In this article, I analyze and explain why the prototype of the Birkin bag created by Hermès in 1985 sold for €8.6m at Sotheby’s in July 2025.

A Japanese bidder paid €8.6 million in July 2025 to acquire the first Hermès Birkin bag. The result, achieved at Sotheby’s, made headlines in the trade press. It also sparked outrage among those who find it absurd to pay so much money for a well-worn handbag. In this article, I explore the controversy and take a broader look at why this Hermès Birkin bag reached such heights.

If you only have 30 seconds

- The prototype Birkin bag, gifted to the actress by Hermès, sold for €8.6m at Sotheby’s

- This astronomical price for a used handbag is explained by:

- Powerful storytelling surrounding an already iconic model

- A unique item with cultural and emotional value

- The search by the ultra-wealthy for new investment instruments

A story that begins on a plane

The story is well known but worth repeating. It’s 1984, on a Paris-London flight. Jane Birkin, then an actress and singer, is traveling with an overflowing basket. Next to her is Jean-Louis Dumas, CEO of Hermès. She tells him she needs a bag that is both elegant and practical. Dumas sketches a design, and a few months later, the first Birkin bag is born. This one-of-a-kind prototype was delivered in 1985 to Jane Birkin herself. Her initials, J. B., are engraved on the clasp.

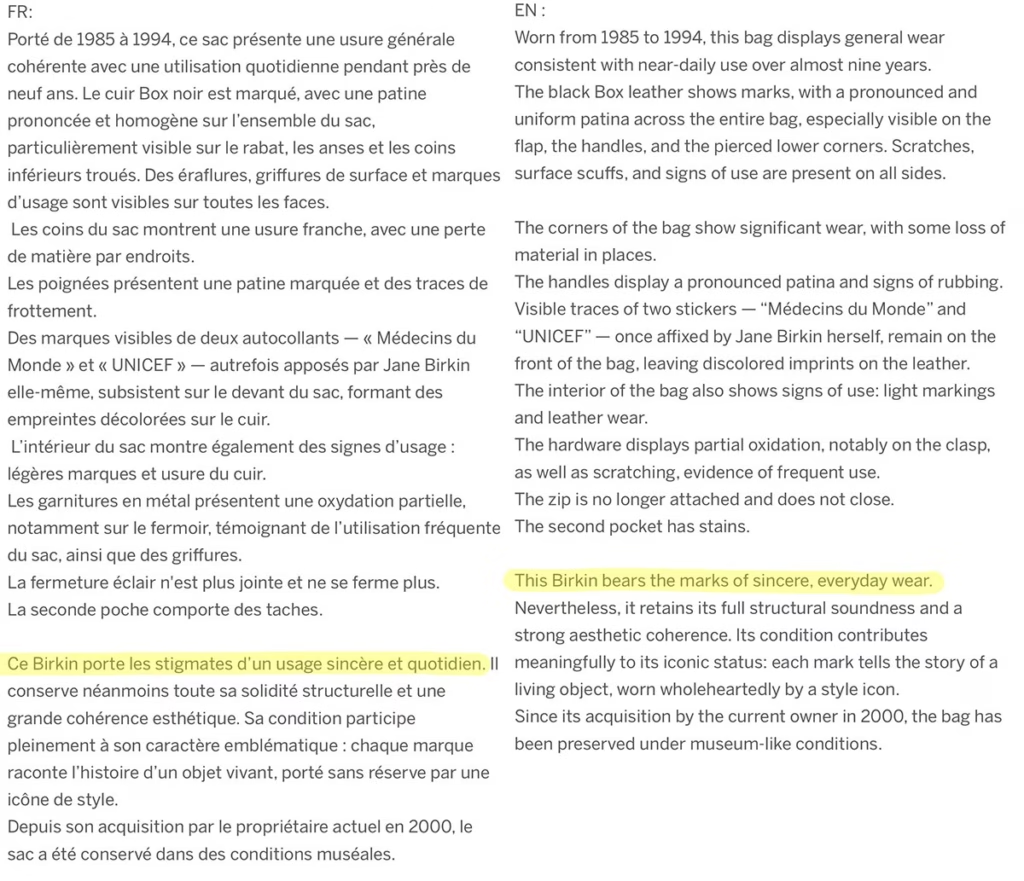

This is no ordinary Birkin bag. It’s the prototype of a model that has become a true “status symbol”. Most importantly, it carries traces of Jane Birkin’s life: activist stickers (Médecins du Monde, UNICEF), a nail clipper at the bottom of the bag, signs of wear. The bag has been well used, and Sotheby’s makes no secret of that. Here is the description provided:

The “stigmata” of a sacred object

During the Sotheby’s auction, this everyday wear and tear was not hidden — it was emphasized and even valorized. The catalog describes the bag as “bearing the stigmata of sincere, daily use.” This word, “stigmata,” is far from trivial and deserves closer examination.

A stigmata is a sacred wound. It implies an association with pain (Jesus on the cross) and holiness (Saint Francis receiving the stigmata).

Using this term to describe a handbag elevates it to the level of a sacred object. This bag is the prototype, the first in a legendary line. In this way, Jane Birkin’s Hermès bag becomes a secular relic, a cultural artifact of historical importance.

Of course, none of this would be possible if the Hermès Birkin hadn’t already become such a success. That leads us to explore the reasons behind this soaring popularity.

In fact, this auction is not unique. Other objects have fetched astronomical prices simply because they were the ancestors of iconic lines. The most striking example that comes to mind is Paul Newman’s Rolex Daytona watch (see video below), which sold for $17,752,500 in 2017.

When an object is inextricably linked to the person who gave it its aura, there are no limits.

When luxury meets investment

This record-breaking sale is no accident. It’s the result of a perfect storm for Hermès. On one hand, the Birkin bag is a successful model for which demand far exceeds supply. On the other hand, the diversification of investment strategies has made this bag “bankable,” meaning it has high potential for return on investment.

Let’s take a closer look at both aspects.

Demand far exceeds supply

The Birkin bag has been a best seller for Hermès for many years. Supply is limited, and high demand creates long waiting lists (or perhaps it’s the other way around). This scarcity enhances Hermès’ pricing power. Hermès is arguably THE luxury house most capable of raising its prices without dampening demand.

The Birkin bag as an investment instrument

Demand for Birkin bags now extends beyond stylish women. A major trend that began at the dawn of COVID is the search for new investment vehicles.

During COVID, we saw a surge in collectors’ interest in items such as sneakers, sports-related objects, watches, vintage cars, and more. The ultra-wealthy, more numerous than ever, are looking to diversify their investments, but also to buy stories. Authenticity, rarity, and signs of a lived experience are now assets — not flaws.

The ultra-wealthy are looking to diversify their investments — and to buy stories.

A lesson in cultural marketing

This Birkin bag isn’t just the most expensive ever sold. It proves that luxury is no longer just about materials or design, but about storytelling, memory, and transcendence. Jane Birkin wore it and wore it out. But it’s precisely these stigmata — both physical and symbolic — that now give it value. The buyer didn’t acquire a handbag: they acquired the original fetish of a cultural empire.

![Illustration of our post "Pay the true price for your coffee at Albert Heijn [Nudge Marketing]"](/blog/app/uploads/true-price-albert-heijn-4-120x90.webp)