The Halloween market has become essential for retailers. Our firm analyzes this market and provides you with the latest statistics.

The Halloween market has become a major event in the retail sector. This holiday, once marginal in our regions, has become essential for confectionery professionals. Retailers can no longer overlook October 31st either. Drawing on our expertise in market research, we’ve compiled statistics from the past 10 years to provide fresh insights into the evolution of the Halloween market.

Contact IntoTheMinds for your retail studies

Halloween Market: Key Facts

- Halloween revenue has more than doubled in ten years

- During the 2020 health crisis, Halloween candy sales dropped by over 10% in value and nearly 13% in volume

- The holiday now accounts for 14% of annual confectionery sales

- More than one in two households participates in Halloween-related purchases

- The event extends well beyond confectionery to the entire food sector

- Sales concentration over just a few days makes it a major commercial event

- €154M: Confectionery revenue for Halloween in France in 2024

- 62 million units: Candy units sold for Halloween in France in 2024

- 16,720 tons: Volume of candy sold for Halloween in France in 2024

- 13.7%: Share of annual confectionery volumes concentrated on Halloween in 2024

- 49%: Percentage of households buying candy for Halloween

- 1.7: Average candy purchase frequency per household for Halloween

- 55%: Percentage of French people who say they celebrate Halloween

- 76%: Halloween celebration rate among 18-24 year olds

- 63%: Percentage of families buying candy for Halloween

Halloween: A Structuring Commercial Event

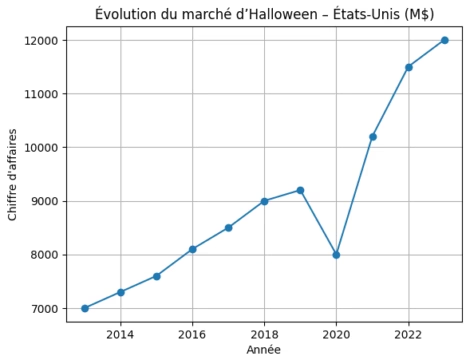

Over about ten years, the October 31st holiday has established itself as one of the most structuring commercial events in Western consumer economies. Originally rooted in Anglo-Saxon countries, this celebration gradually spread to other markets, including continental Europe, where it found particular resonance in a context of seeking accessible festive moments.

The figures observed in France (see infographic above), far from being isolated, illustrate a broader dynamic at work in developed markets. This evolution is characterized by increased purchase concentration, rising value, and consumption expansion well beyond traditional confectionery.

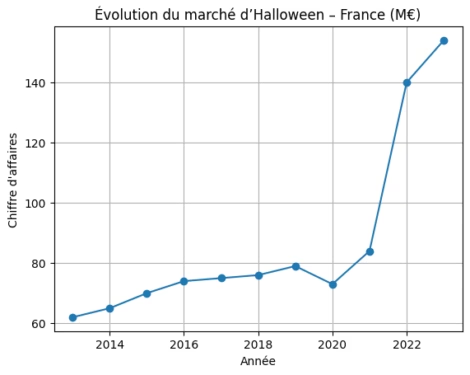

In the early 2010s, Halloween remained a secondary event in many non-Anglo-Saxon markets. In 2013, confectionery sales during this period reached about €62M in the French market, representing just over 12% of annual sector sales. This weight was then comparable to that observed in other European markets at intermediate maturity, where the holiday was beginning to structure promotional calendars without yet rivaling Christmas or Easter.

Halloween week ranks among the top ten weeks of the year for grocery retail.

Sustained Growth Despite Turbulence

Between 2013 and 2016, growth was clear: revenue increased from €62M to nearly €74M, a rise of nearly 20%, while volumes grew by over 12%. This phase corresponded to a first stage of cultural and commercial diffusion, driven by retailers, in-store theatrics, and the rise of sharing formats.

From 2017 onward, Halloween crossed a symbolic threshold. In France for example, confectionery sales reached about €84M, nearly 12% of the category’s annual revenue. This sales concentration over a short period became a key characteristic of the phenomenon. Sales indices then exceeded 170 compared to an annual base of 100, a level bringing Halloween closer to other major seasonal peaks observed in Anglo-Saxon markets.

This intensity is no longer solely child-focused:

- over 75% of young people wear costumes

- nearly 70% of households decorate their homes

- nearly 50% of consumers actively participate in holiday rituals

The adoption of Halloween as a cultural phenomenon is therefore quite broad.

2018 confirmed this trajectory. For example in France, Halloween generated over €85M in revenue during the four weeks preceding October 31st and represented over 12% of annual confectionery sales. Yet the confectionery sector context wasn’t positive as consumption was generally declining. This ability to compensate for structural market decline through event peaks is a trend observable in many Western countries, where so-called “pleasure” categories increasingly rely on ritualized consumption moments.

Expansion Toward a Global Food Market

By 2019, Halloween extended far beyond confectionery and established itself as a global food event. Halloween week ranked among the top ten weeks of the year for grocery retail, with about €1.3 billion in sales in the French market. This level placed Halloween on par with some major religious or sporting event weeks.

French households for example spent an average of €56 on their grocery purchases during this week, while confectionery alone accounted for about €110M during the two weeks surrounding the event. This expansion to the entire shopping basket reflects a dynamic comparable to that observed in other markets, where Halloween has become an excuse for additional purchases rather than just a candy holiday.

October 31st alone concentrates up to 15% of fortnight sales, illustrating last-minute purchasing behavior highly dependent on the event’s proximity. This characteristic reinforces the importance of logistical and commercial preparation for retailers.

Halloween week ranks among the top ten weeks of the year for grocery retail.

Resilience Through Crises and Post-Pandemic Acceleration

The 2020 health crisis caused a sudden but temporary halt. Halloween confectionery sales dropped by over 10% in value and nearly 13% in volume. Yet even in this context, Halloween still represented about 12% of annual confectionery revenue, and October sales remained over 60% higher than an average month. This resilience confirms the now structural nature of the event, capable of absorbing an exogenous shock without disappearing.

By 2021, the rebound was spectacular. Sales exceeded €80M again, with 11% growth compared to 2019. Over 3 million additional buyer households were recruited and nearly half of consumers who suspended purchases in 2020 returned to the market. Halloween now represents about 15% of annual confectionery revenue, compared to just over 12% ten years earlier.

This rise in value, faster than volume growth, reflects a broader trend toward premiumization and multiplication of specific formats in mature markets.

Toward Stabilization at High Levels

In 2022, a new threshold was crossed with about €112M in Halloween confectionery sales, a 19% year-on-year increase and 26% compared to 2019. The period now concentrates 14% of the sector’s annual revenue. October 31st alone accounts for about 11% of period sales, while Halloween week represents nearly one-third of total revenue.

This degree of concentration brings Halloween closer to major global commercial events, where significant value is generated in just a few days. Recent years confirm this transformation. In 2023 and 2024, Halloween revenue stabilized around €150M, while volumes continued to grow slightly, exceeding 16,000 tons.

Halloween’s share of annual volumes reached nearly 14%, compared to about 11% ten years earlier. Nearly one in two households now buys candy for Halloween, with an average purchase frequency approaching two acts and spending around €7 per household, levels comparable to historically more mature markets.

Youth: Driving Force of the Halloween Market

Beyond the numbers, consumer profiles are evolving. 18-24 year olds show participation rates above 75%, families with young children remain at the heart of the celebration, but childless adults and seniors are increasingly contributing to spending. Halloween has thus become a transgenerational event centered on pleasure, conviviality and experience, well beyond its initial childish roots.

This sociological evolution accompanies a diversification of distribution channels and product formats. Specialty stores, local retailers and even e-commerce platforms capitalize on this period to develop specific offerings.

Outlook and Strategic Challenges

In ten years, Halloween has gone from an imported event to a pillar of the commercial calendar in many Western markets. In France, revenue grew from €62M in 2013 to over €150M in the mid-2020s. The holiday has thus more than doubled its impact.

While volume growth now tends to level off, rising value, purchase concentration and category expansion confirm that Halloween has durably established itself as a strategic lever for all retailers and brands, well beyond its original borders.

For food industry and retail companies, Halloween now represents an essential event requiring specific preparation and adapted marketing approaches. The challenge lies in capitalizing on this momentum while anticipating future market and consumer expectation evolutions.

Frequently Asked Questions About the Halloween Market

What is Halloween’s real share in the French economy?

Halloween now represents about €150M in annual revenue, mainly concentrated in confectionery but extending to the entire food sector. The holiday generates nearly 14% of annual confectionery sales and ranks among the top ten weeks of the year for grocery retail, with €1.3 billion in sales during the relevant week.

How to explain Halloween’s commercial success?

Halloween’s success stems from several converging factors: consumers’ search for new festive moments, retailers’ effective marketing strategies, gradual adoption by all generations, and the holiday’s ability to generate impulse purchases concentrated over a short period. In-store theatrics and sharing formats have also contributed to its development.

Which consumer profiles are most active?

18-24 year olds show the highest participation rates (over 75%), but Halloween now reaches all generations. Families with young children remain at the core of consumption, while childless adults and even seniors are increasingly participating in purchases. Nearly one in two households buys candy for Halloween, with average spending of €7 per household.

Can Halloween still grow or has it reached maturity?

The market seems to have reached some volume maturity. In France, we observe stabilization around 16,000 tons and €150 million in revenue. However, value continues to rise through product premiumization and expansion into other food categories. The future challenge lies in maintaining the holiday’s attractiveness and its capacity to renew itself.

What impact did the health crisis have on this market?

The 2020 crisis caused a temporary drop of over 10% in value and 13% in volume, but the rebound was spectacular by 2021 with 11% growth compared to 2019. This resilience confirms Halloween’s structural anchoring in consumption habits, capable of withstanding major external shocks.

![Illustration of our post "Digitization: food & beverage industry companies lag far behind [Research]"](/blog/app/uploads/marche-alimentation-bio-long-120x90.jpg)

![Illustration of our post "Generation Z and work: employers’ perceptions [Research]"](/blog/app/uploads/generation_y_youngsters-120x90.jpg)