The Pet Tech sector — technology dedicated to companion animals — is booming. In this article, we review the market, its trends, and its latest innovations.

Pets have become true members of the family (a phenomenon known as anthropomorphization — see our pet food market study), and this shift is radically transforming an entire sector: that of technology dedicated to companion animals (“pet tech”). There is something for everyone: connected devices, health‑tracking apps, personalized digital services. Our firm conducts studies on these markets all year long, and we wanted to give you an overview of the trends and perspectives shaping pet tech. Enjoy the read!

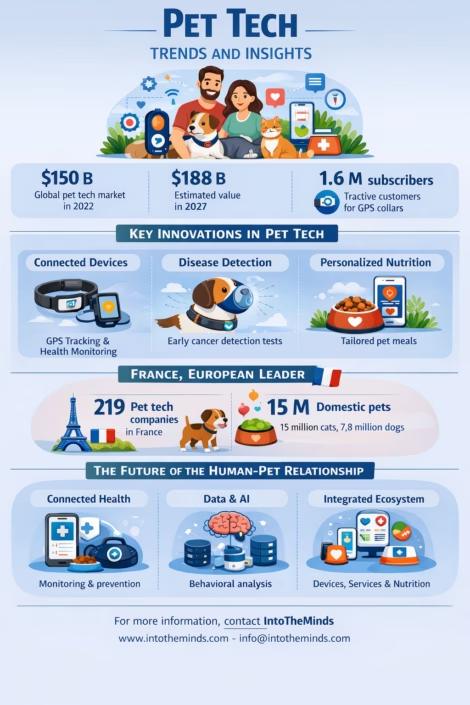

Pet tech: key figures to remember

- 150 billion dollars: value of the global pet tech market in 2022, including connected devices, digital services, insurance, and technological solutions for animals

- 188 billion dollars: projected value of the global pet tech market by 2027

- 1.6 million paying subscribers: Tractive’s global customer base for its GPS collars and connected services

- 150 million euros: annual recurring revenue generated by Tractive through its subscriptions

- 300,000 users: number of Tractive customers in Germany, a market with 25 million dogs and cats

- 35 million dollars: amount raised by Tractive

- 3 minutes: time required to perform a breath test developed by SpotitEarly for early cancer detection

- 2020: year Nestlé Purina launched its Unleashed program dedicated to pet tech start‑ups

- 100: number of applications received by Nestlé Purina during the first edition of Unleashed

- 3 billion Swiss francs: revenue of Nestlé’s petcare segment, including nutrition and technological initiatives

- 7 veterinary clinics: number of sites already opened by Rex with its digitalized veterinary model

A market driven by owners’ love for their pets

Figures from the pet sector show just how dynamic it is. France alone has nearly 75 million domestic animals, including 15 million cats and 7.8 million dogs.

This demographic reality goes hand in hand with a shift in mindset. Pets are no longer seen as simple companions but as true family members. We explored this psychological transformation — anthropomorphization — in another study. It results in a growing acceptance of significant spending for their well‑being.

In France, the average lifetime cost of a dog or cat reaches around 10,000 euros, excluding accidents and major medical procedures. For more demanding animals like horses, this amount can climb to 190,000 euros. These orders of magnitude explain why monthly subscriptions of a few euros or technological equipment costing over 200 euros no longer represent a psychological barrier.

France has 15 million cats and 7.8 million domestic dogs.

Pet tech innovations

Technology for companion animals has moved far beyond simple gadgets. It now encompasses sophisticated solutions that genuinely transform the lives of pets and make their owners’ lives easier.

Remote monitoring

In the field of pet geolocation, Tractive is the undisputed market leader. The company already has 1.6 million paying subscribers worldwide. With subscriptions starting at 5 euros per month, it generates 150 million euros in annual recurring revenue. Its success is built on concrete, everyday use cases:

- real‑time geolocation

- activity tracking

- sleep analysis

- monitoring of physiological indicators

Innovation goes even further with projects like SpotitEarly. This start‑up, founded in 2020, leverages dogs’ extraordinary olfactory abilities — up to 300 million receptors — to detect volatile organic compounds associated with cancer. The animals wear sensors during the tests, while artificial intelligence analyzes their movements and heart rate. This approach illustrates the growing hybridization between pet tech, health tech, and artificial intelligence.

Personalized nutrition

The pet food sector is a particularly fertile ground for technological innovation. In France, this market is worth 3.3 billion euros, including 460 million euros generated through e‑commerce — 12% of total sales. The goal here is not to discuss pet food itself, but to highlight the technological aspects converging with this theme.

Start‑ups such as Japhy, Reglo, or Flouf innovate by offering personalized nutritional formulas, often based on subscription models. Flouf validated its concept through a successful crowdfunding campaign.

Major groups are not staying on the sidelines. Nestlé Purina launched its Unleashed innovation program in 2020, which received over 100 applications. Only six start‑ups were selected, but each benefits from 50,000 Swiss francs in funding and access to a 500‑person R&D team. Nestlé’s petcare segment generated more than 3 billion Swiss francs in 2020, with a 10% increase in demand during lockdown.

At the Websummit 2025, we met a Swiss start‑up (i-kitty), also part of the Unleashed program, which presented an interesting innovation in cat nutrition: an automatic wet‑food dispenser. All automatic dispensers currently work with dry food (kibble), but wet food is healthier for cats. This creates a technological and sanitary challenge: preventing the food from spoiling. The inventors of i‑kitty patented an airtight container whose seal is removed at the last moment by the dispenser. The business model is similar to Nespresso: you pay for the dispenser (the equivalent of the coffee machine) and for the containers (the equivalent of capsules), which are only compatible with the machine.

i‑kitty is an automatic wet‑food dispenser for cats. It was presented at Websummit 2025 and the company is part of Nestlé Purina’s Unleashed program.

Animal health in the digital age

The digitalization of veterinary care represents another major pillar of pet tech. As costs rise and the number of veterinarians fails to keep pace with demand, technology offers innovative solutions.

Rex is a German company founded in 2022 that illustrates this new approach. It has already opened seven veterinary clinics in Germany, with a target of four additional openings in a single year. Its concept primarily targets young urban pet owners — a rapidly growing demographic.

At a macroeconomic level, animal health represents a combined market exceeding 12 billion euros in Germany, including food, accessories, and veterinary care. Technology positions itself as a lever for optimization, prevention, and differentiation of the customer experience.

France, Europe’s pet tech champion

France stands out in this rapidly expanding sector. According to the latest data from the Pet Tech Observatory, France has 219 active companies in this field, representing 19.12% of European pet tech businesses. This leadership position is explained by several factors.

First, French pet culture encourages the adoption of new technologies. Second, the French start‑up ecosystem provides a favorable environment for developing innovative solutions. Finally, proximity to major European markets facilitates international expansion for French companies.

This momentum translates into significant investments. Although the sector is currently experiencing a consolidation phase with a decline in overall investment, some markets are emerging with promising prospects. Italy, for example, invested 2.1 million euros in pet tech in 2024. It is still modest, but it signals a diversification of funding sources in Europe.

The future of the human‑animal relationship

Technology for companion animals is a sector with a bright future. Underlying trends — population aging, anthropomorphization, etc. — will continue to drive market growth. Our analyses also show a convergence toward integrated ecosystems combining connected devices, digital services, personalized nutrition, and preventive health. What happened in human health tech is now happening for pets.

Data plays a central role in this evolution. With 1.6 million subscribers for Tractive and tens of millions of connected animals in Europe, companies are accumulating a massive amount of information on animal behavior and health. This data remains largely underexploited and promises strong potential for companies entering the fields of prevention and personalized care.

In the United States, where the sector generates 157 billion dollars in annual revenue, pet tech is gradually moving from an emerging segment to a structural pillar of the animal economy. This maturity foreshadows the evolution of the European market in the coming years.

Frequently asked questions about pet tech

What exactly is pet tech?

Pet tech refers to all technologies dedicated to companion animals. This includes connected devices (GPS collars, automatic feeders), mobile health‑tracking apps, digital veterinary services, and personalized nutrition solutions. It is a sector that combines technological innovation with animal well‑being.

How much do these technologies cost?

Prices vary widely depending on the solution. A connected GPS collar costs between 50 and 200 euros, with a monthly subscription of 5 to 15 euros. Automatic feeders range from 100 to 300 euros. For personalized nutrition, expect 30 to 60 euros per month depending on your pet’s size.

Are these technologies truly useful or just gadgets?

User feedback shows real usefulness, especially for health prevention and safety. Activity tracking helps detect early health issues, while geolocation reassures owners and facilitates the search for lost pets. Personalized nutrition genuinely improves digestive health and overall well‑being. Ultimately, usefulness is also measured through emotional value — peace of mind is priceless.

Can my veterinarian use this data?

More and more veterinarians are integrating data from connected devices into their diagnostics. Activity tracking, eating habits, and physiological indicators provide valuable information for adapting treatments and detecting certain conditions early.

Is pet tech accessible for small budgets?

Much like human health tech, the offer is becoming increasingly democratized. Entry‑level solutions exist for most needs. Subscription models also help spread out costs. Many owners see these expenses as an investment in their pet’s health, which can reduce veterinary costs in the long run.

![Illustration of our post "What do customers expect from downtown stores? [Survey]"](/blog/app/uploads/retail-shopping-covid19-120x90.jpg)

![Illustration of our post "Disability and inclusion: between obligations and reality in the workplace [Study]"](/blog/app/uploads/banner-blind-aveugle-120x90.webp)