Notre étude du marché des coupe-faim montre qu’ils sont en train de changer complètement les habitudes de consommation et d’achat des populations concernées. Les stratégies industrielles en sont affectées également.

Ozempic, Wegovy and Mounjaro are appetite suppressants from the GLP-1 treatment family. These medications are now reshaping the entire U.S. food industry, creating winners and losers in a multi-hundred-billion-dollar market. For a market research company like ours, this trend is particularly interesting to study as it foreshadows changes in other geographic markets. Specifically, the protein food market is converging with shifts induced by appetite suppressants. We’ve analyzed the U.S. market and latest figures to prepare a comprehensive report on this topic.

Contact IntoTheMinds marketing research firm

Key takeaways

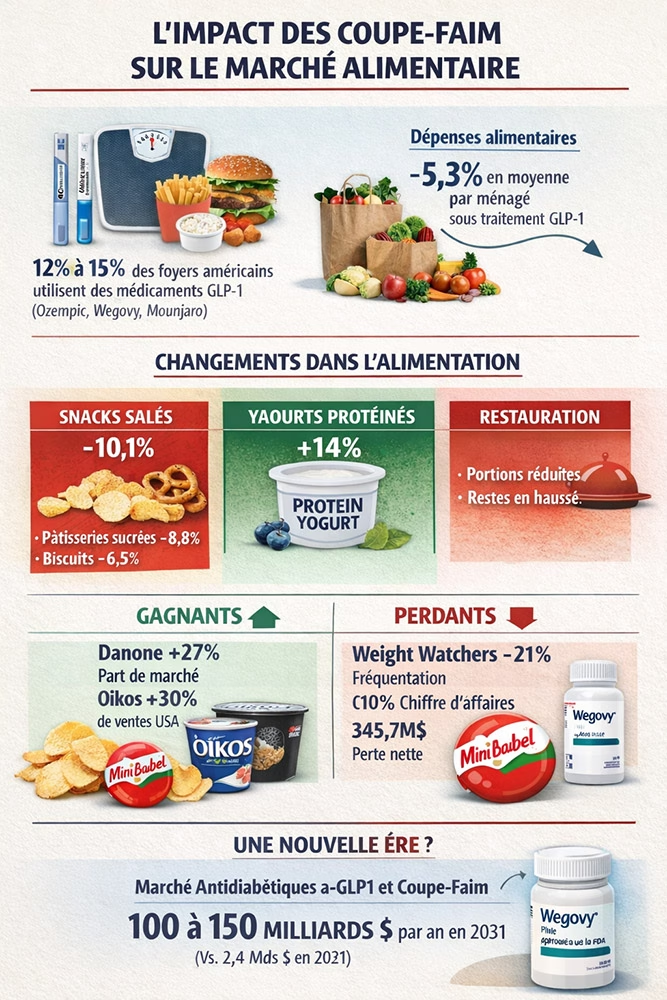

- GLP-1 anti-obesity treatments (Ozempic, Wegovy, Mounjaro) already reach 12% to 15% of U.S. households, representing 45 to 50 million people

- Food spending decreases by 5.3% on average after starting treatment

- Protein-rich products are performing well, unlike ultra-processed foods

- The restaurant industry is adapting menus with smaller portions and high-protein dishes

- The anti-obesity drug market could reach $150 billion by 2031

- 110 million: Number of obese adults in the United States

- 42%: Percentage of American adults suffering from obesity

- -5.3%: Average decrease in food spending among U.S. households using appetite suppressants

- -8.2%: Decrease in food spending among affluent households on anti-obesity treatment

- +3.6%: Increase in yogurt sales among consumers on appetite suppressants

- -10.1%: Decline in purchases of chips and salty snacks among Ozempic users

- -8.8%: Drop in sales of sweet pastries among consumers on anti-obesity medications

- -6.5%: Decrease in cookie purchases among users of appetite suppressants

- +43%: Share of consumers on anti-obesity medications reporting increased fruit and vegetable consumption

- 36%: Share of consumers increasing their protein intake while on appetite suppressants

- 85%: Proportion of patients on anti-obesity medications developing an aversion to fat, sugar or alcohol

- +14%: Increase in sales of Danone’s Greek yogurt in the U.S. in one year

- +30% per year: Growth in sales of Danone’s Oikos brand in the U.S. over two years

- 27%: Danone’s market share in the Greek and high-protein yogurt segment in the U.S.

- +12%: Growth in Mini Babybel sales in the U.S. in 2024

- $350 million: Amount of investments announced by Bel in the U.S.

- 10,000 tons/year: Additional production capacity for Mini Babybel in the U.S.

- -21%: Decline in attendance at Weight Watchers in-person meetings

- -12%: Decrease in Weight Watchers’ annual revenue in 2024

- $345.7 million: Net loss recorded by Weight Watchers in 2024

Mass adoption redefining consumption habits

In less than two years, appetite suppressants have massively penetrated the U.S. market. According to data from an academic panel of 150,000 households, over 16% of U.S. households include at least one GLP-1 user. This rapid adoption comes with measurable economic effects.

The numbers speak for themselves. Food spending decreases by 5.3% on average after starting treatment. In affluent households, this drop reaches 8.2% – a particularly significant phenomenon since these households represent a substantial portion of premium product purchases and dining out.

This contraction isn’t temporary. The study shows the decline persists for at least twelve months while treatment continues, only returning to baseline levels if medication is stopped. Walmart, the retail giant, confirms this trend by observing smaller baskets with fewer items and fewer calories among its customers on treatment.

Food basket recomposition: winners and losers

Analysis of the forty most purchased product categories by U.S. households reveals profound upheaval. Only four categories see sales growth among GLP-1 consumers. Among these, only one shows statistically significant growth: yogurt, with a 3.6% increase.

Conversely, traditionally strong categories in the food industry are experiencing marked declines. Chips and salty snacks drop by 10.1%, sweet pastries by 8.8%, and cookies by 6.5%. These figures are explained by GLP-1’s physiological effects: 85% of patients develop an aversion to fat and sugar, durably altering their food choices. This aversion permanently modifies food choices, going far beyond simple diet logic.

Protein-rich products are emerging as the big winners of this transformation. Danone perfectly illustrates this dynamic. In the U.S., the group holds a 27% market share in the Greek and high-protein yogurt segment. Greek yogurt sales grew 14% year-over-year, while the Oikos brand has averaged 30% annual growth over two years. Across North America, Danone’s revenue grew 5.2% in 2024, then another 2.3% in the first half of 2025. The figures show this growth is largely driven by these product lines.

36% of appetite suppressant users increase their protein consumption.

Industry adaptation to new appetite suppressants

Bel is also benefiting from this trend. Mini Babybel sales in the U.S. jumped 12% in 2024, then another 6% in the following half-year. The group attributes this performance to three factors induced by these appetite-reducing medications: smaller portions, increased protein needs, and preference for simple, digestible products.

In response to this evolution, Bel has committed $350 million in U.S. investments, including $110 million to double production capacity for GoGo squeeZ pouches and expand the Brookings factory. This strategy reflects manufacturers’ confidence in the permanence of these behavioral changes.

The restaurant industry is also adapting. Chains like Chipotle Mexican Grill have launched menus explicitly enriched with protein. This adaptation responds to growing demand: 70% of American consumers report wanting to increase their protein intake, while 27% are actively trying to lose weight.

Impact of appetite suppressants on the restaurant sector

The restaurant industry is also feeling the effects of appetite suppressant use. For example, New York restaurateurs are observing decreased quantities consumed per customer and significantly more leftovers.

In response, chains like Chipotle have launched menus explicitly enriched with protein. This adaptation follows results from quantitative studies of the American population:

- 70% of American consumers report wanting to increase their protein intake

- 27% say they’re actively trying to lose weight.

Another revolution in the U.S., some chains are testing smaller portions and low-calorie menus. These establishments are using nudge marketing strategies by sometimes selling these menus at lower prices to influence consumer behavior. For once, this is a good nudge, unlike less ethical techniques brands use to increase margins, like everything related to shrinkflation.

Attendance at Weight Watchers in-person meetings has dropped by 21%.

Traditional weight loss sectors in trouble

The shock is particularly brutal for historical weight loss players. Weight Watchers illustrates this disruption: membership fell from 4.1 to 3.8 million in one year, attendance at in-person meetings declined by 21%, and revenue decreased by 12% in 2024 to $785.9 million.

The company recorded a net loss of $345.7 million and had to file for Chapter 11 protection to restructure debt exceeding $1 billion. These difficulties illustrate a structural shift in demand, with GLP-1 treatments bypassing traditional behavioral approaches to weight management.

Future outlook: toward lasting transformation

The long-term implications are considerable. The global anti-obesity drug market could reach $100 to $150 billion annually by 2031, compared to just $2.4 billion in 2021. At this scale, even an average 5% decline in food volumes among affected consumers is enough to reshape the balance of many segments. We therefore anticipate a wave of innovation in the food sector.The pace of innovation had tended to slow significantly during Covid This is very positive because precisely during SIAL 2022 we were disappointed by the sector’s lack of vitality.

The announced rollout of oral forms, like the Wegovy pill recently approved by the FDA, could further accelerate this transformation by removing certain usage barriers. Projections suggest these treatments could reach up to 24 million people by 2035, or about 7% of the U.S. population.

These appetite-modulating medications don’t just change what consumers eat. We observe they:

- reduce quantities

- shift value toward more functional products

- weaken volume-based models

- accelerate polarization between food perceived as “useful” and food deemed superfluous.

For the food industry, this is no longer a weak signal but a structural change, already visible in the numbers, and set to intensify as obesity medicalization progresses. Companies that can anticipate and adapt to this new reality will gain a competitive edge in a rapidly evolving market.

Frequently asked questions

How do appetite suppressants like Ozempic actually affect eating habits?

Data shows that 73% of patients on treatment report eating less, while 85% develop an aversion to fat and sugar. This preference modification goes well beyond simple quantity reduction and touches on fundamental food choices.

Which food sectors benefit most from this trend?

Protein-rich products are clearly performing well. Greek yogurts, portioned cheeses like Mini Babybel, and foods perceived as simple and digestible are seeing significant growth. Conversely, sweet and salty snacks are experiencing major declines.

Is this food market transformation sustainable?

Studies show changes persist as long as treatment continues, for at least twelve months. With the anti-obesity drug market potentially reaching $150 billion by 2031, this transformation appears long-term.

How is the restaurant industry adapting to these new behaviors?

Restaurant chains are developing protein-enriched menus and testing smaller portions. Some are even offering low-calorie dishes at lower prices, thereby modifying the sector’s traditional economic equation.

![Illustration of our post "Disability and inclusion: between obligations and reality in the workplace [Study]"](/blog/app/uploads/banner-blind-aveugle-120x90.webp)

![Illustration of our post "German automobile industry: 2024 analysis and outlook [Research]"](/blog/app/uploads/volkswagen-wolfsburg-120x120.jpg)