Today’s post is far away from marketing but was triggered by a communication issue, which remains a central topic is modern marketing.

ING announced within 30 days that it would reduce interest rates on both its current account and its savings account. Interest rates for current accounts will be 0,05% (let’s say nothing) and on savings accounts it will be decreased from 1% basis rate + 0,5% loyalty bonus to 1%+0,25%. In today’s context those two decisions deserve to be analyzed more deeply and interpreted.

What did banks do in the past to reduce their costs? Well, usually they tried to become more efficient by reducing their payroll or decreasing their infrastructure costs. This however isn’t enough any longer to reach European targets as far as a bank’s own funds are concerned. ING discovered that it was much easier to reduce costs by paying its customers less for their money. However something like this is politically incorrect and it’s much easier to say it’s someone else’s fault. That’s what ING did actually. They sent the following message to their customers through their Home-Banking software :

The Short-term (European Central Bank) and long-term interest rates (Interest Rate Swap) are decreasing. This situation leads us to modify the loyalty bonus applied to our green savings account.

From Dec. 9th 2011 following interest rates will be applied on the ING Green savings account: basis interest rate of 1% (unchanged) + loyalty bonus of 0,25% (instead of 0,50% previously).

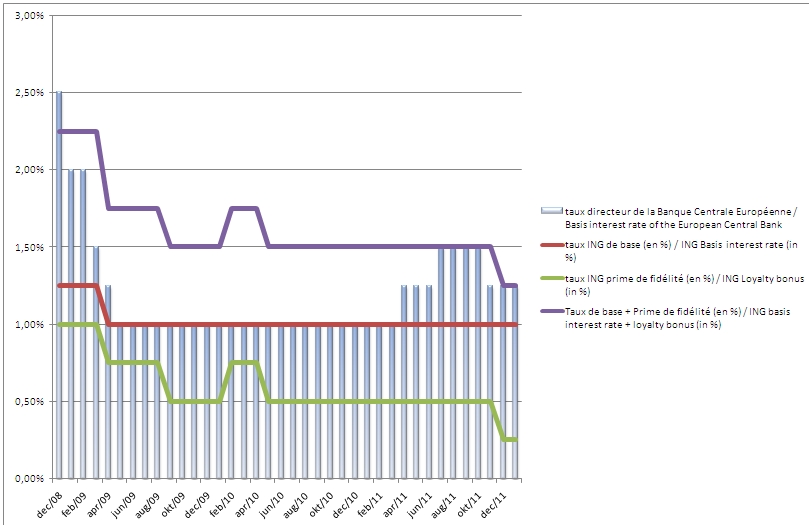

I was wondering whether claiming that it was the ECB’s fault was totally justified. A lot of energy an time was required to find historical data on ING Green savings account’s interest rates, but I finally found them. When one compares them to the ECB’s rates you can come pretty quickly to a few conclusions:

- The basis interest rate (1%) has been almost constant for years and changes in the ECB’s rates are reflected in the loyalty bonus

- The ECB increased its rate in April 2011 and July 2011. However those two increases led to no effect in the ING savings accounts rates.

- The ECB rate is the same as in April 2011 and nonetheless ING decreases its interest rates. There’s something wrong going on here, doesn’t it?

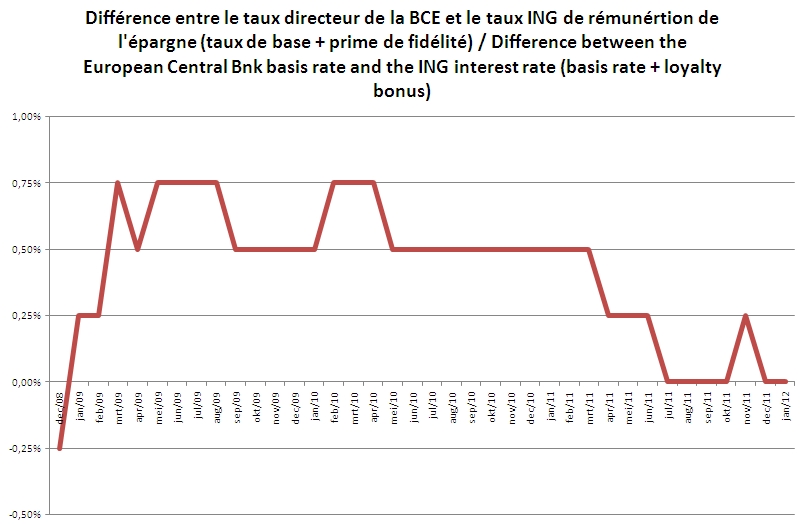

I also calculated the difference between the ECB rate and the ING interest rates (basis rate + loyalty bonus). What you can see on the graph below is that ING started in March 2011 narrowing down the difference between its rates and that of the ECB. As of today there is no difference and the price ING pays you for your money is the same it pays to the ECB.

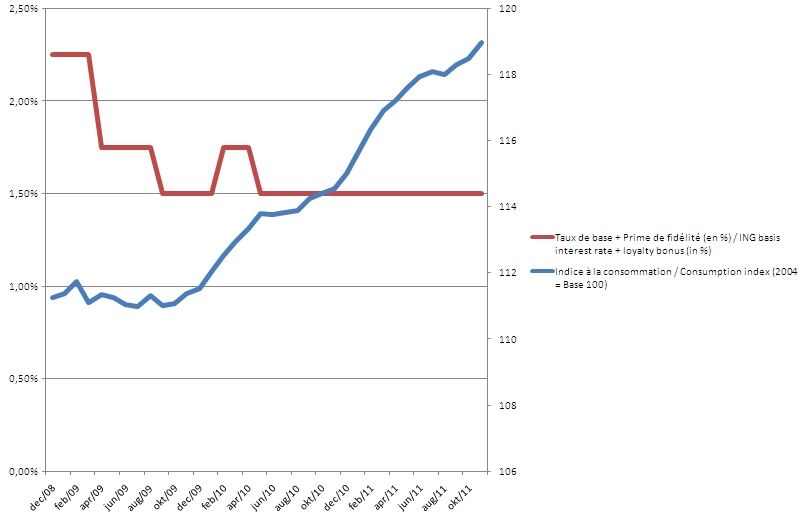

Last but not least (and it’s no good news for consumers), I compared the ING interest rates to the Belgian consumption index. The rates stay flat (and will even decrease as of Dec. 9th). Yet the consumption index keeps increasing (and the inflation too), meaning that you lose even more money than before by letting your money on a ING savings account.

My take :

The European Central Bank was the perfect scapegoat. A quick analysis reveals that ING’s explanation is far from reflecting all the truth. Yet the majority of ING clients will not even notice the change. Even worse, I think that ING’s move will be seen by its competitors as a permission to do the same and that we’ll have to cope with decreasing rates in the coming months, which in combination with increasing inflation, will expose us to become worse off.

Posted in Marketing.