Your bank knows a lot about you and, as a matter of fact, the banking sector has been investing huge amount in Big Data for years. Similarly retailers know also a lot about you through the purchases you make. Is the next step a merger of data from both world to enhance behavior predictability ? This is the subject of an article on Visionary Marketing. However, unlike you may think, the idea of using banking data for other aims is not new and has already been tested in 2014 in Europe (see at the end of this article for further details).

Here’s why we don’t think it’s a good idea.

Do customers really trust banks ?

In the article of Visionary Marketing, the question of trust is taken as granted among banks’ clients. Actually, the question of how much trust customers place in banks is not as easy to analyze as it may seem.

Contradictory results on how much customers trust their banking insitutions have been published. For instance, an 2015 HBR paper called for restoring the trust in banks. At the same time, 89% of Belgian customers were said to trust their bank. Major banks like Belfius also announced a 95% level of customer satisfaction (which led us 2 years ago to question their measure of customer satisfaction). What is the truth about trust ? The truth is to be found in the definition of “trust”. Market research done by EY allows to answer that question. Their research entitled “Winning through customer experience” gives a lot of insights on the level and the definition of trust.

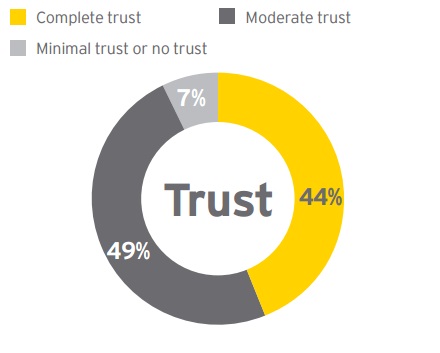

The first insight is that a minority of customers (44%) completely trust their bank. The second insight is that trust is influenced by perceived stability of the institution and by customer experience (in particular how you are treated).

Degree of trust in main banking provider (source : EY market research)

Banks don’t know what you buy

Bank can only guess what you’ve purchased but don’t know the details of it. Based on the name of the merchant they are able to guess relatively precisely to which category this purchase belongs (retail, leisure, insurance, …) and provide you with some graphs about how your consumption is distributed. However, because this data is limited to total purchase amounts, it’s not as useful as one may think.

What banks do know is how total distribution is distributed among several merchants; in particular banks may have the key to provide the so-called share of wallet to retailers. Yet, this information can already be bought (this is one core business of Nielsen for instance) and banks tend to be less reliable than market research institutes. Why ? Because consumers use alternative payment methods like cash and meal vouchers to shop at supermarket. In Belgium for instance the meal vouchers market has turned 100% electronic since 01 January 2016

What would happen if banks would share your data ?

Imagine that banks would share your data and you suddenly get offers from retailers interested in your purchasing from them ? Wouldn’t it look like retargeting that users experience from websites like Booking.com and the like ? Wouldn’t it increase the feeling of being tracked ?

Our guess is that we’ve already reached a high level of tracking and that users have lost the biggest part of their privacy. We hypothesize that the user acceptance would be very low and that it would negatively influence the customer experience and the perceived security of the banking institution.

Moreover, as we wrote in the introduction, the idea of sharing banking data is not new. It’s already been tested by ING in March 2014. It quickly led to harsh reactions. The ING experiment was withdrawn after only 2 weeks of violent reactions.

Conclusion

Companies of all size want to seize their share of the Big Data pie and collect as much data as possible. Ethics has become a minor problem. We think it’s not.

Consumers will increasingly become aware of their data-related rights. We think that privacy enforcement is the next big thing for the coming years.

Too many companies have already gone too far. Increasing the advertising pressure and the number of stimuli on consumers will not increase their level of attention.

Image: Shutterstock

Posted in big data, Marketing.