In this article, you’ll discover the latest figures on the beer market in general, followed by a focus on the microbrewery segment. We will focus on the British, Italian, French, Belgian and German markets.

The beer market is resilient despite inflation. In 2023, sales in France rose by 6.6% in value but fell by 3.7% in volume. Microbreweries are doing particularly well in this tense environment. In this article, you’ll find the latest figures on the beer market and a focus on microbreweries in 5 countries: Italy, the UK, France, Germany, and Belgium. Don’t hesitate to contact our market research agency for any requests or projects you may have.

Contact IntoTheMinds: we’ll get back to you within 60 minutes

The beer market in Europe

There are 9684 breweries in Europe, and average per capita consumption is 70 liters per year.

There are considerable differences. In France, the average consumption is 33 liters a year, while in the Czech Republic, it’s 136 liters. But it’s in France that there are the most breweries (2,500!), 8 times more than in Poland, even though average consumption in this country is three times that of France.

So, European nations have huge disparities in consumption and brewing tradition (see table below).

| Country | Average annual per capita consumption (in liters) | Number of breweries |

| Czech Republic | 136 | Not reported |

| Austria | 102 | 349 |

| Poland | 93 | 326 |

| Germany | 92 | 1507 |

| Denmark | 79 | 261 |

| Irland | 71 | 80 |

| European Union average | 70 | 9684 |

| Netherlands | 70 | 936 |

| United Kingdom | 68 | 1830 |

| Spain | 58 | 297 |

| Portugal | 53 | 110 |

| Italy | 38 | 916 |

| Greece | 35 | 75 |

| France | 33 | 2500 |

Regarding segmentation, not all beers experienced the same trends in 2023. First of all, it should be noted that sales volumes fell in all segments. The average decline was 3.7%, but there were wide disparities. While specialty beers fell by 2.4%, luxury beers lost 12.1%. Luxury beers were the only segment to decline in value (-0.8%). Due to inflation and despite lower sales volumes, all other segments grew in value.

| Segment | Market share | Change in value 2023 | 2023 change in volume |

| Specialty beers | 57,4% | +7,6% | -2,4% |

| Specialty lagers | 30,9% | +6,9% | -2,5% |

| Luxury beers | 6,1% | -0,8% | -12,1% |

| Shandy and non-alcoholic beers | 5,6% | +6,8% | -6,8% |

In France, 2/3 of all beers are sold in supermarkets (34.8%) and hypermarkets (30.5%). These two sales channels saw an inflation of 10.1% in 2023. Convenience stores account for almost 20% of sales (19.8%).

Finally, it is useful to have an overview of sales by producer type to conduct the transition to the microbrewery market.

| Type of producer | Market share | Change in value (2023 / 2022) | Change in volume (2023 / 2022) |

| Classic private label | 6,4% | +7,9% | -4,7% |

| First-price distributor’s brand | 1,1% | +4,4% | -2,1% |

| Thematic distributor brand | 0,3% | +6,2% | -6% |

| Major groups (ABInbev, …) | 66,9% | +5,5% | -5,7% |

| SME’s | 16,5% | +8,7% | +0,4% |

| Mid-sized groups | 8,8% | +13,2% | +5,8% |

As you can see, 2/3 of the market is dominated by large groups. SMEs (including microbreweries) account for 16.5% of the market. It’s also interesting to note that in 2023, large groups and private labels (distributor brands) declined in volume, unlike SMEs and intermediate groups. So, in addition to inflation, there is a shift in consumption towards less mainstream and potentially more qualitative products.

The British craft beer market

Beer and the British: it’s a real love story. Going to the pub after work is an authentic British tradition and the cement of business relationships. Market trends show that it’s not just about quantity. It’s also about diversity. This is reflected in the number of microbreweries becoming increasingly popular in the UK. Despite their local roots, their international ambitions are also well-established. Here are some figures from market research presented at the EMAC 2018 conference:

- The number of microbreweries has more than doubled in the UK between 2010 and 2015

- The United Kingdom is the country with the most significant number of microbreweries: more than 1700

- 1 in 6 UK breweries plans to double their production, sales, or number of employees by 2018

- Only 15% of these microbreweries export their production, but more than 50% aim to be present in international markets.

The Italian craft beer market

The same market trend can be observed in other European countries. In Italy, for example, there were 75 craft breweries in 2007 and 718 in 2016, representing an almost tenfold increase in their number. The graph below shows this impressive development.

Evolution of the number of microbreweries and bars brewing their beer in Italy (2007-2016)

The French market for craft beer

As far as the production of craft beers is concerned, the wine country is not to be outdone. Indeed, the French territory had 200 craft breweries in 2007 and counted the creation of a hundred breweries and microbreweries per year since 2013. There were 900 in 2016.

The Belgian craft beer market

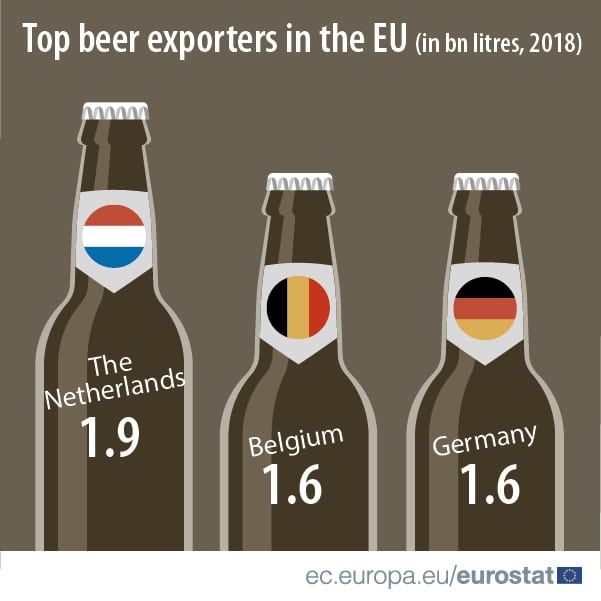

In Belgium, the number of breweries increased from 115 in 2003 to 278 in 2018. Therefore, Their number has more than doubled in 15 years, which for many is synonymous with creating a bubble that is likely to burst soon. Belgium is the second-largest beer exporter in the European Union, with 1.6 billion liters exported in 2018.

The German craft beer market

Germany records the creation of more than 200 breweries between 2010 and 2018, increasing from 1333 to 1539. It is also the country that produces the most liters of beer in the European Union (21% of production or 8.3 billion liters of beer brewed).

A few words in conclusion

The market is still dominated in terms of volume by the major brands. However, consumers are showing much interest in new tastes and authenticity, reflected in the creation of local micro-brands.

For example, large organizations such as ABInbev detected this trend very early and have invested in local brands for a long time to build up as vibrant a portfolio of brands as possible.

“The Brussels Beer Project” is a successful example of a Microbrewery whose distinguishing feature is that its launch was financed by crowdfunding and which today has a complete range of very diversified products on national distributors’ shelves.

Sources

- Artisans Gourmands: The booming craft beer market

- Statista: Beer’s success story in the land of wine

- FEBED (Belgian Federation of Beverage Distributors): The number of breweries has doubled in eight years

- Eurostat: Happy International Beer Day!

- Brauer Bund: Deutsche Brauwirtschaft in Zahlen

Image : shutterstock

![Illustration of our post "SIAL 2024: 12 tips to organize your visit [Guide]"](https://5cc2b83c.delivery.rocketcdn.me/app/uploads/sial-2018-etude-de-marche-france-alimentation-1-120x90.jpg)

![Illustration of our post "Pay the true price for your coffee at Albert Heijn [Nudge Marketing]"](https://5cc2b83c.delivery.rocketcdn.me/app/uploads/true-price-albert-heijn-4-120x90.webp)