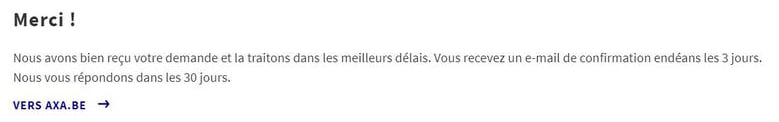

Customer satisfaction seems to be a foreign concept to Axa, and the company makes no secret of it. When you send in a question via the Axa website, the promise that you will receive an answer within 30 days is simply staggering. If we needed proof that traditional insurance companies are incapable of adapting to the needs of their customers, this is it. This disastrous customer experience management leaves a gap for Insurtech start-ups.

Introduction

The concept of “customer-centricity” is not new. Some see its origin in a quote from Peter Drucker in 1954, others, like Peter Fader, in the invention of direct marketing by Lester Wunderman in the 1960s. In any case, the movement from transactional to relationship marketing visible in the extension of the marketing mix from the 4Ps to the 7Ps in the 1990s argues for an old concept. We can, therefore, legitimately expect it to have been integrated by all companies. The example of Axa proves the contrary.

99% of requests will be answered within 30 days even if the customer has been lost by then.

Axa does not understand the basics of customer satisfaction

In another article, I questioned the staggering figures put forward by Thomas Buberl, the CEO of Axa, regarding customer satisfaction. The case I present below adds to my argument. In any case, it proves that customer satisfaction scores do not always reflect reality.

When you can have your shopping delivered within 15 minutes when Amazon even delivers on Sundays, some companies adopt a different rhythm. When you send a request to Axa Belgium, the company undertakes to acknowledge receipt of your request within 3 days and reply within … 30 days. All the customer has to do is wait.

Contrary to many examples on the Internet, this is not an individual case or a subjective assessment. It is a procedure described by Axa’s customer service (see screenshot above). This procedure proves to us that understanding the customer is not in their DNA. How can you reasonably expect a customer to wait 30 days? Isn’t this the antithesis of what a “customer-oriented” service should be?

Contrary to many examples on the Internet, this is not an individual case or a subjective assessment. It is a procedure described by Axa’s customer service (see screenshot above). This procedure proves to us that understanding the customer is not in their DNA. How can you reasonably expect a customer to wait 30 days? Isn’t this the antithesis of what a “customer-oriented” service should be?

On the other hand, this 30-day deadline has a significant advantage. It allows us to display impressive performance indicators since it is a safe bet that 99% of requests will receive a response within 30 days, even if the customer has been lost by then.

Measuring customer satisfaction can only be effective if you measure it where it really counts.

Lessons learned in customer satisfaction

If customer satisfaction is important to you, I think there are several lessons to be learned from Axa.

Be honest when measuring customer satisfaction

The first piece of advice is to measure customer satisfaction honestly. The basic rule is always the same: avoid asking biased questions. There is a great temptation to direct the questions to obtain answers that will meet the objectives set by the management (see here the case of another behemoth: Belfius).

Measure customer satisfaction in the most crucial places

Measuring customer satisfaction can only be effective if you measure it where it really counts. Represent the customer journey and measure customer satisfaction in the most important places first.

Define KPI’s in line with your customers’ expectations

Your performance targets should be in line with your customers’ expectations. If the customer expects a response within 24 hours and your target is 30 days, your measurement is wrong. To define your objectives, use a qualitative or quantitative approach, or simply take what your competitors are doing as a reference.

Conclusion

Axa has already learned the hard way that any fallacious argument to avoid its contractual obligations is not admissible. Following Covid, the company initially refused to compensate its covered clients for business losses. It was the subject of more than 1,500 lawsuits from restaurant owners and finally decided to release €300m to end the lawsuits.

Today’s example shows us the profound gap between the priorities of the Axa-type behemoths and customers’ expectations. This gap is a blessing for start-ups active in the Insurtech sector, which are coming to shake up these giants with feet of clay by pressing where it hurts: better customer experience, ultra-fast reimbursement, hyper-available customer service, radically better value proposition.

Posted in Marketing.