It is no secret that Europe’s population rapidly aging which has been challenging the pension system for the last decades and lead to massive transformations of European systems in the 1990s. Nowadays, the sustainability of the systems is highly debated, and, without doubt, a pressing concern. The recent strikes in France have reignited the debate around the fairness, effectiveness, and security of the pension systems.

The most compelling statistics:

- 3/4 Europeans do not regularly consult their pension administration, with 26% who have never discussed their pension

- 51% of Europeans are willing to retire earlier with reduced pension benefits.

- 72% of women and 67% of men in Europe doubt that their pension will cover their basic needs in retirement.

- High-income individuals are twice as likely to know their retirement age and three times more likely to know their retirement income compared to low-income earners.

- 48% of Europeans are unsure about their retirement entrance age.

- 2/3 of Europeans are uncertain about their future pension payments, with one in five expressing strong uncertainty.

- 47% of Europeans believe that certain professions should retire earlier, with physically demanding jobs considered more deserving

Pension anxiety in Europe

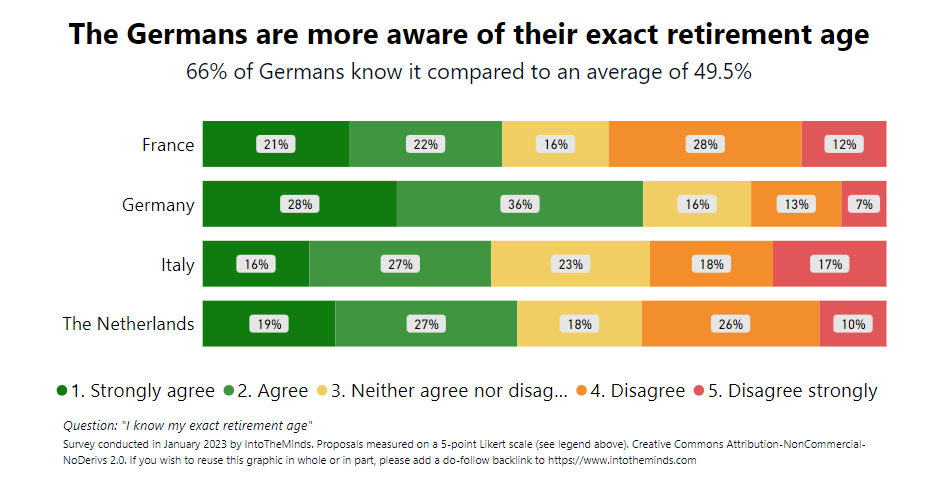

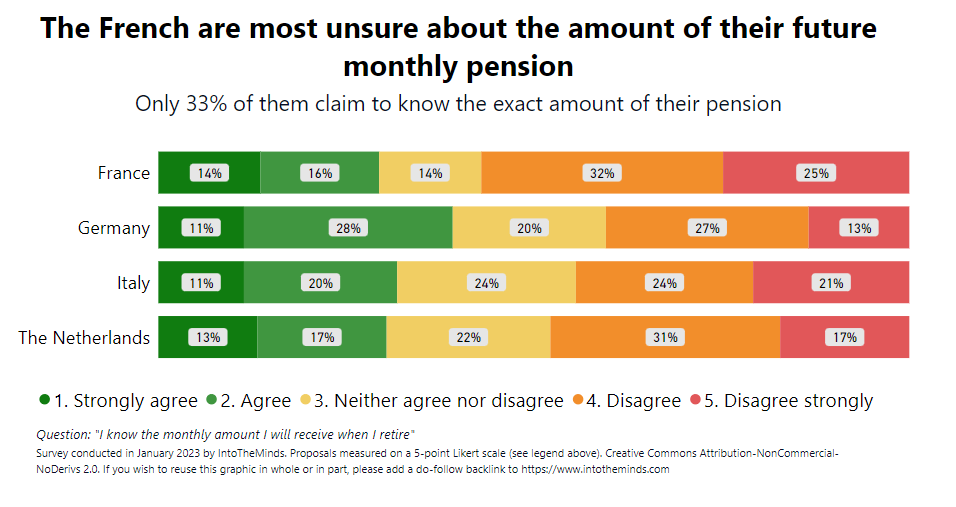

Astonishingly, approximately two-thirds of Europeans are unaware of the specific amount they can expect to receive in monthly pension payments, with one in five individuals expressing a strong sense of uncertainty. Additionally, almost half of people also do not know their exact retirement age which underlines the currently observable pension anxiety in the Europe. Interestingly, the Germans are most confident in knowing their retirement age (see figure 1) and pension payments (see figure 2), while French people are most unsure about these two factors.

Figure 1

Figure 2

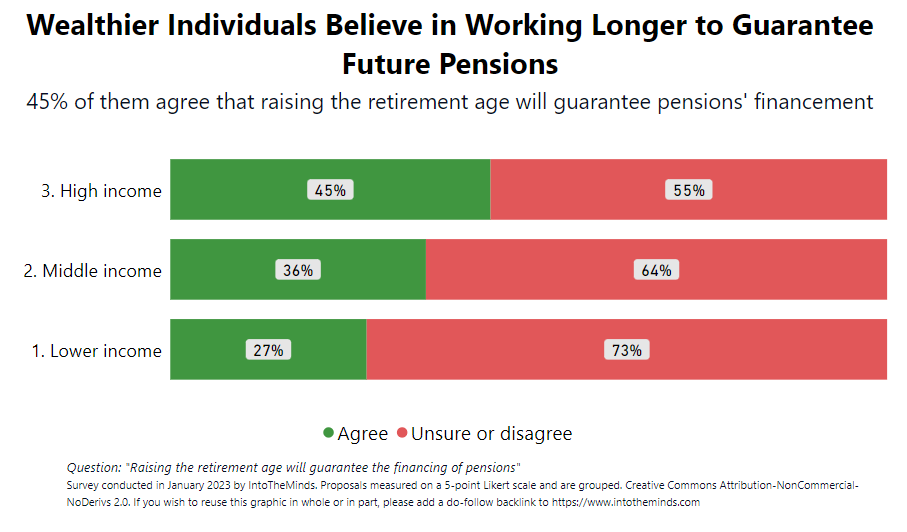

Not surprisingly, high-income individuals are almost twice as likely to know their exact retirement age and three times more likely to know their retirement income than low-income earners. While only 27% of low-income workers believe in working longer to guarantee future pension, 36% of middle-income and 45% of high-income earners believe that this is the solution for ensuring future pensions (see figure 3). These differences concerning income are hardly surprising: More precarious groups have higher demand on today’s income and less planning security for future income and savings. They are also less likely to have saving plans, while wealthier individuals have access to a broader range of investment options, allowing for additional wealth accumulation beyond traditional pensions. Therefore, we observe pension anxiety mostly among the low-income earner group.

Figure 3

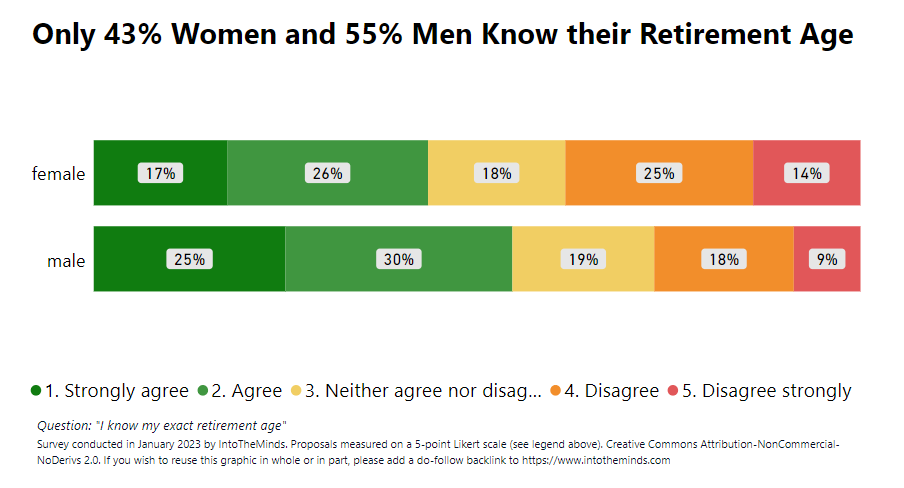

We also observe vast gender differences: With 43 %, Women are 12 percentage points less sure about the retirement age, as well as 8 percentage points (29 % in total) more uncertain about their monthly future pension (figure 4). Our study also finds that 72% of women do not believe that their pension will meet their basic needs once they retire. Note, that the percentage for men at 67% is also shockingly high. These findings complement what the academic literature finds about the reason: Women tend to provide more unpaid care work, work less in a formal setting, work much more part-time throughout their lives (as explained here) which are factors that add to an uncertainty felt more by the women.

Figure 4

Would Europeans like to retire earlier if given the chance?

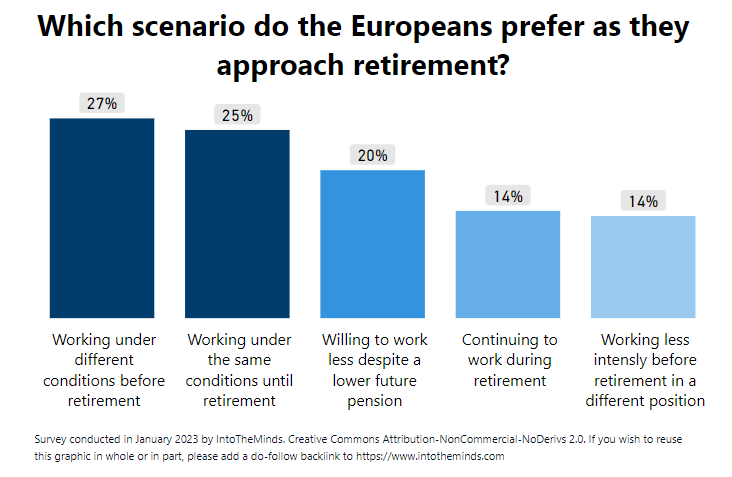

The people are divided with 51 % willing to retire earlier with a reduced pension. We further asked about specific scenarios, as seen in figure 5. The most unpopular scenario is to work less intensely before retirement in a different position, yet most people would prefer different working conditions before retirement. Women are slightly more in favour of working under different conditions than men which might be because women’s career patterns are not as straight forward than those of man, as explained above. Therefore, it is not surprising that women are more likely to state to prefer working in different conditions before retirement.

Figure 5

How do people prepare for retirement?

Three out of four Europeans do not regularly consult their file with the pension administration and 26% have never discussed their pension with the administration which might explain the “pension anxiety” of not knowing when to retire and with how much. We also wanted to know what Europeans think about stocks as a method to save for retirement. 55 % agree and 45 % disagree that stocks are the best way to save up. This is not surprising because, although stocks have been proven to be the most lucrative method long-term with mitigating effects of inflation, there are major downsides, such as the risk of big short-term losses in comparison to the saver option of bonds.

Do Europeans sympathise with the strikes in France?

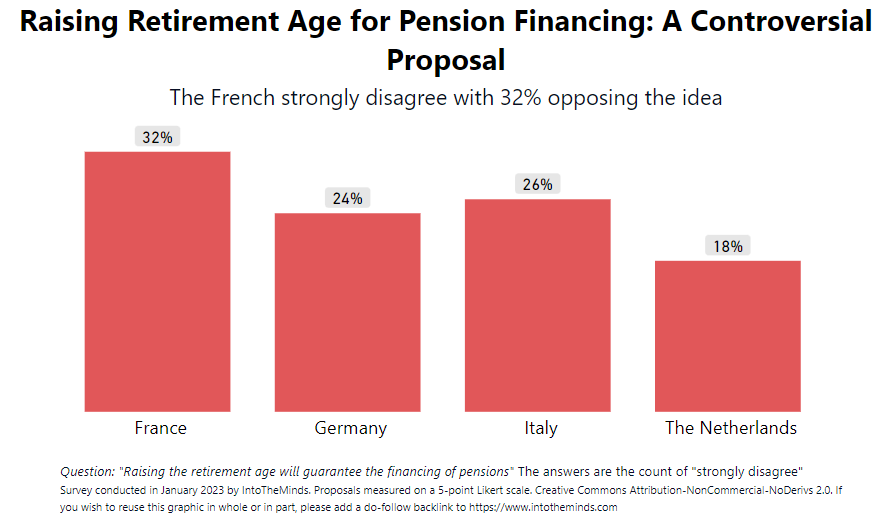

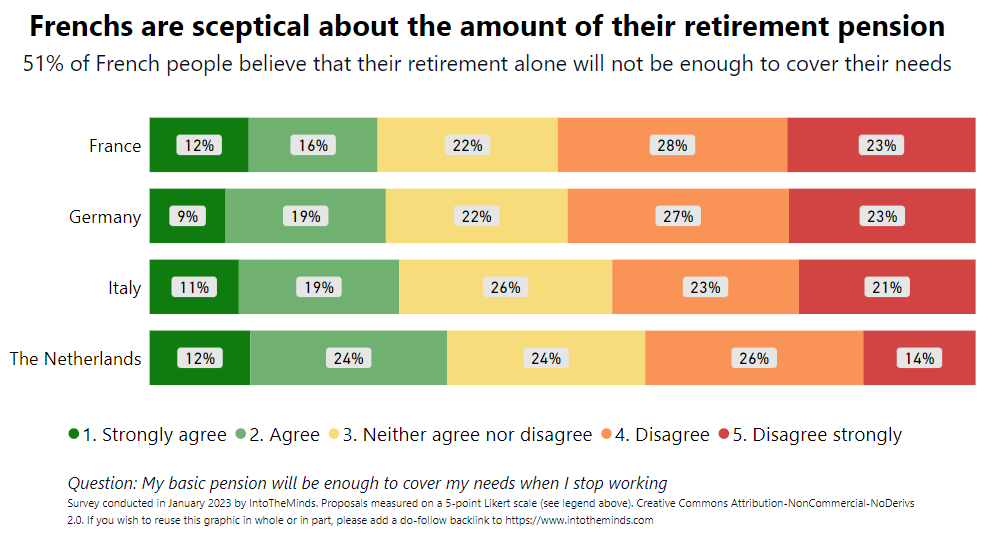

There have been nationwide protests in France against the law change to increase the retirement age from 62 to 64. With 32 % of French people thinking that raising the retirement age will not be the right method to guarantee the financing of pension (figure 6), only 18 % of Dutch people would oppose that statement. That displays the different attitudes about the reform and the reason to why the French are protesting so massively. This analysis goes hand-in-hand with the fact that only 14 % of Dutch people, yet a staggering 23 % of French people think that their basic pension will not be enough to cover their needs when they stop working (figure 7).

Figure 6

Figure 7

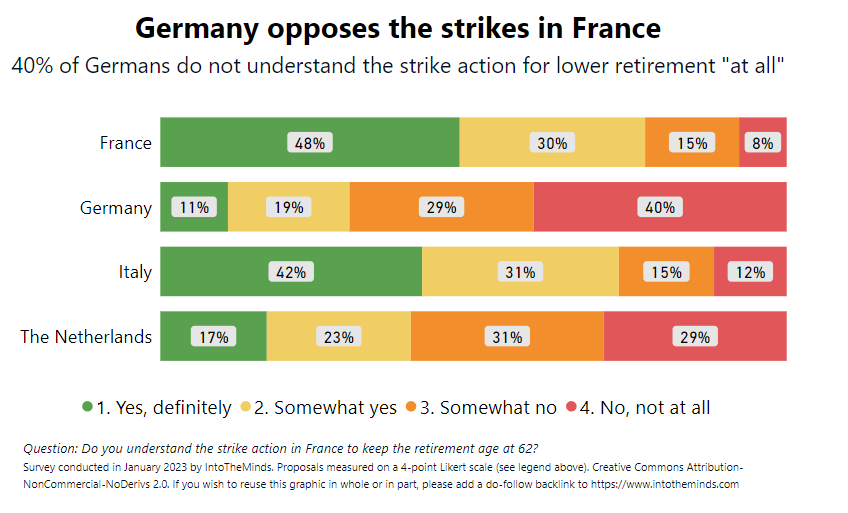

In fact, more than half of Europeans think that even the age 62 is too high to retire and only 34 % thinking it is appropriate. This is an interesting finding as the current retirement of the countries interviewed is between 64 and 67, so 62 is not even close. This is consistent with the findings that 55 % sympathize with the strikes in France. However, there are stark country differences: The French and Italians largely agree with the strikes (78 and 73 % respectively), while the Germans and the Dutch strongly oppose the strikes with 69 and 60 % against them (figure 8). That reflects the different national attitudes towards strikes. Our findings are in line with other studies on the “strike willingness” and we see that, in fact, Germany and the Netherlands are at the bottom of the list with only 18 (22 for the Netherlands) strike-related absences per year per 1000 employees. France leads the list with 5 times more days (92 in detail) than Germany. The principal argument presented by the French government to increase the retirement age is to ensure the financing of pensions. Interestingly, almost 2 out of 3 Europeans would say that this is not an expedient solution.

Figure 8

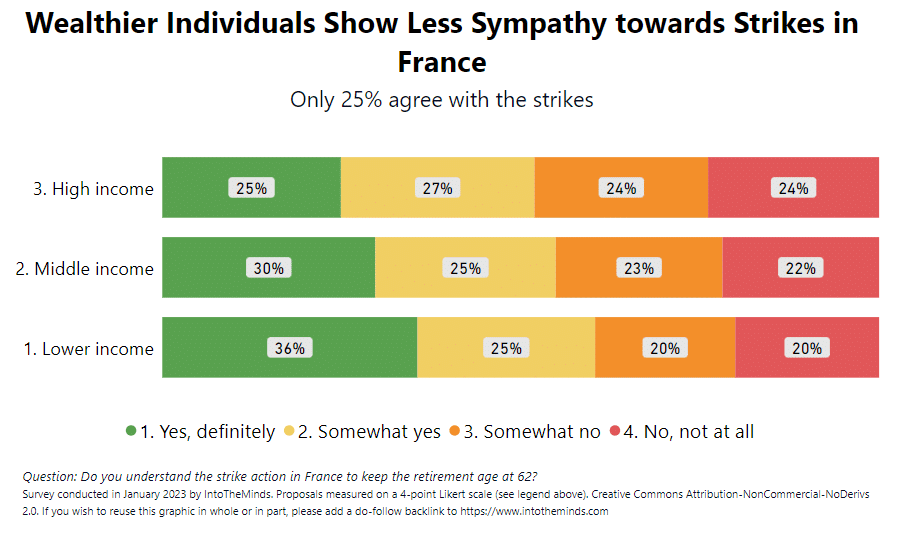

We also investigated whether rich people are equally as likely to support the strikes as those in low-income groups. We do find that there are difference, mainly that the wealthier individuals show less sympathy towards the strikes in France. Only one in four strongly agrees with the strikes, while one is four people completely disagrees. If we look at the attitudes of in the lower-income group, it becomes clear that they stand much more behind the strikes: 36% completely agree with the strikes, 25% somewhat agree, while only 40% (48% of wealthier people) disagree with them. The reason might be that white-collar workers are simply not as exposed to the hardship of low-income jobs and therefore do not share the same believe that an early retirement would be just. See figure 9 for the full breakdown.

Figure 9

Is it fair that some professions retire earlier?

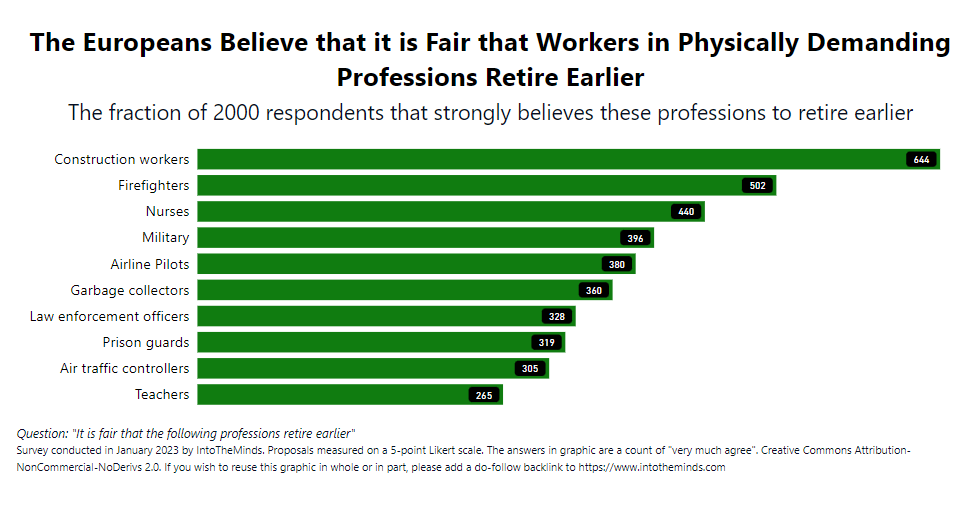

Half or Europeans (47 %) would agree that it is right that some professions retire earlier and only 12 % strongly oppose that concept. When we look more closely into which professions are worthy to retire early according to our participants, we see those workers in physically demanding job, such as (in descendance) construction workers, firefighters, nurses, and the military, should get the privilege of retiring earlier (see figure 10). On the flipside, people think that more mentally demanding jobs, such as air traffic controllers and teachers are less worthy of early retirement. This is an interesting finding, as the retirement of air traffic controllers is among the lowest with 55 years, reason being the mentally demanding workload. Additionally, the education sector ranks among the highest in terms of individuals experiencing depression and three out of four teachers retire early (in Germany) .

Figure 10

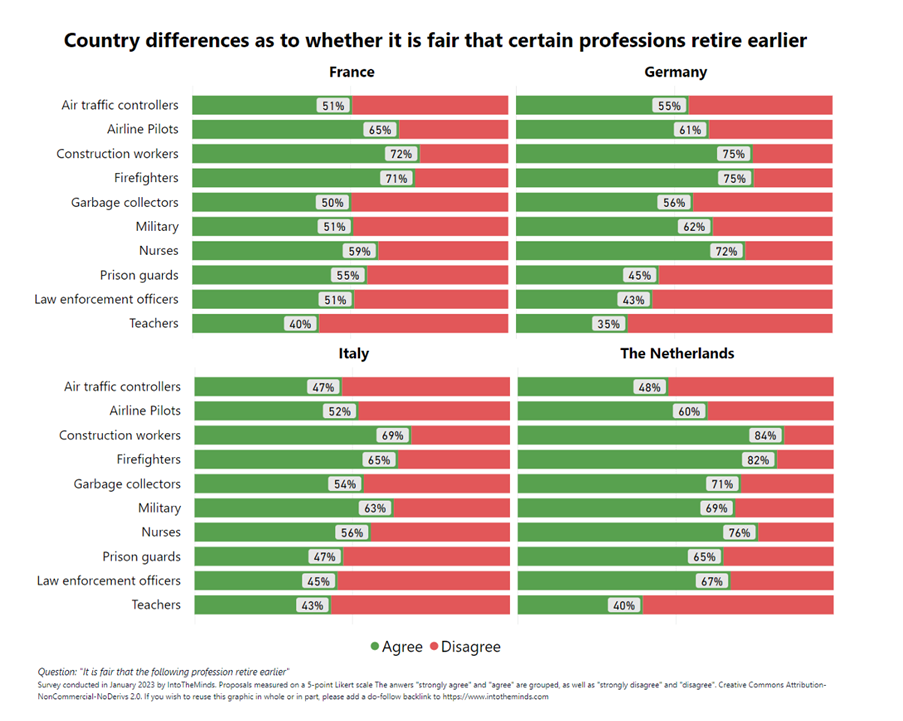

There are also country differences: Germans are strongest in believing that teachers should not retire earlier (65% disagreement), while they strongly believe that nurses should retire earlier (72%), a percentage only trumped by the Netherlands with 76%. The Dutch are also most supportive of construction workers and fire fighters retiring earlier (84% and 82%) which is a score 11 and 7 percentage points higher than the second (Germany with 75% and 75%). The Italians and German disagree the most with early retirement for prison guards and law enforcement officers.

In general, we can observe that in total, the Dutch are most supportive of certain professions retiring earlier:

- The Netherlands : 662 percentage points of agreement,

- Germany : 579 points,

- France : 564 points,

- Italy : 541 points.

Please find the full list in figure 11.

Figure 11

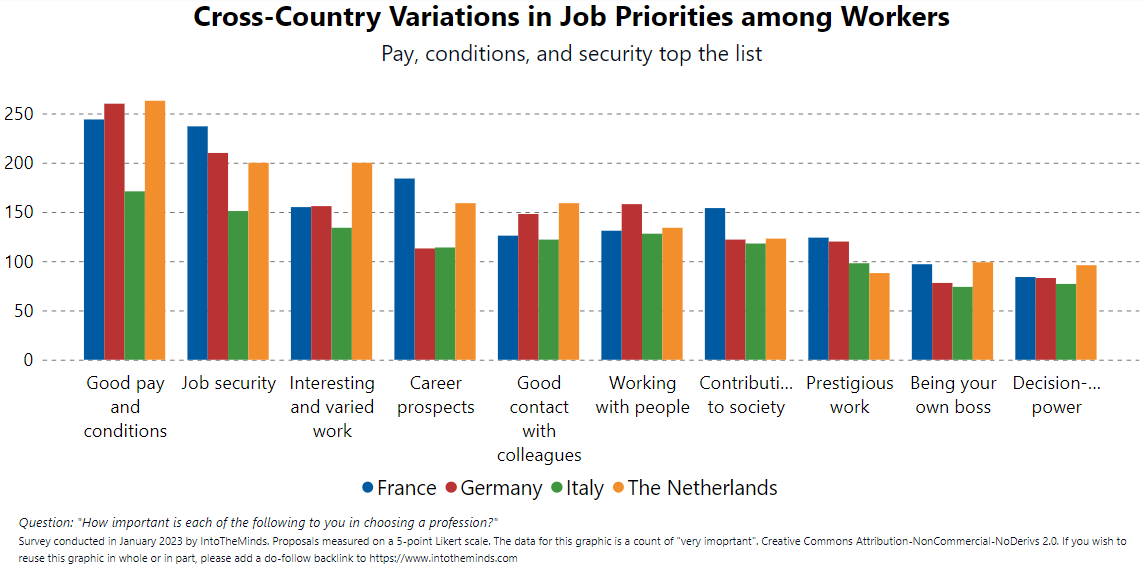

Are the Germans really that money-hungry and Dutch individualistic, as the stereotypes predict?

Europeans value the most being well paid and good working conditions, as well as interesting and varied work. The least important aspects are “prestigious wok”, “being your own boss” and “decision-power”. However, we can observe interesting country differences. In fact, the Germans, and the Dutch value a good pay the most; Italians don’t believe that strongly in good pay. And, yes, the Dutch are very individualistic with scoring on top for “being your own boss” and “decision power”, yet “being in good contact with colleagues” is also very valued. Very interesting for our pension analysis are the findings for France. The French deem “job security”, “good pay” and “career prospects” as very important which are aspects that frequently discussed in the pension debate. The full comparison can be found in figure 12.

Figure 12

Conclusion

In conclusion, our findings highlight the prevalent pension anxiety among Europeans with high levels of uncertainty about future pension payments and the retirement age. We discovered that low-income earners and women face higher levels of uncertainty. Furthermore, our findings reveal the varied preferences as regards the investment in stocks, and retirement options. Although most people would agree with the motivation of the strikes in France, the Germans and the Dutch do not agree with the strikes per se which underlines the strike apprehension in these countries. Specifically, the Germans express discontent with their situation but are not inclined to take the same extent of action as observed among the French population.

Sources

- [1] https://www.oecd-ilibrary.org/sites/ca401ebd-en/index.html?itemId=/content/publication/ca401ebd-en

- [2] https://money.cnn.com/retirement/guide/investing_stocks.moneymag/index4.htm#

- [3] https://www-tandfonline-com.ezproxy.ulb.ac.be/doi/pdf/10.1080/13545700903153963?needAccess=true

- [4] https://namiccns.org/2020/02/27/which-jobs-are-most-susceptible-to-depression/

- [5] https://www.spiegel.de/lebenundlernen/schule/pensionierung-unter-lehrern-drei-von-vier-gehen-vorzeitig-in-den-ruhestand-a-1244730.html

- [6] https://link.springer.com/article/10.1007/s00391-014-0669-y?rs=true

- [7] https://en.wikipedia.org/wiki/Pensions_in_Germany

- [8] https://www.expatica.com/it/finance/retirement/pension-in-italy-82946/

- [9] https://www.cleiss.fr/docs/regimes/regime_france/an_3.html

- [10] https://www.pensioenfederatie.nl/website/the-dutch-pension-system-highlights-and-characteristics

Posted in Research.