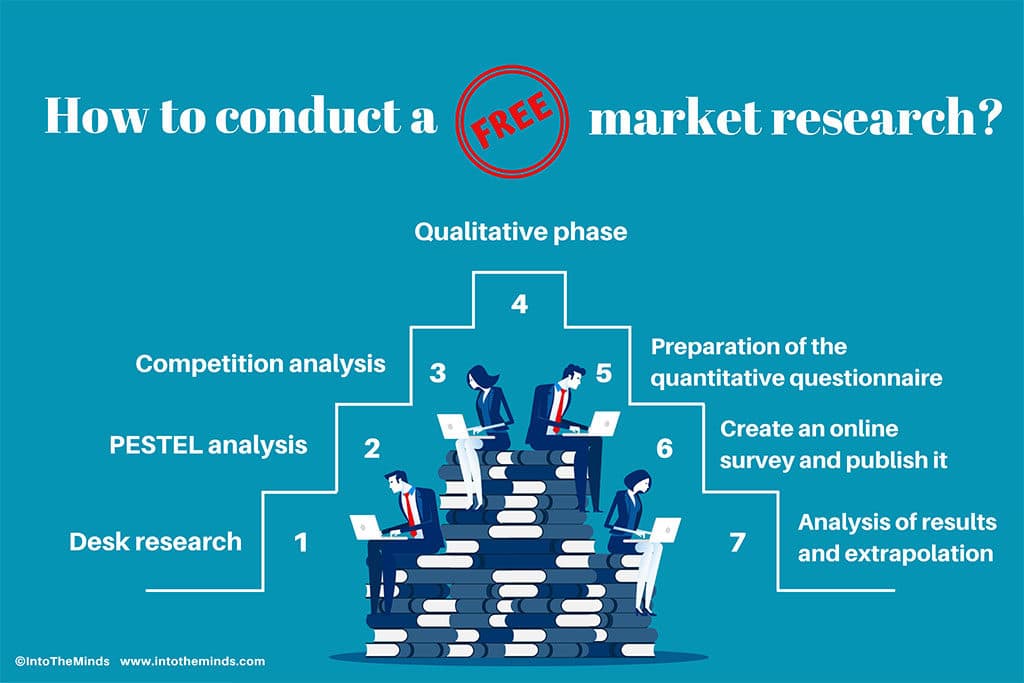

To do market research for free, don’t limit yourself to an online survey. Combine different market research techniques in this sequence:

- Carry out desk research to get a first view of the market dynamics. Use free resources, such as professional reports and scientific publications.

- Complete the PESTEL analysis. Use the information from the desk research and complete it with official statistics, also free of charge.

- Carry out your competition research: firstly, establish a list of competitors and criteria to benchmark, complete this list by visiting a trade fair and doing a mystery shopping exercise (also valid in B2B).

- Start a qualitative phase: opt for qualitative interviews or focus groups depending on the context of your market research. Analyse the needs of your future customers. Present them with a prototype of your product/service and collect their impressions, factors of satisfaction and dissatisfaction, their needs. Formulate the hypotheses you want to verify and on which the success or failure of your project will depend.

- Prepare a quantitative questionnaire of 20 questions or 10 minutes maximum. Formulate the questions based on the most critical assumptions to be statistically validated concerning your financial and business plans. Test this questionnaire on a small sample of people to ensure that it is well written, not confusing and not too long.

- Conduct an online survey: enter your questionnaire in a free tool (SurveyMonkey, google forms…) and distribute your questionnaire. Be sure to collect the variables that will allow you to check that the respondents are in your target market.

- Analyse the answers, extrapolate the results and draw your conclusions. Integrate the results into your financial and business plans.

In the rest of this article, we detail each of the steps and include links to resources that will allow you to explore each level of conducting a free market research study. We based ourselves on our 7-phase methodology and adapted it to retain only those techniques that would be conducive to free market research.

Step 1: Desk research

The desk research is nowadays done on the internet (click here for a full article on the desk research). It is, therefore, the foundation of excellent free market research.

Based on documents such as professional reports, existing studies and scientific publications, you will already have a good idea of the dynamics of a given market, consumer expectations and differences by country. Remember that if a large number of resources are free, the most complete and recent ones may be subject to a charge and should, therefore, be excluded to allow your market research to remain free.

Do not despair. Some publications, particularly scientific ones, are sometimes free of charge because some journals or authors nowadays decide to affix the “CC” (Creative Commons) seal to their work. To maximise your chances of finding the information you are interested in, use Google Scholar and enter search terms in English. On a query like “consumer behaviour supermarket” (152000 results, see above), you see that some publications are available for free because the authors have chosen to make their work available for free on their Academia page. You should also visit this site to consult the documents related to your market research.

Step 2: PESTEL analysis

The PESTEL analysis consists of analysing the factors that influence your market without you being able to control them: Political, Economic, Sociological, Technological, Ecological, Legal. The data enabling you to evaluate these 6 factors can be found both in your desk research and in official statistics and publications. The national statistical institutes (INSEE in France, STATBEL in Belgium, Portal des Statistiques in Luxembourg, Centraal Bureau Voor de Statistiek in the Netherlands) are full of interesting reports on different sectors of activity. Also consider consulting the websites of official organisations whose business is focused on a single sector (Anses in France for the food sector, the UPU for the postal sector, and so on) as well as those of professional federations and chambers of commerce.

To learn more about the PESTEL study, consult this article or this online course.

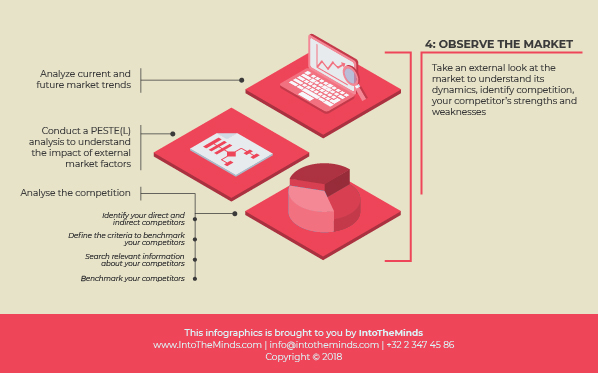

Step 3: Competition analysis

The competition research will allow you to know who you are going to be up against and to measure your chances of success. Your objective is threefold:

- establish a list of your future competitors.

- establish a list of comparison criteria.

- complete the checkboxes, that is to say, evaluate the criteria chosen for each of the competitors.

Here are some tips from professionals on how to carry out your competition research for free. If information is available online, the information you are really interested in will not be available. You will need to be cunning and persevering to gain access to it. We recommend that you visit one or more trade shows (visitor admissions may be free on some of them) to get an overview of the competition. Remember that some trade shows, by the number of exhibitors gathered, present a representative sample of the competition (for example SIAL for food). You can pretend to be a potential customer and carry out a mystery shopping survey with your competitors and thus “fill in the blanks” of your competitive benchmark.

Mystery shopping is of course not limited to visiting a trade show: email, telephone, all approaches are possible as long as your “coverage” is credible.

Step 4: Qualitative phase

This is one of the most crucial phases of your market research: the qualitative phase. However, it is often overlooked, as market research is usually wrongly limited to an online survey. But how do you conduct a survey (online or offline, for that matter) without knowing what questions to ask? It is precisely the purpose of the qualitative phase to identify the salient points, the satisfied or unsatisfied needs of your future employees, and to develop hypotheses.

While there are many qualitative techniques, 2 of them can be easily implemented without spending money: qualitative interviews and focus groups. To determine which method is best suited to your project, consult this article.

In the free version of the qualitative study, you will need to be persuasive to convince respondents to give a little of their time and help you. Professional market research institutes are used to remunerating respondents, which significantly facilitates their recruitment. You won’t have that luxury.

Here are some tips and mistakes to avoid:

- Explain your approach and the added value of your interlocutor’s contribution (highlight it).

- Be flexible. If you opt for individual interviews, visit the respondent (home, office) at times that suit him/her.

- If you are organising a discussion group, think about creating a friendly atmosphere to receive your guests.

- be careful not to “recruit” people from your circle of friends (danger of bias).

- make sure that the people you recruit are in your target range.

Step 5: Preparation of the quantitative questionnaire

At the end of the qualitative phase, you must be able to identify the most essential points that will decide the success or failure of your project. Here are some examples of hypotheses you could make:

- the assumption of customer needs: x% of the French population is dissatisfied with…

- the correlation hypothesis: consumers of organic products are more likely to be interested in my product/service.

- the assumption of the market size: x% of the companies in my target group express interest in my product/service.

- the pricing hypothesis: respondents declare themselves willing to pay x€ for my product/service.

These assumptions are the basis for the drafting of your quantitative questionnaire.

The questionnaire can be globally divided into 2 distinct parts:

- Control variables: you must first collect information about the respondent to ensure that they are in the targeted group and then be able to analyse the results according to these control variables (gender, age, sector of activity, and so on). Ask only for the strictly necessary information.

- Questions: they are derived from the assumptions made.

Our advice for a successful quantitative questionnaire:

- Do not exceed 20 questions: the questionnaire must be completed in a maximum of 10 minutes.

- Ask the most important questions at the beginning of the questionnaire so that you can avoid tiredness, that is to say, the tendency for the respondent to answer nonsense because he or she wants to finish the questionnaire.

- Repeat the most important question: if a hypothesis is particularly crucial to verify, formulate two similar questions that you will place at the beginning and end of the questionnaire to ensure the consistency of the answers.

- Test your questionnaire: ask friends to answer the questionnaire in front of you. Observe their reactions (including facial expressions) to detect any misunderstanding or potential problems. Ask them at the end of the exercise what problems they have encountered.

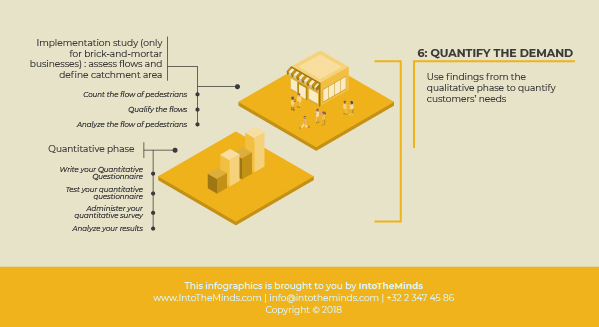

Step 6: Create an online survey and publish it

Once your quantitative questionnaire has been finalised, it must be published. It is, of course, possible to distribute paper copies (in some cases this may be the only viable approach) but it must be admitted that online surveys have nowadays become the fastest and cheapest technique. In your case, you’ll have to be cunning to avoid spending anything.

Create an online survey with a free-of-charge online tool.

There are many tools available to create a free online survey. Some people use Google Forms, other SurveyMonkey or GetFeedback. The choice is endless. As far as we are concerned, we would tend to opt for SurveyMonkey.

Publish your survey.

This is the most complicated part when you have a restricted budget. If you can’t afford any expenses, you will have to put all your energy into the diffusion of your questionnaire. While social media is, of course, a secure gateway to the outside world, there are many other ways to collect answers. Remember to activate your network so that it distributes your questionnaire widely by email. Perhaps you know an “influencer”, a well-connected person in your network who could boost the distribution of your online survey? But don’t expect a miracle. In the absence of a financial incentive, responses will remain scarce, and it will take you time to reach your quotas. This is the least controllable part of market research. Don’t get discouraged and follow up daily to activate and motivate your network.

Here are some considerations for your online survey:

- define response quotas to be obtained according to the control variables.

- do not stop the online survey until you have reached a sufficient number of responses. Remember that it is risky to extrapolate results from samples of less than 100 people.

- only retain the answers of the respondents who are in your targeted group and ensure that you have at least 100 qualifying answers.

Step 7: Analysis of results and extrapolation

Under the assumption that you have received a sufficient number of responses to your online survey, you will be able to extrapolate them (in econometrics this is called “making a statistical inference”).

Without wishing to enter into mathematical considerations for the purposes of this article, however, we suggest that you pay close attention to the breakdown of the responses obtained and the standard deviations. A small sample size (for example, 100 qualifying responses) will only allow extrapolation if the standard deviation of the responses is small, that is, if the entire sample is broadly of the same opinion.

The transition from market research to the business plan is made through the financial plan.

By greatly simplifying things, we could say that to make your financial plan a reality you need:

- a potential number of customers in a given territory (provided by extrapolation).

- an average price per purchase.

- a frequency of purchase.

Multiplying these three variables will allow you to assess the maximum market potential over a given period of time. A safety margin (for example 50%) will then be applied to obtain a realistic scenario. Knowing that the start of an activity is always progressive, it is not superfluous to smooth this scenario over 3 to 5 years in order to obtain realistic sales figures.

Conclusion

Conducting market research is in itself, a challenging exercise. It is a complex, iterative process and by no means an exact science. Market conditions (PESTEL) can sometimes lead to sudden reversals that will contradict the best analyses. Doing free market research is, therefore, a challenge that will require a lot of energy, work and dedication. Don’t be discouraged and if you have any questions, don’t hesitate to contact us.

Image : shutterstock

Posted in Marketing.