The partnership between the Parisian department store BHV and Shein was the worst commercial fiasco of 2025 in France. This textbook case could well be repeated elsewhere in Europe, so I will return to it in detail to analyse its causes and effects.

The installation of Shein at BHV constitutes one of the most controversial commercial events of 2025 in France. This alliance between the Chinese fast fashion giant and the iconic Parisian department store triggered a real media and social storm. This fiasco calls for a comprehensive analysis that I propose in this article after my visit to BHV on Christmas Eve. I adopt in this analysis a very factual point of view based on available quantified data and the experience of our consumer behaviour research institute. At the end of this article, I explain the 2 major mistakes made by BHV (the first related to brand image, the second to customer satisfaction) and explain why I think BHV has self-destructed.

Contact IntoTheMinds for your retail studies

Key takeaways

- The Shein corner at BHV attracted between 8,000 and 12,000 daily visitors in the first days but attendance figures quickly fell

- 2%: share of the total BHV surface area occupied by Shein.

- a few dozen: the number of daily purchases made in the Shein corner at BHV in December

- 28% of Shein customers made cross-purchases in other BHV departments

- 70% of French people consider this partnership a strategic mistake for BHV

- 90%: proportion of French people who have heard about the Shein–BHV affair

- 58%: share of French people who have a negative perception of the Shein – BHV operation

From acquisition to transformation: chronology of a controversial mutation

The saga begins well before Shein’s arrival. On 16 February 2023, Galeries Lafayette announced the sale of BHV Marais to SGM (Société des Grands Magasins), led by Frédéric Merlin. At that time, BHV displayed impressive figures:

- €300 million in revenue in 2022

- 13 million annual visitors

- 1,300 employees

Even though the store was loss-making (estimated annual loss between €15 and €20m), it is a jewel that only needs to be revitalised to return to profitability.

Frédéric Merlin, the new owner, immediately displayed his ambitions: “return BHV to Parisians”. This local refocusing strategy is based on a finding: 15% of visitors are foreign, a proportion deemed excessive. The objective? Prioritise “driver” departments like DIY and home, rather than following the trend towards ultra-luxury.

The acquisition was finalised on 10 November 2023, after validation by the Competition Authority. But the challenges are immense. The recovery phase quickly reveals its limits. In September 2024, Frédéric Merlin mentioned a “structural shock” linked to the partial pedestrianisation of rue de Rivoli, leading to a 20% drop in attendance. Staff numbers fell from 1,300 employees to around 1,000 by the end of 2024.

Paradoxically, this 25% reduction in payroll allowed the group to return to financial health. From a loss of €11m on 31 July 2023, BHV would show a profit of €150,000 one year later. This improvement is explained by €55m in savings on personnel costs and €5m in savings on general expenses.

The bosses of BHV and Shein are displayed, all smiles, on a giant poster on the BHV front. The honeymoon will only last a few days, the time for suppliers and financial backers to jump ship.

The announcement that changes everything: the partnership with Shein

1 October 2025 marks a decisive turning point. SGM and Shein officially announce their exclusive partnership, planning the opening of a 1,200 m² corner on the 6th floor of BHV Paris and deployment in 7 provincial stores. The stated objective: create 200 direct and indirect jobs in France.

The reaction is immediate. From 2 October 2025, several brands announce their intention to leave BHV. Positions multiply, highlighting the systemic issue: commerce represents 3.6 million jobs in France and more than 25 million in Europe.

The Caisse des dépôts, engaged in negotiations to buy the BHV walls, distances itself. It specifies that it was not informed of the project and declares itself unfavourable. This position considerably complicates SGM’s real estate strategy, the operation being valued at €300 million.

On 10 October 2025, the protest hits the streets. Employees and Parisian elected officials demonstrate their opposition. Unions advance alarming figures: nearly 300 unfilled positions in two years, with staff falling from 1,076 at the end of 2023 to “barely 750” in autumn 2025.

On the supplier side, the situation also deteriorates. Unpaid bills are estimated at nearly €4 million, with several dozen brands awaiting payment. This cash flow crisis reveals the department store’s structural difficulties.

Institutional isolation intensifies on 13 October 2025. SGM is unanimously excluded from the Union du Commerce de Centre-Ville (UCV), automatically leading to its exclusion from the Alliance du Commerce. This symbolic sanction illustrates the professional sector’s rejection.

On 23 October 2025, the image crisis reaches its peak. Disneyland Paris renounces sponsoring BHV’s Christmas animations, forcing management to postpone the opening of festivities from 4 to 18 November 2025. This two-week shift occurs at a critical time, with the end of year traditionally concentrating a significant part of department stores’ activity.

The opening of the Shein space at BHV in Paris attracted crowds. Nearly 50,000 people rushed to the 6th floor, which made the BHV boss cry victory in the first days.

The long-awaited opening and its first results

On 5 November 2025 at 1pm, the Shein corner finally opens its doors on the 6th floor of BHV. The 1,200 m² space has 11 fitting rooms and offers a mainly textile assortment. From opening, queues form, with customers present from 9am.

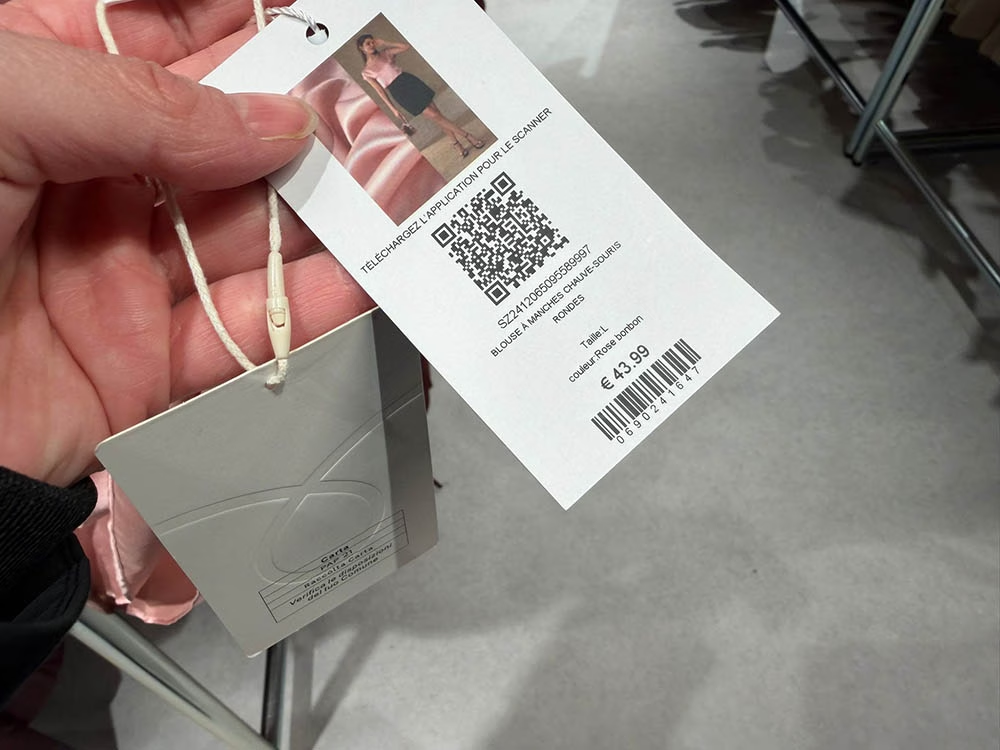

The pricing strategy reveals an upscale compared to the online offer: jeans at €40, sweaters at €32, coats up to €98. These prices contrast with Shein’s usual positioning (sweaters around €15, trousers at €13 online). There is therefore a real shock between customer expectations and reality. This shock is called in English “disconfirmation” and is at the root of customer dissatisfaction.

To stimulate cross-sales, an aggressive promotional mechanism is put in place: each purchase in the Shein corner entitles to an equivalent voucher usable in the rest of BHV.

The first results exceed expectations in terms of attendance. According to Frédéric Merlin, the corner attracts between 8,000 and 12,000 daily visitors. In one month, more than 50,000 customers would have discovered the Shein space at BHV. This last figure, coming from Frédéric Merlin himself, clearly shows that after the crowd of the first days attendance quickly levelled off. Moreover, nothing is communicated on the percentage of buyers compared to visitors.

The average basket in the corner is between €37 and €45 depending on statements and periods, higher than the average online basket in France (less than €30). This performance is explained by the “physical store” effect and the selection of more upscale products.

The most structuring data for the store’s economy concerns the “cross-buy” rate: 28% of Shein customers make purchases in other BHV departments. This halo effect allows Frédéric Merlin to affirm that Shein brings additional customers, regular BHV customers buying little at Shein.

According to management, the Shein corner generates as much revenue as the entire women’s fashion of the store. This remarkable performance is explained by traffic concentration and the effectiveness of the promotional mechanism.

Behind these flattering figures, a very temporary reality is actually hidden that will lead BHV into the rut.

On Christmas Eve, the 6th floor of BHV (Shein’s) was deserted by customers. After the enthusiasm of the first days, customers massively turned away from the store.

The collateral costs: when commercial success hides a deeper crisis

Despite these performances, the “collateral costs” materialise quickly. From 6 November 2025, several brands effectively leave BHV. The example of Skin & Out perfectly illustrates these arbitrages: the brand buys back its stock for €1,500, sacrificing a distribution that generated €40,000 in annual revenue.

This break represents 4% of Skin & Out’s “department stores” activity (nearly €1 million). The virality of the operation (nearly 2 million views on an account of 60,000 followers) shows that the crisis also works as a visibility machine for those who “break” publicly.

The political dimension intensifies. On 8 October 2025, Banque des Territoires ends negotiations with SGM on the purchase of the walls. This break directly complicates the real estate strategy, the operation being valued at €300 million with an envisaged structure of €140 million contribution and €160 million loan.

On 26 November 2025, Frédéric Merlin is heard at the National Assembly for nearly two hours. He defends his choice by reinscribing Shein in a “more popular” strategy and recalls the quantitative argument: Shein would respond to more than 25 million French customers.

On the traffic effect, he specifies that 80% of corner visitors would be intramuros Parisians who “did not visit or no longer visited” BHV. He relativises Shein’s place (2% of the building’s surface) while emphasising that 75% of BHV’s revenue is not made by fashion.

This photo taken on 22 December 2025 reveals the full extent of the Shein fiasco at BHV. Only one checkout remains open and the floor is populated only by “zombie” customers who come there without really knowing why. They moreover have a lot of courage to have reached the 6th floor because the lifts are broken and the escalators too. Let your imagination run wild about the hassle.

Public opinion: massive rejection despite contradictions

A survey reveals the extent of the affair’s notoriety: 9 out of 10 French people have heard about it, mainly via traditional media (87%) rather than social networks (26%).

The negative perception of the operation reaches 58%, with an asymmetric impact: 70% of French people consider it a strategic mistake for BHV, while for Shein, 52% estimate that it worsens its image but 32% see an opportunity for improvement.

The study sheds light on the economic engine of the debate: 60% of French people find it difficult to dress properly at low cost and 54% say they are torn between their values and their purchasing power. This tension partly explains Shein’s commercial success despite controversies. But it is also in this tension that we find the source of the fiasco. After the crowd of the first days, the departments are deserted. The reason is undoubtedly to be sought in the prices practised which are far from consumer expectations. The latter are used to paying ridiculously low prices for items bought online on Shein. They therefore expect a price positioning of the same order at BHV but this is not the case at all. The items are indeed sold much more expensive and the consumer does not feel like getting a good deal.

Added to this is the ethical aspect and the scandal that will earn Shein an inquiry commission and a bill proposal aimed at banning the platform.

One of the reasons for the Shein fiasco at BHV is to be sought in the prices practised, which had nothing to do with the prices practised online by Shein. Consumers had price expectations, forged by their knowledge of the online platform, and were necessarily disappointed to discover prices well above what they knew.

The parallel crisis of Shein online

An external variable complicates the interpretation of BHV corner performances: Shein’s specific online crisis at the same period following the sale of dolls.

This controversy has an influence on French purchasing behaviours: 53% consider reinforced control measures necessary. Among Shein buyers, 34% declare they would continue to buy “one way or another”, while 49% would postpone their purchases to other platforms. On 11 December 2025, an analysis based on bank transactions from a panel of one million people reveals a marked drop in Shein sales in France.

In November 2025, value sales fall 45% compared to October, while the fashion market grows 8% over the same period. The decoupling is very concentrated: on 6 November 2025, Shein’s revenues in France fall 38% on the day.

This simultaneity with the BHV opening (5 November) is not fortuitous. It coincides with the suspension of the Shein marketplace, which represents about 10% of the platform’s activity. Although apparently minor, this stop produces a strong shock, probably because it affects growth dynamics and third-party seller offer.

This simultaneity is central in the analysis: store traffic and basket success can coexist with an online revenue crisis, without mechanically attributing one to the other.

On Christmas Eve (photo taken on 23 December by my friend Ghalia Boustani whom I thank), the 6th floor was deserted.

BHV: what prospects for 2026?

We must distinguish in our analysis the operational measures that are independent of the Shein crisis, and the consequences of the failed marriage with the Chinese platform. I deal with these aspects below in 2 separate paragraphs.

The operational measures to take in 2026

On 12 December 2025, SGM announced a project to secure supplier relations via a “quasi-instant” payment solution. The objective is to become 100% autonomous “by the end of the year”, with the integration of 15 to 30 suppliers in January 2026, then the onboarding of almost all “by the end of March”. This statement therefore tends to shift the blame for late payments to Galeries Lafayette. It would be a €20m investment to deploy the new systems.

In parallel, the brand announces the arrival of a “hundred” new brands in 2026. They must replace those that left with a challenge of size: what to replace brands as prestigious as Guerlain or Dior with?

On 15 December 2025, Frédéric Merlin also unveiled the store plan for 2026:

- 1,000 m² food halls in the basement (planned opening June 2026)

- at least 500 m² parapharmacy on the ground floor

- an entire floor allocated to Shein

This last choice seems highly problematic to me because without corrective measure regarding the prices practised, this floor will not take off. Worse, I think it would contribute to further damaging BHV’s image.

Has BHV self-destructed?

The Shein affair at BHV will become a case study in marketing schools and among retail professionals. It illustrates that behind every cobranding hide challenges in terms of:

- image

- customer satisfaction

To put it differently, not all partnerships are good to tie. And the BHV – Shein affair unfortunately demonstrates this wonderfully.

Let’s start with the problem related to brand image. The image conveyed by Shein could only annoy other retailers. Frédéric Merlin could not not know it. He knew he would antagonise sectoral organisations. Worse, he should have anticipated that Shein’s brand image, perceived negatively by French brands, would negatively spill over onto his suppliers. By betting on an alliance with Shein, he could only lose. Even if the crowd had been there, major French brands could only dissociate themselves from the brand. He moreover half-admits in this letter that prestige brands left BHV for this reason.

Then there is the problem of customer satisfaction. I do not understand how such an elementary error was made. The mechanism of customer satisfaction formation is based on the unconscious comparison between customer expectations and reality. In the case of Shein at BHV, it is a disaster. Customers formed their expectations based on what they paid online or what they read about the derisory prices practised by Shein. When they arrive at BHV, the disappointment is enormous. Prices have nothing to do with those practised online. Dissatisfaction is maximum. If you allow me a touch of humour, I would say that Frédéric Merlin would only have needed to consult us to anticipate this problem.

In the end, I am very pessimistic for 2026. After Galeries Lafayette’s announcement not to sell the building to SGM, I anticipate a catastrophic scenario. I have a little idea of the “Anglo-Saxon” company with which Galeries Lafayette entered into exclusive negotiations. This real estate manager will not do things by halves once the sale is finalised. What I foresee is a play in 3 acts:

- Inventory and development of several scenarios to make the building profitable: This will inevitably lead to an upscale or rental to several high-end brands. BHV, especially in its configuration announced by Frédéric Merlin, will no longer have its place there.

- Architectural project: the company that will have bought the walls will necessarily have to go through a complex architectural project to make the best use of the available space. Compliance, modernisation and upscale will necessarily be planned.

- Works and end of lease for BHV: when a permit has been issued for the works, SGM’s lease will be terminated and BHV’s adventure will stop. Article 1722 of the Civil Code indeed allows the lessor to terminate the lease in case of works preventing the continuation of operations.

Knowing that BHV’s operating lease was signed in November 2023, the end of the lease is therefore in November 2032. But there is little chance that BHV’s adventure will last that long. Financial problems will necessarily accumulate, making the operation of the business increasingly difficult and weakening SGM. We can therefore bet that SGM would welcome with some relief the termination of its commercial lease for works because it would allow it to claim compensation. If SGM still has sufficient funds to hold on, I think this adventure should end in the next 3 years, i.e. by 2029. It will be the end of an entrepreneurial epic that will have lasted more than 70 years (BHV was created in 1957).

Frequently asked questions about the Shein affair at BHV

Why did Shein choose BHV for its first physical store?

BHV’s choice is explained by several strategic factors. First, the exceptional location in the heart of Paris, near the Hôtel de Ville, guarantees maximum visibility. Then, Frédéric Merlin, BHV’s boss, was looking for a partner capable of attracting new customers to turn around a financially struggling store. Finally, Shein wanted to test the physical store concept in a controlled environment before considering wider expansion.

Are the announced attendance figures reliable?

The figures of 8,000 to 12,000 daily visitors come directly from BHV and SGM management. Although impressive, they seem consistent with the observed enthusiasm from opening and regular queues. However, visitors and buyers must be distinguished: the conversion rate remains “below its potential” according to management itself. These figures reflect more curiosity than commercial adhesion. Moreover, Frédéric Merlin himself spoke of attendance of 50,000 people in the first month, which demonstrates that the figures of 8,000 to 12,000 were only valid for the first days. Our visit on 22 December 2025 shows that daily buyers were counted in dozens at most.

What becomes of the provincial opening projects?

This is the black spot in the file. The planned openings in Dijon, Reims, Grenoble, Angers and Limoges are postponed sine die. Management no longer communicates a precise calendar, which suggests difficulties in replicating the Parisian model. Controversies, financing problems and institutional isolation probably complicate these expansion projects.

What are the real financial stakes for BHV?

The stakes are considerable. BHV was losing €15 million a year before the takeover by SGM. The Shein corner generated in a very temporary way as much revenue as the entire women’s fashion of the store, with a halo effect on 28% of customers. But collateral costs are heavy: brand departures, unpaid bills estimated at €4 million, real estate financing difficulties. As our analysis shows, Frédéric Merlin’s bet, SGM’s boss, is failed and will undoubtedly lead to a worsening of BHV’s financial health.

What will become of BHV in 2026?

It is likely that this commercial fiasco will worsen BHV’s financial situation and permanently damage its image. The departure of the most important brands will decrease the department store’s attractiveness and Galeries Lafayette’s announcement not to sell the building to SGM augurs a dark future. We think the new owner will be keen to revalue the whole which will undoubtedly lead to doing without BHV in its current form.

![Illustration of our post "Pay the true price for your coffee at Albert Heijn [Nudge Marketing]"](/blog/app/uploads/true-price-albert-heijn-4-120x90.webp)