Once upon a time, e-commerce was a magic word for anyone wanting to launch an “easy” business. The infopreneurs who sell you dropshipping training courses made no mistake about it. But the situation has changed. Today, even e-commerce is stagnating, a victim of the economic crisis triggered by the end of quantitative easing and free money. In this article, we analyze the figures that reflect this gloom and look to the future of e-commerce.

Contact IntoTheMinds for your market research projects

E-commerce statistics in 2023

- Product sales:

- For the second trimester, online product sales were down 1% from the previous year. However, for the first three months of the year, they were still on the rise, with a gain of 1%.

- Despite these mixed figures, the volume of online transactions rose by 5.3% in the second trimester compared with the same period in 2022. In addition, the number of new merchant websites rose by 7%.

- Potential by sector:

- Services:These grew by 14% in the second trimester of 2023, driven mainly by transportation, tourism, and leisure.

- Beauty:This sector continued to grow between April and June, with an increase of 5%.

- Furniture and decoration:online transactions are down 2%.

- Technical products: A significant drop of 14%.

- Fashion and clothing:Online clothing sales fell by 4.3% in the first seven months of the year compared to 2022. In the second trimester, this sector recorded an 8% decline. This represents a 10% decline in the pre-crisis period.

- Internationalization:International apparel e-commerce websites saw their sales increase by 3.1%, while national websites recorded a 2.4% decline.

- Expectations of e-commerce managers (France 2023 survey)

- 60%of French e-commerce website managers have been impacted by the war in Ukraine and the resulting inflation.

- The main concerns are rising transport and delivery costs (76% of respondents) and falling household consumption (75%of respondents).

- 83% of e-retailers have increased their prices to offset rising production costs, and 53%have reduced their margins.

- Only 24%of French e-commerce bosses expect prices to return to normal in the second half of 2023, and 35% in the first half of 2024.

- 61%of e-commerce retailers expect their sales to grow, although this figure is down 6 points in 2021.

- 25%of websites were unprofitable in 2022, up 9 points in 2021, and only 55% were profitable in 2022, down 8 points on the previous year.

- 71%of e-retailers anticipate concentration in the online sales sector.

- 75%expect international sales growth over the next two years.

Over the past 10 years, e-commerce has been a growth driver in Western countries. The digitization of our behavior and purchasing habits has led to a proliferation of online sales projects, particularly since COVID-19. Although by 2023, it will be impossible for a retailer not to have a web-shop, the war in Ukraine and inflation nevertheless catches up with e-business. On the one hand, this is reflected in the expectations of e-commerce bosses and, on the other, in the latest sector statistics, which show a clear slowdown.

E-commerce managers concerned about the current environment

A survey carried out in the first half of 2023 provides insight into the concerns of e-commerce managers. The war in Ukraine and the ensuing acceleration in inflation have affected 60% of e-commerce websites. Logically, 83% have had to increase their prices, but 53% have also decided to absorb part of the increase by reducing their margins.

E-commerce companies are, therefore, facing a liquidity crisis. With banks more cautious than ever, the most fragile e-commerce websites will likely face major risks. For some, survival will mean selling their businesses. This explains why 71% of e-retailer managers anticipate consolidation in the sector.

Faced with this unprecedented situation, 35% of French e-commerce managers do not anticipate a return to normality before 2024. However, the latest European inflation forecasts will likely dampen their hopes, as a return to 2% inflation is expected in 2025. Remember that this deadline is only being pushed back by the ECB.

2023: slowdown varies by sector

The first thing that strikes you is the potential heterogeneity depending on the sector. While product e-commerce is in decline, service e-commerce is still in the black. In the second trimester of 2023, services e-commerce is up by 14%. The beauty sector, to take just one example, is up 5%. At the same time, online apparel sales are faring badly. The fall is 4.3% for 2023, but the situation is worsening month by month. In the second trimester of 2023, the fall was even 8%.

Let’s take a closer look at the clothing sector. This sector is, of course, in crisis. Announcements of bankruptcies of iconic clothing brands punctuated the year 2023. The fact that these brands still need to make the digital shift and have accumulated problems is undoubtedly one reason. But if we look at the territorial footprint of apparel brands, some are doing very well and can even continue growing. These are the brands with an international presence. Their sales continued to rise (+3.1%), while national brands saw their sales contract (-2.4%).

In the final analysis, this is hardly surprising. In times of acute crisis, when consumer morale is low, some sectors suffer more than others. Clothing is one such sector, as are certain foodstuffs such as butchers. During the 1929 crisis, research on large populations showed that clothing and meat were the two everyday consumer goods people quickly gave up.

What solutions for your e-commerce?

Responding to 2 key consumer expectations

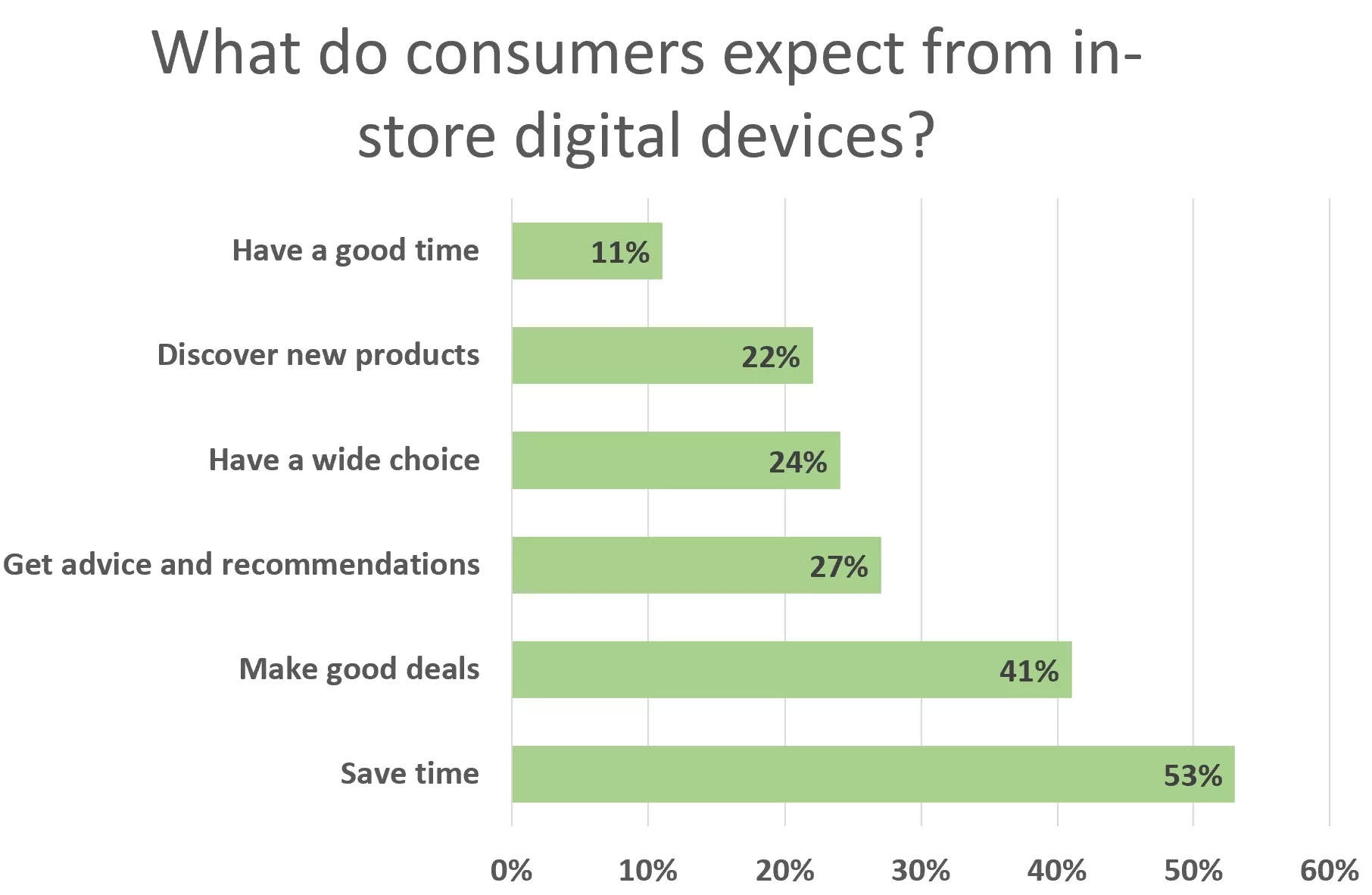

As we discussed in two previous analyses (here and there), consumers have very specific expectations of in-store digital: saving time (53%) and getting a good deal (41%). The same applies to e-commerce. Therefore, all efforts must be directed towards a customer experience that is as efficient as possible and delivers financial advantages.

Converge offline and online

Following on from the previous proposition, there are certainly synergies to be sought between online and offline commerce. Let’s take the example of a food retailer. Over January-April 2023, it fell by 4.9%, while the decline in traditional retail was less marked (-2.5% in supermarkets, for example). Nevertheless, the practice of buying food products online remains firmly entrenched. Over the last 12 months, for example, between 36% and 39% of French households have bought convenience goods online.

As a result, many retailers are playing on the hybridization strategy to support their e-commerce business. Offline teams are also entrusted with online-related tasks to satisfy customers and save them time.

Internationalisation

The final area of focus is, of course, internationalization. We have seen that international websites are more resilient to the crisis in the apparel sector. Generally speaking, all e-commerce websites need to be international. Translating your website is an essential step, made easier and less costly by generative AI. Our research has shown just how beneficial translations can be for SEO.

Posted in Research.