.

- Regulation of the Paris fleet through a fee for operators (amount varying from 50 to 65 euros per scooter depending on the total number in circulation).

In Belgium, since the beginning of 2019, market players have had to apply for a permit to hope to make their scooters available to Brussels users. The operator must be able to install at least 50 scooters on the network and ensure compatibility between its operating plan and that of the City of Brussels.

The criteria that are taken into account in the operating plan for shared scooters in Brussels:

- Technical conditions of the vehicle

- Conditions of use for private individuals

- Recycling of used vehicles

Shared scooters since the outbreak of the health crisis

In Paris, there are more than 6 suppliers of shared scooters. During the confinement, only Dott continues to provide the service in the French capital, although the fleet was halved.

Many operators offered their services free of charge to healthcare staff and other essential trades during this period, in Brussels as well as in several European and world metropolises.

Some figures

- 85% drop-in market activity since the start of the lockdown (March 2020)

- 1/3 of the staff laid off at Bird, 14% at Lime

- More than 80% drop-in activity at Velib (shared bikes in Paris)

- Reduced or even suspended activities for many providers of shared transportation (Lime, Jump, and many others)

- Paris suspends the fee payable by operators

- Postponement of specific mobility projects such as the shared electric bicycle

The post-lockdown counterpart is the presumed willingness of users to avoid public transport. It remains to be understood to what extent users will be inclined to use these shared means of transportation. Market players have announced more frequent cleaning to prevent the spread of the virus and reassure their users.

Illustration : Shutterstock

Posted in Marketing.